The announcement late yesterday that Larry Summers has withdrawn from the race to be the new head of the US central bank caused much volatility in the markets in Asia with equity futures surging and the US dollar tumbling against a number of currencies. Larry Summers was amongst the front-runners to succeed Ben Bernanke as … “With Sterling approaching $1.60, little room for disappointment”

Month: September 2013

Sterling still riding high against US dollar

The British pound managed to keep its upward movement against its major currency counterparts during the past week as well. Upbeat data coming from the UK’s labour sector led to appreciation of the GBP/USD pair to 1.5872, or a climb by more than 240 pips compared to a week earlier. Chart movements of other major … “Sterling still riding high against US dollar”

Best Forex Product of the Year goes to FxPro

Forex broker FxPro won the Best Forex Product of the Year at the UK Forex Awards. The prize was given for the recent launch of FxPro’s powerful Qant strategy builder tool – a tool that makes creating EAs accessible for non-programmers. FxPro uses the agency model and reflected on the one year anniversary to the … “Best Forex Product of the Year goes to FxPro”

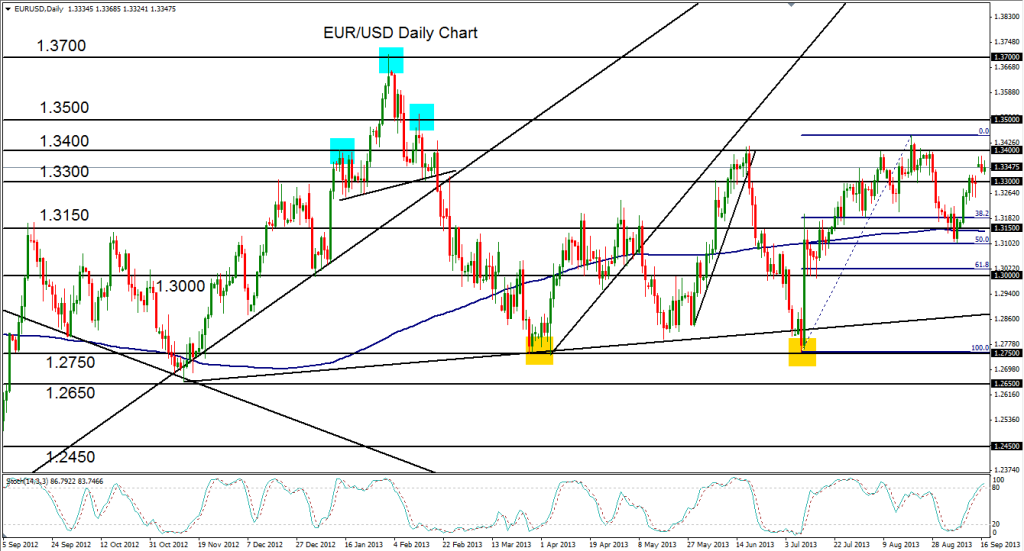

EURUSD and USDJPY Elliott Wave Review After the Gap

Markets gaped against the USD on Sunday, away from Friday’s close price. We can see higher prices on EURUSD, US bonds and also US stocks futures after Larry Summers withdrew from the contest to succeed Ben Bernanke as the next chairman of the Federal Reserve. We have also seen a gap down on Crude Oil … “EURUSD and USDJPY Elliott Wave Review After the Gap”

QE Tapering Preview: 5 Reasons, 6 Scenarios and 7

The Federal Reserve convenes for a highly anticipated meeting to make a decision about QE tapering. There is a a very high probability that the Fed will announce a reduction in the pace of bond buying on September 18th, and probably by $10-15 billion to $70-75 billion. Here are 5 reasons for the expected tapering, 6 … “QE Tapering Preview: 5 Reasons, 6 Scenarios and 7”

EUR/USD: Trading the German ZEW Sep 2013

The German ZEW Economic Sentiment Index is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 9:00 GMT. … “EUR/USD: Trading the German ZEW Sep 2013”

GOLD: Weak, Vulnerable.

GOLD: The commodity remains vulnerable having followed through lower the past week. Support stands at the 1,300.00 level with a violation targeting the 1,272.12 level. A turn below here will turn attention to the 1,250.00 level and next the 1,215.00 level. Its weekly RSI is bearish and pointing lower supporting this view. Conversely, the commodity … “GOLD: Weak, Vulnerable.”

Week Ahead of Fed Meeting: Dollar Soft

This trading week was not good for the US dollar even as traders continued to speculate about possible quantitative easing tampering at the next week’s Federal Reserve policy meeting. The currency ended the week mostly lower against other majors. Chances for a war in Syria were falling, reducing demand for the dollar as a safe investment. The unexpected drop of jobless claims revived the US currency even though it was attributed to statistical error. … “Week Ahead of Fed Meeting: Dollar Soft”

Sweden Krona Falls with Shrinking GDP

The Sweden krona fell after the official data showed that the nation’s economy contracted last quarter, making investors less interested in Sweden assets. Statistic Sweden reported that gross domestic product shrank 0.2 percent in the second quarter of 2013 from the first quarter on a seasonally adjusted basis. Year-on-year, the economy expanded 0.1 percent, far slower than analysts have predicted — 0.6 percent. The data was obviously bad … “Sweden Krona Falls with Shrinking GDP”

Dollar Closes Weaker as US Fundamentals Unpleasantly Surprise

The US dollar erased gains versus the euro and closed lower against some other major currencies, including the Great Britain pound and the Japanese yen, as fundamental reports from the United States were not good at all, making market participants question necessity of stimulus tampering. Today’s reports from the US were surprisingly poor. Retail sales rose just 0.2 percent, missing the forecast of 0.5 percent. The University of Michigan reported … “Dollar Closes Weaker as US Fundamentals Unpleasantly Surprise”