On Wednesday, Sterling was trading above 1.57 USD and the Euro was trading above 1.34 USD. On fundamentals, there seems to be disparity between the economic situation in the UK and Europe to justify the strength in their respective currencies. No doubt economic data in the UK recently has exceeded expectations with GDP figures revised … “Economic Fundamentals and Geo-political concerns should boost the US”

Month: August 2013

Rand Gains While Other Risky Currencies Decline

The South African rand was able to strengthen today even though the vast majority of commodity-related currencies experienced weakness due to concerns about possible stimulus tampering in the United States. The Federal Reserve released the minutes of its policy meeting earlier this week, suggesting that reduction of asset purchases is likely later this year. The announcement resulted in widespread risk aversion on the Forex market. Most risky currencies remain under … “Rand Gains While Other Risky Currencies Decline”

GBP/USD Falls Even as GDP Revised Positively

The Great Britain pound attempted to rally against the US dollar today, but failed even though UK economic growth was revised upward in today’s report. The currency tried to keep gains versus the Japanese yen, but struggled to do this. The Office for National Statistics released the second estimate of UK gross domestic product, which showed growth by 0.7 percent, up 0.1 percentage point from the previous estimate. The data … “GBP/USD Falls Even as GDP Revised Positively”

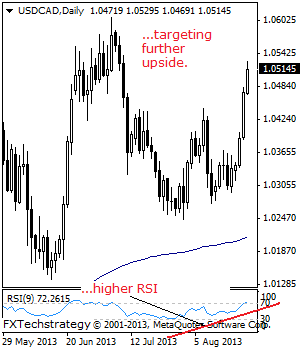

USDCAD: Bullish, Pressures More Upside

USDCAD: With the pair breaking and holding above the 1.0444 level on Wednesday and following through higher on Thursday, there is risk of further upside offensive. Resistance resides at the 1.0550 level, its psycho level with a breach of here opening the door for more gains towards the 1.0600 level followed by the 1.0650 level. … “USDCAD: Bullish, Pressures More Upside”

Yen Weakens Ahead of Kuroda’s Speech

The Japanese yen fell yesterday and extended the decline today ahead of the speech of Bank of Japan Governor Haruhiko Kuroda, which he will deliver in Jackson Hole tomorrow. Kuroda will speak at the Federal Reserveâs annual monetary conference tomorrow. He will likely explain the policy decisions the BoJ has done and speak about future actions of the central bank. Experts think he will maintain bias for monetary accommodation, which is … “Yen Weakens Ahead of Kuroda’s Speech”

Contradictory Data Results in Mixed Performance of Dollar

Today’s macroeconomic reports from the United States were contradictory as some of them were suggesting that the US economy experiences stable growth, while others showed problems of the economy. As a result, the US dollar demonstrated mixed performance, retaining gains versus the Great Britain pound and the Japanese yen, but erasing advances against the euro. The Conference Board leading economic index rose 0.6 percent in July after showing no change … “Contradictory Data Results in Mixed Performance of Dollar”

UK Pound Weakness Likely to Persist

UK pound continues to weaken in Forex trading, thanks to a number of factors. One of the concerns about the pound is that the recent optimism about the economic recovery has been a bit much. Some analysts think that the pound is overvalued, and that it will head lower for the long term. UK pound is lower against the euro and the dollar today, dropping as analysts consider the situation. Pound had received a boost earlier … “UK Pound Weakness Likely to Persist”

Euro Struggles to Log Gains On Better Economic News

Euro is struggling to log gains against the US dollar today, following improved economic news and a global stock rally. European stocks are heading higher, after a mixed Asian session, and US stocks are preparing for a higher open. Good news out of the eurozone should provide some support to the euro. The latest economic news out of the 17-nation eurozone indicates that things are starting to improve. The flash composite purchasing … “Euro Struggles to Log Gains On Better Economic News”

Aussie Rises with Help from China’s Manufacturing

The Australian dollar managed to rise today paring yesterday’s losses, with help from China’s macroeconomic data that showed an unexpected improvement of the manufacturing sector. Today’s report showed an expansion of manufacturing in China, the biggest trading partner of Australia. The news allowed the Aussie (as the Australian currency is often called) to recover after yesterday’s decline caused by signs of smaller monetary stimulus in the United States. The currency still remains vulnerable due to possibility … “Aussie Rises with Help from China’s Manufacturing”

Yuan Rises as Manufacturing Expands for First Month in Four

The Chinese yuan rose a little today, erasing previous losses, as the manufacturing sector unexpectedly expanded this month, reducing risk aversion caused by yesterday’s Federal Reserve’s policy minutes. The HSBC Flash China Manufacturing Purchasing Managers’ Index rose from 47.7 in July to 50.1 in August. It was the first reading above 50.0 (which indicates expansion) since April. Analysts have predicted an increase to just 48.3. USD/CNY fell … “Yuan Rises as Manufacturing Expands for First Month in Four”