The pound is having a great run in the market. For the past month positive data has been coming out of the UK and it looks promising. Thursday proved to be a busy day for both the pound and the euro. The BoE had a base rate decision, the ECB had a press conference and Mario Draghi (President of the ECB) made a speech.

Base rates have been held at current levels by both the ECB (European Central Bank) and the BoE (Bank of England). Fiscal policy has also been left unchanged, as expected by both the ECB and BoE although the BoE has mentioned several times that interest rates may rise if unemployment falls from current levels to below 7%. The BoE is also not afraid to use interest rates if inflation edges above the threshold (2.5% or higher).

Guest post by Accendo Markets

Mario Draghi is still cautious about the recovery of the Eurozone which is fragile. We still need additional data to see if the recovery is weak or moderately strong. Looking at recent data, particularly German factory orders, which was disappointing, the recovery still looks rather weak. In addition, forward guidance by the ECB has not helped keep downward pressure on market rates. Market rates have been rising due to speculation that QE may start in September. In addition a rates cut is still an option.

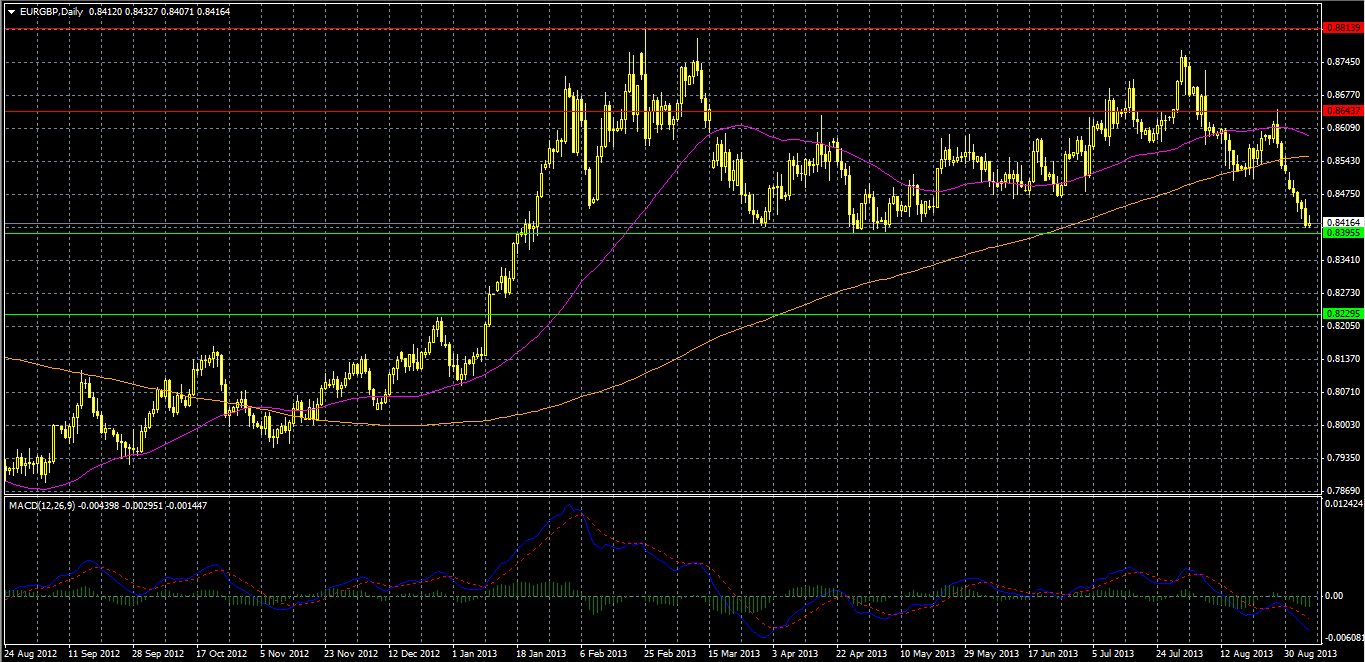

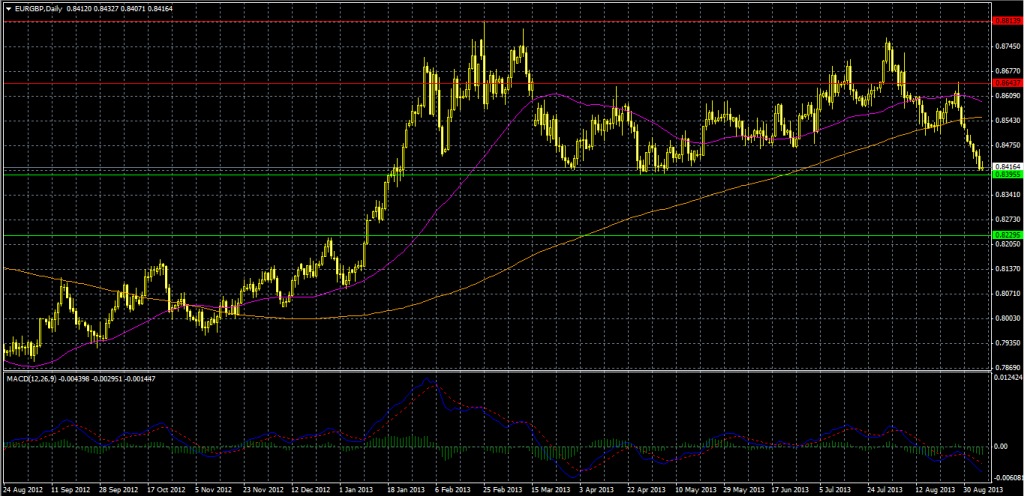

| Support 2 (S2) | Support 1 (S1) | Current Price | Resistance 1 (R1) | Resistance 2 (R2) |

| 0.82295 | 0.83955 | 0.84164 | 0.86437 | 0.88139 |

The pair was trading in a sideways market from mid-March to early July. The pair then broke our R1 but momentum was lost, thus the pair retraced and is currently in a down trend. At current levels the pair has established a 3 month low. S1 is a very rigid floor for the pair and it has tested this level twice. It looks highly likely that the pair will test this level again and if the pair breaks this level then we could see a downside bias to S2.

S2 is a weak support for the pair. It was a resistance for the pair in December 2012. The pair has not tested this level hence it is weak. S3 would be at the 0.81551 level and the pair had tested it twice as a resistance hence it is very strong.

R1 is a strong ceiling for the pair. R2 is the highest high the pair has been for nearly 2 years thus R2 is a strong roof for the pair.

Technicals: Moving Averages and MACD (Moving Average Convergence Divergence)

• 50-day MA (magenta line) and 200-day MA (orange line) have become a resistance for the pair. This will aid our R1 greatly.

Further reading: EUR weakness exposed by NFP

• MACD is negative. MACD line is still below red signal line indicating a bearish stance for the pair.

In the near term, the outlook for the pair is bearish. Technicals support this view and the recovery of the UK looks more promising than the recovery of the Eurozone. Increasing market rates have been caused by the Fed and this is becoming a nuisance for the ECB. Meanwhile across the channel, the UK is unlikely to make big changes unless inflation increases, in which case they will have to raise rates.

CFDs, spreadbetting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.