The Israeli new shekel declined today as political tensions in Middle East escalated after the United States signaled about possible attack on Syria in case the Middle Eastern country uses chemical weapons. The USA signaled about possible cruise missiles strike to deter Syria from using chemical weapon. The shekel dropped as investors avoided Israeli assets on concerns that potential conflict will involve Israel. The Bank of Israel kept interest … “Shekel Drops as USA Signal About Attack on Syria”

Month: August 2013

Loonie a Little Lower on Fed Bets, Middle East Jitters

Very little about the Canadian dollar is being driven by what’s happening in Canada today. Instead, the loonie is responding to everything that’s going on in other countries. Fed bets and concerns about the Middle East are weighing on the Canadian dollar right now. US durable goods orders are changing the view of what the Federal Reserve will do about tapering its bond purchase program. Durable goods orders fell … “Loonie a Little Lower on Fed Bets, Middle East Jitters”

Euro Gets Boost as Rate Cut Possibility Fades

Earlier in the month, there had been talk of a possible rate cut at the next ECB meeting. However, the chances of a rate cut are diminishing, and that is providing help for the euro, even as risk appetite flees in the wake of troubles in Syria. The European Central Bank has made it clear during the crisis that it is willing to do whatever it takes to keep the eurozone intact. Additionally, ECB President Mario Draghi … “Euro Gets Boost as Rate Cut Possibility Fades”

USD/JPY: Trading the US Pending Home Sales Aug 2013

US Pending Home Sales, a key leading economic indicator, is an important gauge of activity in the housing sector and of consumer spending. A higher reading than forecast points is bullish for the dollar. Here are all the details, and 5 possible outcomes for JPY/USD. Published on Wednesday at 14:00 GMT. Indicator Background Pending Homes Sales provides analysts and … “USD/JPY: Trading the US Pending Home Sales Aug 2013”

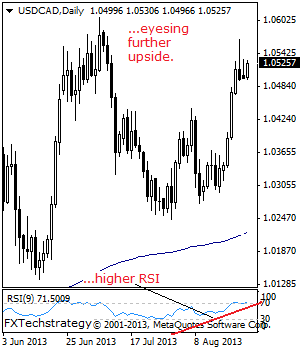

USDCAD: Broader Bias Remains To The Upside

With USD/CAD reluctant to weaken further following its Friday negative candle formation, the risk is for it to recapture the 1.0567 level. Resistance resides at the 1.0600 level, its psycho level with a breach of here opening the door for more gains towards the 1.0600 level followed by the 1.0650 level. Its daily RSI is … “USDCAD: Broader Bias Remains To The Upside”

NZ Dollar Drops Sharply at Beginning of Trading Session

The New Zealand dollar managed to gain yesterday despite the very bad trade balance, but reversed gains today. The currency dropped rather sharply at the beginning of the current trading session and remains soft as of now. The New Zealand trade balance posted the deficit of NZ$774 million in July. It is compared to the consensus forecast of $18 million deficit. It was the biggest shortage in 10 months. Moreover, the figure was the worst July reading … “NZ Dollar Drops Sharply at Beginning of Trading Session”

Dollar Fluctuates as Speculations About QE Tampering Continue

The US dollar fluctuated today, without moving in any particular direction, as traders continued to speculate if the Federal Reserve will tamper its quantitative easing program as soon as the next month. As was expected, the US currency continued to follow the outlook for Fed’s QE tampering that was constantly changing. Durable goods orders slumped 7.3 percent in July, more than twice the forecast decrease. The report followed poor housing data … “Dollar Fluctuates as Speculations About QE Tampering Continue”

Indonesian Rupiah Falls as Traders Think Policy Makers Do Not Do Enough

The Indonesian rupiah followed the Brazilian real in decline. The reason for the drop was the same: Forex traders were unconvinced by efforts that the central bank was making to revive the nation’s economy. The Indonesian current account deficit was the record $9.8 billion last quarter of this year. To address the issue, Finance Minister Chatib Basri announced last week that the government will offer tax reduction for exporters, while the Bank Indonesia is … “Indonesian Rupiah Falls as Traders Think Policy Makers Do Not Do Enough”

Brazilian Real Drops as Central Bank’s Efforts Leave Traders Unconvinced

The Brazilian real dropped today as Forex traders were unsure if the measure taken by the central bank will be enough to support the currency that demonstrates profound weakness. The Banco Central do Brasil auctioned 10,000 foreign-exchange swaps today. Last week, the central bank indicated that it is going to offer $1 billion of loans every Friday and $500 million worth of currency swaps four times per week … “Brazilian Real Drops as Central Bank’s Efforts Leave Traders Unconvinced”

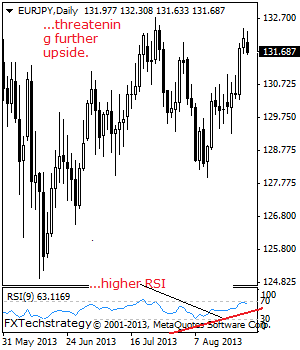

EURJPY: Faces Broader Upside Risk

EURJPY- With the cross bullish and closing higher the past week, we expect more gains to follow in the new week. Despite its present price hesitation, the above view remains intact. Resistance resides at the 132.74 level where a break will aim at the 133.81 level. Above here will pave the way for a run … “EURJPY: Faces Broader Upside Risk”