US Non-Farm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Indicator Background … “EUR/USD: Trading the US Non-Farm Employment Change Aug 2013”

Month: August 2013

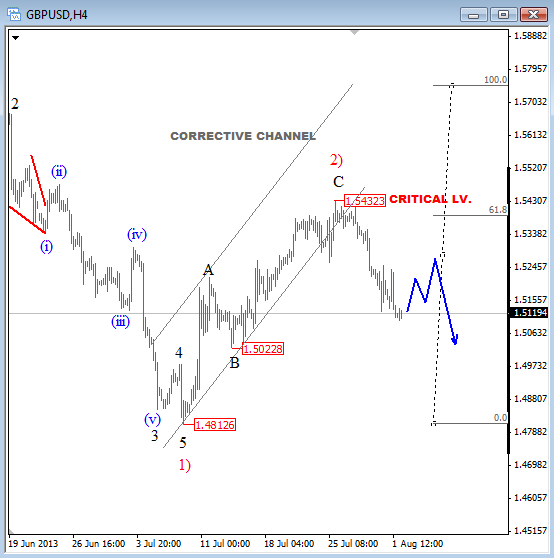

GBP/USD: Zig-Zag Is Pointing Lower – Elliott Wave Analysis

GBP/USD made three legs up from 1.4810, called a zig-zag that found resistance just slightly above the 61.8% retracement area as noted in our past updates. Notice that the market reversed impulsively down from 1.5430 which means that the rally is complete and that bears are now stronger, so expect even lower levels in the … “GBP/USD: Zig-Zag Is Pointing Lower – Elliott Wave Analysis”

AUD/USD Drops on Fed Concerns, AUD/JPY Rises on China’s PMI

The Australian dollar slumped against its US counterpart on concerns about quantitative easing tampering from the Federal Reserve. The currency advanced versus the Japanese yen as China’s manufacturing expanded last month. China manufacturing Purchasing Managersâ Index advanced from 51.1 in June to 51.3 in July, frustrating analysts who have predicted a drop to 49.8. China is the biggest trading partner of Australia. Institute for Supply Management reported that the US … “AUD/USD Drops on Fed Concerns, AUD/JPY Rises on China’s PMI”

Czech Koruna Rises Depsite Prospects for Intervention from Central Bank

The Czech koruna gained today even as the central bank signaled that it may intervene to weaken the currency and spur inflation. The central bank left interest rates near zero at yesterday’s meeting. The Czech National Bank kept its main interest rate at the technical zero (0.05 percent) yesterday. With near-zero borrowing costs, the bank has no room for rate cuts and may resort to intervention to prevent further inflation deceleration, … “Czech Koruna Rises Depsite Prospects for Intervention from Central Bank”

US Dollar Maintains Its Strength in the Midst of Risk Appetite

Even though risk appetite appears to be on the rise today, the US dollar is gaining ground. Greenback is heading higher as investors and others look to the future of possible Fed tapering, and compare the US economic recovery to the situations in other countries. Yesterday, the Federal Reserve concluded a two-day meeting without offering any clues about when it will begin tapering. Initially, this led to a rather dramatic drop for the greenback. However, … “US Dollar Maintains Its Strength in the Midst of Risk Appetite”

Forex Crunch Key Metrics July 2013

The positive trend continues. The first month of the second half of 2013 saw another rise in page views and another record. However, it was not much higher than the previous month. The “to taper or not to taper” question and movements in the Australian and Canadian dollars were contributors to the rise. Here are … “Forex Crunch Key Metrics July 2013”

Japanese Yen Drops as Funds are Moved Overseas

Japanese yen is heading lower today, dropping against its major counterparts, as Japanese investors purchase overseas bonds and as the data out of China turns out to be better than expected. The Japanese yen is lower across the board today as risk appetite makes a serious comeback and as Japanese investors send their money overseas. With Asian stocks surging, and the Nikkei closing above 14,000, it is little surprise … “Japanese Yen Drops as Funds are Moved Overseas”

EUR/USD Dips as ECB Holds Rates

The euro sank against the US dollar after the European Central Bank maintained interest rates and suggested that monetary policy will remain accommodative for a long time. The currency managed to gain against some other majors, including the Japanese yen and the Swiss franc. The ECB kept its main interest rate at 0.5 percent. Comments of President Mario Draghi after the policy meeting were fairly dovish: Underlying price pressures in the euro … “EUR/USD Dips as ECB Holds Rates”

Pound Climbs as BoE Maintains Policy & Manufacturing Expands

The Great Britain pound jumped today after the Bank of England left its monetary policy unchanged and as manufacturing expanded in July faster than was expected by market participants. The BoE announced today that its policy remains the same: The Bank of Englandâs Monetary Policy Committee today voted to maintain the official Bank Rate paid on commercial bank reserves at 0.5%. The Committee also voted to maintain the stock of asset purchases financed by the issuance … “Pound Climbs as BoE Maintains Policy & Manufacturing Expands”

Peter Cronin to lead institutional sales business in EMEA

US based Forex Broker Gain Capital (forex.com) announces the appointment of Peter Cronin as the head of institutional sales business in the region of Europe, Middle East and Africa. The company enjoys higher institutional trading volume in recent months. For more about the appointment, here is the official press release: LONDON, SINGAPORE and NEW YORK, … “Peter Cronin to lead institutional sales business in EMEA”