The Swiss franc was mixed today even as the general risk-adverse market sentiment was beneficial to the currency. The Swissie rose a little against the euro, but fell versus the US dollar. Risk aversion rules the Forex market this week and it benefited safe currencies, including the yen and the franc, but still they perform not as well as they should. The UBS consumption indicator remained virtually unchanged in July. Other indicators, including … “Franc Mixed, Swiss Economy Looks Stable”

Month: August 2013

Fear and Greed with GBP/USD

Fear and greed are two emotions which can overrule a trader’s rational mind, and by extension, the financial markets. With every data release or piece of financial news, markets will react on both an emotional and rational level. The divergence between the two often causes large intra-day swings in financial markets, and so can represent … “Fear and Greed with GBP/USD”

Yen Attempts to Rally on Risk Aversion

The Japanese yen was attempting to rise today against other most-traded currencies as risk aversion prevailed on the Forex market. The currency failed to keep gains versus the US dollar, but maintained rally against the Great Britain pound. Geopolitical tensions in Middle East continue to drive markets and this increases bid for safer assets. The yen, being one of such assets, excels in such environment, though its performance today was not … “Yen Attempts to Rally on Risk Aversion”

Greece’s bailout is inevitable, Sales tax hike decision awaited

Even though recent news suggests that the Eurozone is on the road to recovery it is still fragile. Greece is a great example of why the Eurozone is still a fragile economy. There is a high probability that Greece will need an additional bailout. Germany is the only country in the Eurozone that is keeping … “Greece’s bailout is inevitable, Sales tax hike decision awaited”

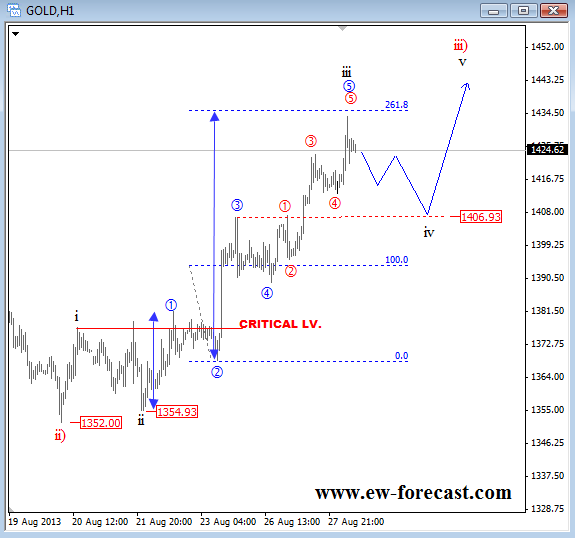

Gold and Oil Are Ready For A Pull-back (Elliott Wave

We know that after every five wave move, a correction follows in three waves. And that’s exactly what is happening on OIL; we see a completed five wave move from 105.50 to 112.20 so the market is now forming a pull-back; an a)-b)-c) move back to the former wave four zone placed at 108.57. On … “Gold and Oil Are Ready For A Pull-back (Elliott Wave”

MarketsPulse Re-certified: ISO-9001:2008 Quality Management System

Binary options provider MarketsPulse is re-certified with the ISO-9001 2008 quality management system certification, following a previous certification. Here are more details: LONDON– MarketsPulse, a global binary options platform provider, was recently reissued the ISO-9001:2008 certifying that the company continues to meet the highest level of quality in software development and customer satisfaction standards defined … “MarketsPulse Re-certified: ISO-9001:2008 Quality Management System”

Hungarian Forint Drops as Central Bank Performs Interest Rate Cut

The Hungarian forint weakened today after the nation’s central bank performed an interest rate cut yesterday. The general market sentiment was not helping the currency either. The Magyar Nemzeti Bank (the central bank of Hungary) reduced its main interest rate by 20 basis points to 3.8 percent at yesterday’s meeting. The bank explained its outlook: In the Councilâs judgement, Hungarian economic growth is likely to recover gradually this year; however, … “Hungarian Forint Drops as Central Bank Performs Interest Rate Cut”

Dollar Attempts to Maintain Rally, Fails

The US dollar was trying to rally on speculations about possible quantitative easing tampering, but failed to do so against such currencies as the euro and the Japanese yen. The greenback managed to keep gains versus the Great Britain pound. US macroeconomic data was good today, adding to chances of QE tampering in September. The Richmond manufacturing index unexpectedly returned into the positive territory this month, jumping from -11 to 14. The Conference … “Dollar Attempts to Maintain Rally, Fails”

AUD/USD: Trading the Australian August 2013

Australian Private Capital Expenditure measures the value of new capital expenditures made by private businesses. A reading which is higher than the forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Australian Private Capital Expenditure is released each quarter, which magnifies … “AUD/USD: Trading the Australian August 2013”

Mexican Peso Suffers from Risk Aversion

This trading session was marked by widespread risk aversion, resulting in losses to currencies of emerging markets. The Mexican peso was among the losers. The tension between the United States and Syria made investors unwilling to risk and encouraged them to stick to safer assets. Speculations about potential quantitative easing tampering by the Federal Reserve continued to affect the market sentiment in a negative manner, especially after today’s good macroeconomic reports from the USA. All … “Mexican Peso Suffers from Risk Aversion”