NZDUSD has recovered 78.6% of its losses from the April-June 2013 High-Low range. The pair has benefited from the recent institutional inflow against its major counterparts such as EUR, GBP high-betas. The post-FOMC surge higher seems to be overdone but likely to sustain within weekly price range.

As the Buy Climax starts to fade, current appreciation is viewed as corrective and our favored scenario is that this should retrace back to the Weekly TL support area in the near-term. According to BNZ, the fair-value for the pair ranges between 0.8100-0.8700. Any dovishness in the part of RBNZ coupled with near-term depreciation in G10 majors could drive the pair down even further.

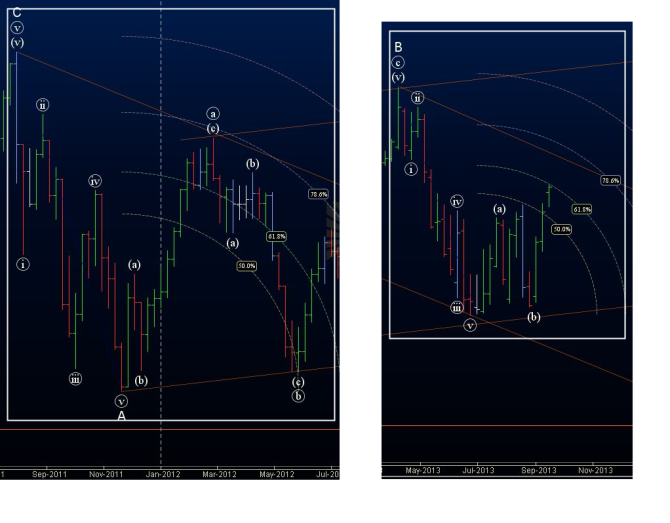

From the Elliottwave perspective, we are approaching the end of a three wave correction C=A after the five wave impulsive downfall. PA also has a self-similar attribute to the price range of Jul-Feb 2012 where three wave correction was also ended at 78.6% retracement. With fibonacci 78.6%/1.618% price symmetry, we have reason to believe that Kiwi should pullback towards 0.8180 area before any further appreciation.

The Daily RSI is extremely overbought and the recent bullish euphoria should fade from 0.8400-50, a potential reversal zone.

Robbie M. Sharif

Technical Strategist

www.fiblogix.com