Trading strategies are very essential to having a successful trading practice. Traders try out various trading strategies throughout their trading sessions. The strategy that this article describes can be classified as an advanced trading strategy. Carry Trade Strategy is based on the interest rate differentials. The strategy is famous for its unique approach of targeting interest rates for the purpose of earning “twin benefits”, namely: interest rate differential, as well as currency trade benefit or capital gain.

Traders target the currency which carries a lower interest rate in order to buy the currency which pays the higher interest rates. Hence, traders get the benefit of interest rate difference, as well as currency value appreciation.

The strategy in detail

In order to be successful in the Carry Trade Strategy, one must choose the correct currency pair; a pair which consists of two currencies wherein one of the currencies is high interest yielding, while the other one is low interest yielding. It is also advisable to consider a currency pair which is either stable, or in an uptrend in favor of the high yielding currency.

Let’s understand the strategy in detail. As discussed so far, the ideal Carry Trade Strategy consists of buying the currency of a country where the interest rate is rising against the currency where the interest rate is either stable or falling. Therefore, while buying the high yielding currency will lead to a higher amount of interest receipt, selling the low yielding currency, on the other hand, will lead to alower amount of interest payment, which will, in effect, lead to interest rate differential as a gain. Another part of the strategy gains which includes capital gains, is a result of an underlying economic play. The high yielding currency will appreciate in its value against the low yielding currency, as higher interest rate would lead to lesser availability of money flow into the economy supporting the strength of the currency.While in case of low yielding currency, the money circulation in the economy would be higher, resulting into depreciation of value. Henceforth, by buying high yielding currency and sellinglow yielding currency, the value of high yielding currency appreciates against the low yielding currency, and in the end, we get the capital gains as well.

As the basis of the strategy is the interest rate, one must be thorough with the benchmark interest rates of global central banks. One can find various sites which show the global central banks rates. Moreover, one should also be able to understand the underlying fundamentals behind the interest rate changes. This can be known after thorough economic analysis of both countries where the currencies in the pair are from.The currency which comes from the country that faces inflationary pressure in the economy wherein the central bank looks for an interest rate hike needs to be bought.On the other hand, the currency which comes from the country that faces little inflationary pressure as compared to the need of increasing money supply in the economy in order to bolster growth needs to be sold.

Example:

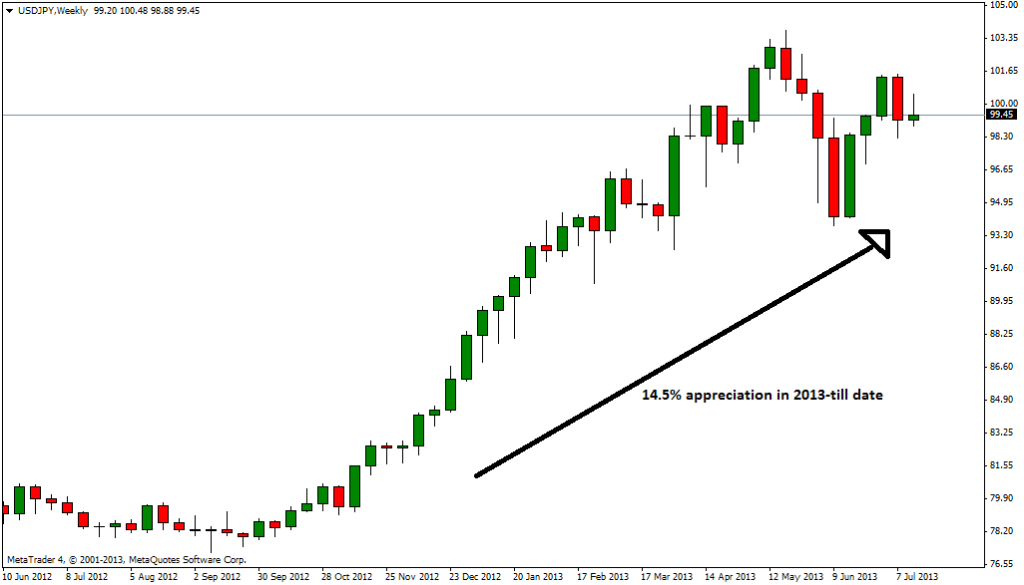

Let us take for example USDJPY; the pair which has gained nearly 14.5% in the year 2013,till to date. Interest rate in US as implemented by the Federal Reserve has been at 0.25% since December 2008.In the same way, the interest rate in Japan as implemented by the Bank of Japan is at 0.10% since October 2010. Hence, by practicing Carry Trade Strategy in this pair, we should long the pair by buying USD and selling JPY, which ultimately would return capital gain of 14.5%. In addition to this, the interest rate differential of 0.15% (0.25% receivable on USD – 0.10% payable on JPY) would be an added benefit. And so, the Carry Trade Strategy on USDJPY since the start of the year, generated 14.65% return in just nearly 8 months, which as compared to S&P 500 which generated nearly 2.45% gain in 2013, to date, as well as to FTSE which, on the other hand, generated nearly 11% gain in 2013, to date, is much higher.

Feedback:

Even though the Carry Trade Strategy seems to be the “win-win strategy”, there are limitations attached to it. The currency pairs which are considered good to trade using theCarry Trade Strategy are generally the more volatile ones; and so, one needs to have proper risk management tools in order to maximize the gains. Another thing which needs emphasis on is the frequency of central banks to intervene.If the central bank tends to intervene repeatedly, it will generate more volatility in the market, and thus, a higher chance of having a loss, especially if the intervention is not favorable to one’s trade. In order to avoid this limitation, one needs to properly understand the underlying fundamentals behind interest rates changes which will help the trader predict the future interest rates, and in effect enable him/her to limit the risk.

Source: Admiral Markets Australia