After trading lower at the end of last week, the UK pound is picking up some steam, turning it around against the yen, and moving higher against the US dollar. At the end of last week, the UK pound appeared ready to give up. Even with a better growth report, the pound was heading lower. The Office for National Statistics reported that business investing in the United Kingdom grew 0.9 per cent during … “UK Pound Picks Up Steam”

Month: August 2013

Another Difficult Week for Dollar Traders Ahead? Very Likely

The US dollar has experienced a rather volatile week as traders were digesting the words of the Federal Reserve about its future monetary policy. What does the current week hold for the greenback? Perhaps, yet another period of unpredictable moves. Recently, the US currency was mainly driven by speculations about possible quantitative easing tampering. Such talks will likely affect the behavior of the currency in the near future, meaning that the dollar will … “Another Difficult Week for Dollar Traders Ahead? Very Likely”

Japanese Yen Gains Against Other Major Currencies

Japanese yen is gaining against majors today, showing some strength as concerns about the Fed tapering program’s timing cause uncertainty and as Forex traders look ahead to the sales tax hike expected in Japan. Right now, there are expectations of a sales tax hike in Japan, and it’s one of the signs that Prime Minister Shinzo Abe is truly ready to go through with the reforms he promised. Japan has … “Japanese Yen Gains Against Other Major Currencies”

GOLD: Sees Further Bullish Momentum.

GOLD: With GOLD returning above the 1,348 level, further bullish offensive is likely. This leaves the commodity targeting further upside towards the 1,450.00 level, its psycho level. A cut through here will aim at the 1,500.00 level, its psycho level. A cap may occur here and turn it lower but if that fails, more upside … “GOLD: Sees Further Bullish Momentum.”

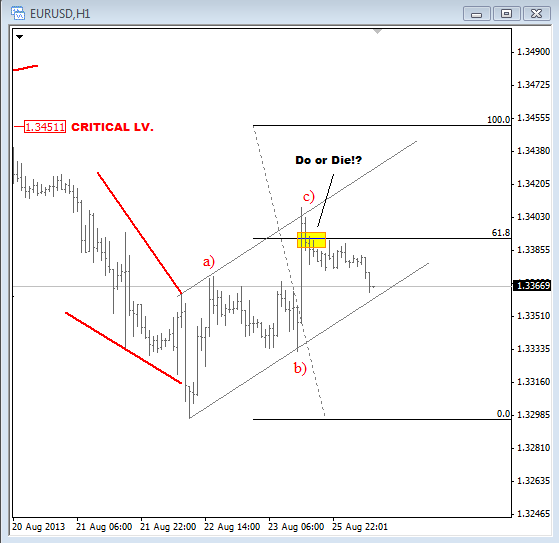

Tracking USD Long Set-Ups While EUR Is Below 1.3450 and

We can see some USD strength at the start of this European morning coming back into the market: a move which has been expected based on the latest intraday price action. We were looking for a three wave move down on USDCHF with our members, and so far we can see that pair nicely found … “Tracking USD Long Set-Ups While EUR Is Below 1.3450 and”

EUR/USD: Trading the German IFO Aug 2013

The German Ifo Business Climate is a monthly composite index of about 7,000 businesses, which are surveyed about current business conditions and their expectations concerning economic performance over the next six months. A reading which is higher than the estimate is bullish for the euro. Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the German IFO Aug 2013”

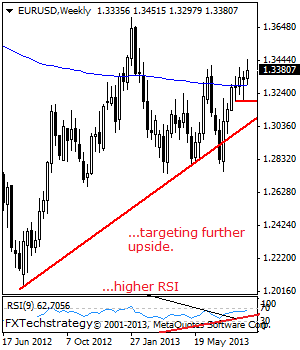

EURUSD: Bull Pressure Points To The 13451 level Weekly

With EUR closing higher the past week, more bullishness is expected to recapture the 1.3451 level. A break through here will set the stage for more strength towards the 1.3500 level with a break resuming its broader upside and turning attention to the 1.3550 level. Further out, resistance resides at the 1.3600 level. Its weekly … “EURUSD: Bull Pressure Points To The 13451 level Weekly”

Another Volatile Week for US Dollar Ended

This week was poor in terms of macroeconomic news from the United States, but this did not prevent the US dollar from fluctuating, sometimes quite wildly. The minutes of the Federal Reserve policy meeting was the major event during the week. Forex traders were waiting for the Fed minutes, anticipating signs of stimulus tampering in September. The actual release attempted to downplay such expectations, but market participants remained convinced that … “Another Volatile Week for US Dollar Ended”

Euro Ends Friday with Gains

The euro ended Friday with gains with help of improving eurozone consumer sentiment and growing German economy. The positive data make an interest rate cut by the European Central Bank unlikely. The consumer confidence indicators improved both for the eurozone (to -15.6 form -17.4) and for the European Union (to -12.8 from -14.8) in August from July. German gross domestic product demonstrated 0.7 percent growth in the second quarter of 2013, which was confirmed … “Euro Ends Friday with Gains”

Loonie Erases Losses as Inflation Accelerates

The Canadian dollar was falling today, but managed to pare losses before the end of the trading session as Canada’s inflation accelerated even though it was still below forecasts and the central bank’s target. Statistics Canada reported that the Consumer Prices Index rose 1.3 percent in July, up 0.1 percentage point from June, but still trailing the forecast of 1.4 percent. Core inflation accelerated to 1.4 percent, also … “Loonie Erases Losses as Inflation Accelerates”