Fundamental data from the United Kingdom continued to be good, adding to evidences of economic growth. It supported the Great Britain pound, which rallied today, but currently has troubles maintaining gains. The sterling remains higher versus the Japanese yen, but retreated against the US dollar as of now. The manufacturing Purchasing Managers’ Index advanced from 54.8 in July to 57.2 in August, the highest level in two-and-a-half years, while output and new … “GBP Rallies as Recovery Proceeds, Has Hard Time Maintaining Rally”

Month: September 2013

Canadian Dollar Heads Higher as Syria Cools Down

Canadian dollar is getting a little boost against its major counterparts today, gaining ground as concerns about what’s happening in Syria ease a little. Additionally, Forex traders are waiting for information on policy from the Bank of Canada on Wednesday, as well as August employment data slated to be released on Friday. Loonie is getting a little help today, heading higher as concerns about Syria ease. Worries about imminent US … “Canadian Dollar Heads Higher as Syria Cools Down”

Euro Heads Lower on ECB Expectations

Euro is mostly lower today, struggling as ECB expectations keep the 17-nation currency down. The currently-low rates are expected to continue, with the announcement coming later this week. All eyes are on central banks this week as Forex traders await decisions and statements from policymakers. One of the banks that will be spotlighted this week is the European Central Bank. However, expectations for the ECB are that things … “Euro Heads Lower on ECB Expectations”

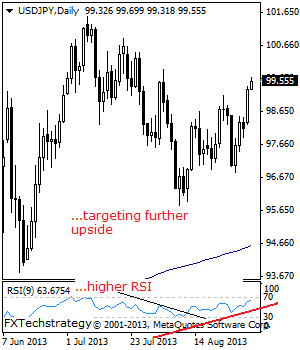

USDJPY Targets Further Upside

USDJPY: Having maintained its upside offensive, USDSJPY looks to extend that strength in the days ahead. However, it will have to retake the 99.93 levels and then the 100.86 level to create scope for more gains where a break will resume its upside offensive. Further out, resistance resides at the 101.52 level. Conversely, support comes … “USDJPY Targets Further Upside”

Leverate’s LXFeed gets a performance boost

Software provider Leverate has redeveloped its LXFeed data feed from the ground up with multicast architecture resulting in an even faster feed. These kind of improvements do not include shiny screenshots, but are certainly useful for traders. Leverate recently opened an R&D center in Kiev. For more about this performance boost, here is the press … “Leverate’s LXFeed gets a performance boost”

Microsoft Nokia deal unlikely to impact EUR/USD

Software giant Microsoft will buy the mobile department of the Finnish company Nokia for around 7.2 billion dollars. This is big news in the world of smartphones and for anyone interested in these industries. However, the buying of a euro-zone company by a US company is unlikely to have a positive impact on EUR/USD, even … “Microsoft Nokia deal unlikely to impact EUR/USD”

Aussie Advances as RBA Does Not Mention Interest Rate Cuts

The Australian dollar advanced today after the Reserve Bank of Australia left interest rates unchanged and did not mention potential interest cut in its statement. The RBA left its key interest rate at 2.5 percent at today’s meeting. The central bank said: Recent information is consistent with global growth running a bit below average this year, with reasonable prospects of a pick-up next year. The statement was … “Aussie Advances as RBA Does Not Mention Interest Rate Cuts”

Currency Cap Stays as Long as Needed, Swissie Drops

The Swiss franc fell yesterday and maintained losses today as central bank’s Vice President Jean-Pierre Danthine indicated that the cap on the currency stays as long as the economic situation warrants. The currency managed to register gains versus the Japanese yen. Danthine said: The cap isnât there forever — it is there as long as it corresponds to monetary conditions. Earlier, Swiss National Bank President Thomas Jordan that said he sees no … “Currency Cap Stays as Long as Needed, Swissie Drops”

Week of Central Banks, Is It Bullish for USD?

The US dollar ended both the last trading week of August and the month itself with solid gains. Should traders remain bullish on the currency? Analysts do not see reasons not to be. The first trading week of September started rather quietly as the United States were celebrating the Labor Day. Yet the rest of the week will be anything but quiet. As much as five major central banks will announce policy decisions: … “Week of Central Banks, Is It Bullish for USD?”

AUD/USD: Trading the Australian GDP Sep 2013

Australian GDP provides a broad measurement of the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity. A reading which is higher than the forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at … “AUD/USD: Trading the Australian GDP Sep 2013”