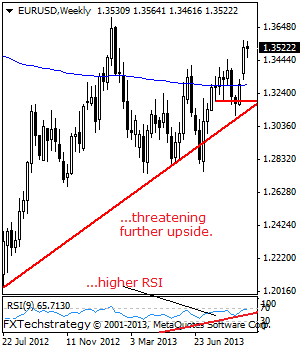

Though closing almost flat the past week, EUR continues to retain its broader upside. Risk of a return to the 1.3700 level remains. Further out, resistance resides at the 1.3800 level followed by the 1.3850 level. Its weekly RSI is bullish and pointing higher supporting this view. Conversely, on a reversal of its current upside … “EURUSD: Maintains Its Bullish Bias”

Month: September 2013

CRUDE OIL: Bearish, Sets Up To Weaken Further

CRUDE OIL continues to weaken, leaving the risk of further downside expected in the new week. Support lies at the 102.00 level followed by the 101.00 level. A violation of here will aim at the 100.00 level and then the 99.00 level, its key psycho level. Its weekly RSI is bearish and pointing lower supporting … “CRUDE OIL: Bearish, Sets Up To Weaken Further”

Mixed Week for US Dollar amid Debt Ceiling Talks

This week was mixed for the dollar as US politicians were debating about the issue of the budget and the debt ceiling, increasing demand for safer currencies, including the greenback, but hurting the appeal of the US currency at the same time. The United States are nearing the limit of their debts and US politicians should agree to cut spending or raise the debt ceiling, otherwise it will lead to a government default. Such outcome could be potentially catastrophic … “Mixed Week for US Dollar amid Debt Ceiling Talks”

Aso Says No Tax Cuts, Yen Jumps

The Japanese yen rose Japanâs Finance Minister Taro Aso signaled that there will not be tax cuts, increasing demand for the currency as a safe haven. Good macroeconomic data helped the currency too. The finance chief said that he is not considering corporate tax cuts. Meanwhile, economists speculate that Prime Minister Shinzo Abe will announce a sales tax hike next week. Aso also … “Aso Says No Tax Cuts, Yen Jumps”

Pound Jumps as Carney Sees No Need for More Stimulus

The Great Britain pound surged after central bank Governor Mark Carney signaled that he sees no need for additional monetary stimulus as economic recovery gains momentum. Such comments were definitely positive for the currency, which was unable to outperform the Japanese yen though. The Bank of England leader said yesterday: My personal view is, given the recovery has strengthened and broadened, I donât see a case for quantitative easing and I have … “Pound Jumps as Carney Sees No Need for More Stimulus”

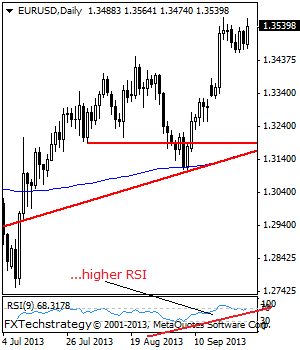

EURUSD: Looks To Recapture The 1.3568 Level and Beyond.

With EUR remaining bullish and pointing higher following a reversal of its Thursday weakness, the risk is for a return above the 1.3568 level to occur. Further out, resistance comes in at the 1.3600 level followed by the 1.3650 level and possibly higher towards the 1.3700 level. Its daily RSI is bullish and pointing higher … “EURUSD: Looks To Recapture The 1.3568 Level and Beyond.”

5 Most Predictable Currency Pairs – Q4 2013

A predictable currency pair will make a convincing follow through after breaking a clear technical barrier, or hesitate and bounce off. A less predictable currency pair will trade choppily and frustrate the technical trader. Some currency pairs are consistent with their behavior, while others change over time. Evens in markets, periods of the year and … “5 Most Predictable Currency Pairs – Q4 2013”

Brazilian Real Falls Despite Efforts of Central Bank

The Brazilian real fell today as US budget impasse led to nervousness among Forex traders and unwillingness to buy riskier assets of emerging economies. The currency was soft despite the efforts of the central bank. The US debt ceiling problem continued to affect the market sentiment negatively and this makes higher-yielding currencies weaker, including the real. To address the issue, the central bank keeps in place the $60 billion intervention program to bolster the currency and rein inflation. … “Brazilian Real Falls Despite Efforts of Central Bank”

Swiss Franc Rises as Positive Data Results in Optimism

The Swiss franc surged today, reaching the highest level since February against the US dollar and the strongest rate since June versus the euro, as positive macroeconomic data improved the outlook for nation’s economic growth. The KOF Economic Barometer rose to 1.53 in September up from 1.37 in August. The median forecast has promised a smaller increase to 1.46. The report said: The latest development in the dynamics of the KOF Economic Barometer leads to the expectation that year-on-year … “Swiss Franc Rises as Positive Data Results in Optimism”

Loonie Falls on US Shutdown Worries, Lower Oil Prices

Canadian dollar is falling today, dropping on concerns about the US government shutdown possibility, and on oil prices. There’s a lot weighing on the Canadian economy right now, and that is affecting the loonie for the worse. Concerns that the Republican-controlled House of Representatives will force a government shutdown over the Patient Protection and Affordable Care Act are affecting the Canadian economy. A shutdown would have an impact on the US economy, and Forex traders know that … “Loonie Falls on US Shutdown Worries, Lower Oil Prices”