The Polish zloty appreciated today as the nation’s central bank left its key reference rate unchanged and signaled that it is not going to reduce borrowing costs in the future. The National Bank of Poland kept its benchmark interest rate at 2.5 percent. Such decision was expected by market analysts. The bank said in the statement that global and domestic growth improved somewhat in the second quarter of this year. The central bank concluded: … “Zloty Rises as NBP Does Not Plan Cutting Interest Rates”

Month: September 2013

Pound Up on Exceptionally Good Services PMI

The Great Britain pound was rising every single day of this week and today was not an exception as the very good data about the service industry drove the sterling even higher. The Markit/CIPS UK Services Purchasing Managers’ Index rose a little from 60.2 in July to 60.5 in August. Analysts have expected a drop to 59.3. The report said: Augustâs survey of UK service providers signalled continued strong growth of activity and new … “Pound Up on Exceptionally Good Services PMI”

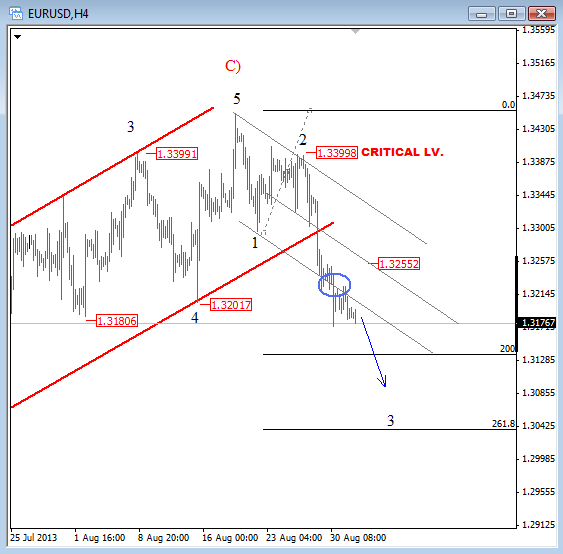

EURUSD Could Be Forming A Major Turning Point For The

EURUSD is trading nicely lower for the last week or so. This could be start of a new and larger impulsive bearish trend. However, the decline from 1.3450 is actually still in three waves, so a corrective outlook must not be ignored. We will stay with the current sentiment and focus on the bearish scenario … “EURUSD Could Be Forming A Major Turning Point For The”

Japanese Yen Logs Small Gains

Japanese yen is logging small gains today, gaining a little ground as uncertainty puts safe haven assets in demand. However, a big move by the yen is unlikely, since there is enough news to keep the currency somewhat weak. With the release of the Fed’s Beige Book expected to boost tapering expectations today, it is little surprise that the yen is showing some signs of weakening against the US dollar. … “Japanese Yen Logs Small Gains”

Broad-Based Eurozone Recovery Not Quite Enough

There’s too much uncertainty about the geopolitical situation right now, and that is weighing on riskier assets today. Indeed, the euro is struggling a bit, even though it appears as though there is a broad-based recovery happening in the eurozone. The latest Eurozone Composite Purchasing Managers Index, compiled by Markit Economics, indicates that a broad-based recovery is underway. The PMI reading showed an improvement to 51.5 from the July number of 50.5. … “Broad-Based Eurozone Recovery Not Quite Enough”

USD/JPY Looks Bearish as US Economy grows by 2.5%

The US will not go to war with Syria unless its allies are with them. However, the UK and France will not be heading into Syria until the UN investigations are complete and the results are given. This geopolitical event has put pressure on the dollar. However the USD had gained after sound economic data … “USD/JPY Looks Bearish as US Economy grows by 2.5%”

Australian Dollar Rallies for Third Day as GDP Growth Matches Estimates

The Australian dollar extended its rally for the third consecutive trading session today as the nation’s economy grew in line with forecasts last quarter, reducing chances for additional interest rate cuts from the central bank. Australian gross domestic product expanded 0.6 percent in the second quarter of 2013, matching analysts’ expectations exactly. The first quarter’s growth was revised down by 0.1 percentage point to 0.6 percent. Australian Industry Group … “Australian Dollar Rallies for Third Day as GDP Growth Matches Estimates”

US Dollar Rallies on Positive Fundamentals, Gains Small

The US dollar rose today as fundamental reports were good, supporting the case for the Federal Reserve to reduce monetary stimulus. The gains were not big, though, and the greenback actually retreated against some currencies, including the Great Britain pound and the Australian dollar. As was expected, the US currency was relatively strong and macroeconomic data were helping it. The Institute for Supply Management manufacturing Purchasing Managers’ Index was up a little from … “US Dollar Rallies on Positive Fundamentals, Gains Small”

USD/JPY: Trading the ISM Services PMI Sep 2013

ISM Non-Manufacturing PMI (Purchasing Managers’ Index), is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the services industry. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. … “USD/JPY: Trading the ISM Services PMI Sep 2013”

Growing Swiss Economy Does Not Help Franc

The Swiss franc dropped today, falling for the second consecutive day even as last quarter’s economic growth of Switzerland was above economists’ expectations. The weakness was likely caused by signs that the central bank will maintain the cap on the currency for a long time. Swiss gross domestic product expanded 0.5 percent in the second quarter of 2013, beating the forecast of 0.3 percent. The report said: As in the previous quarters, positive contributions to growth came primarily … “Growing Swiss Economy Does Not Help Franc”