Markets gaped against the USD on Sunday, away from Friday’s close price. We can see higher prices on EURUSD, US bonds and also US stocks futures after Larry Summers withdrew from the contest to succeed Ben Bernanke as the next chairman of the Federal Reserve. We have also seen a gap down on Crude Oil Futures after the U.S. and Russia have agreed on a framework for Syria to destroy its chemical weapons stockpile by the middle of 2014, according to media reports on Saturday.

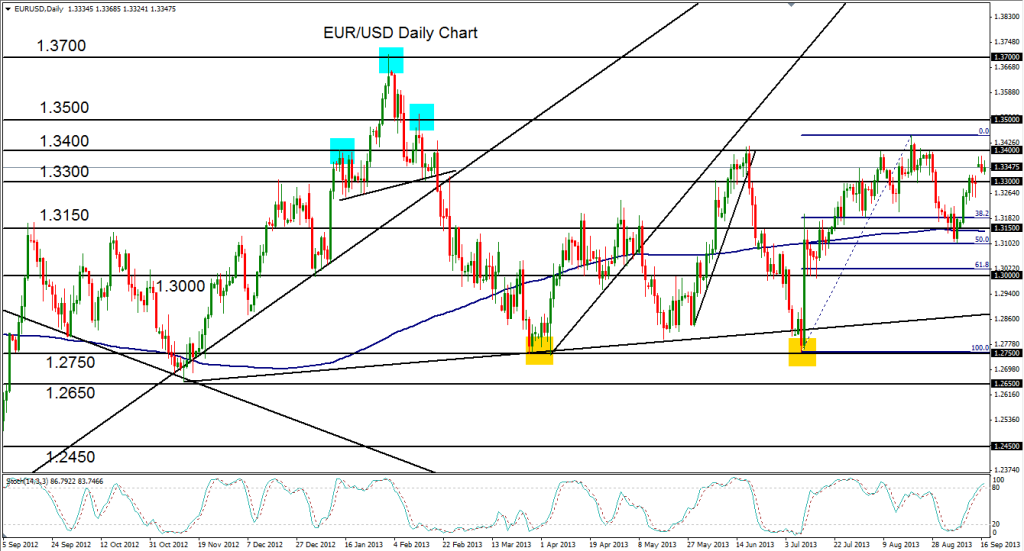

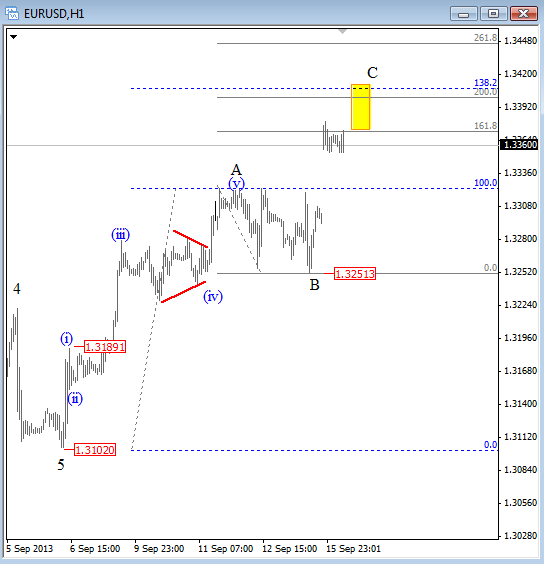

Below we can see a gap up on EURUSD, where we expected a move higher into wave C after a recent correction in wave B. Keep in mind that gaps usually get filled and that we also only have a three wave rise from the monthly lows, so a bearish reversal could follow this week. Technical resistance comes in at 1.3380-1.3400.

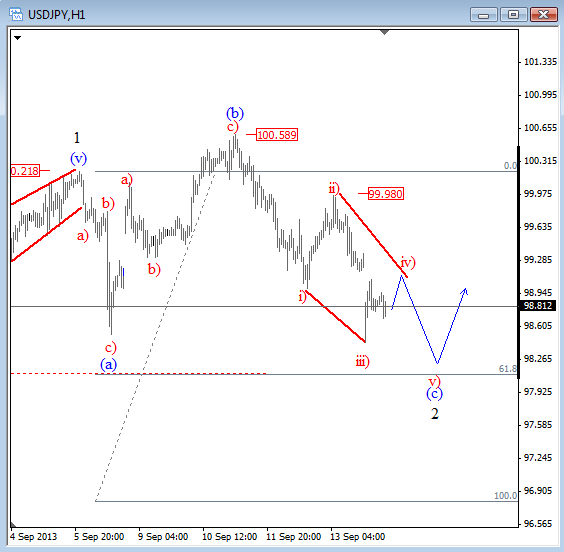

While EURUSD and US Bonds gaped higher the USDJPY moved to the downside and finally reached levels around 98.50 that we highlighted several times last week. However we need a five wave move in wave (c) for a valid and completed expanded flat correction. As such, we are not tracking an ending diagonal in wave (c) that may complete the pattern around 98.00 area with a sub.-wave v). We also see a 61.8% in that zone which could be very interesting for buyers.