The New Zealand dollar jumped today as China’s manufacturing index climbed to the highest level in 16 month, suggesting that the economy of New Zealand’s biggest trading partner is still in a good shape. Chinaâs manufacturing Purchasing Managers’ Index climbed from 50.3 in July to 51.0 in August. Analysts have predicted ahead of the data a smaller increase to 50.6. The report said that the improvement was caused mainly by new orders and noted: In our … “NZ Dollar Jumps as China’s Manufacturing PMI Reaches 16-Month High”

Month: September 2013

Japanese Yen Lower Across the Board

Japanese yen is lower across the board today, dropping as continued economic stimulus measures keep the currency lower against its major counterparts. With economic stimulus likely to continue in Japan, yen weakness is expected to be a regular part of the landscape. The economic stimulus efforts in place by the Bank of Japan are expected to be working, with expectations high for an upward revision to GDP for the second quarter of 2013. However, even with … “Japanese Yen Lower Across the Board”

Better Economic Data Doesn’t Help the Euro Much

The latest economic data isn’t doing much to help the euro today. The 17-nation currency is struggling against its major counterparts, despite the latest report on manufactured goods. There are still enough concerns about the eurozone and its recovery to give some Forex traders pause about the euro. Markit Economics reports today that the Purchasing Managers’ Index (PMI) moved up to 51.4 in August, showing an improvement over the July … “Better Economic Data Doesn’t Help the Euro Much”

Ringgit Advances on Hopes for Fiscal Measures

The Malaysian ringgit advanced today, paring earlier decline, on hopes that the government will announce measures that will help to improve the financial health of Malaysia. The Malaysian government is expected to announce measures that should reduce spending. Among them: a consumption tax, reduction of subsidies and delay of infrastructure projects. The ringgit rallied, paring the previous drop that was caused by concerns about possible quantitative easing tampering by the US Federal … “Ringgit Advances on Hopes for Fiscal Measures”

Webinar: Why is the euro so high? (Updated September

You are welcome to join me for a webinar titled Why is the euro so high? The webinar will be held on September 3rd, 15:00 GMT, and is courtesy of FXstreet. Join here. This is the second version of the webinar, originally held back in June. In the original version, I also discussed when the … “Webinar: Why is the euro so high? (Updated September”

Syrian tension leads to losses on the global markets

Indices European stock markets continued their downward movements over the past week. Growing tension over the Syrian crisis, with possible military strikes against the country, caused concerns among investors, waking them up from the summer lethargy. All major indices closed in red territory on Friday, with the biggest fall registered by Spain’s IBEX – down … “Syrian tension leads to losses on the global markets”

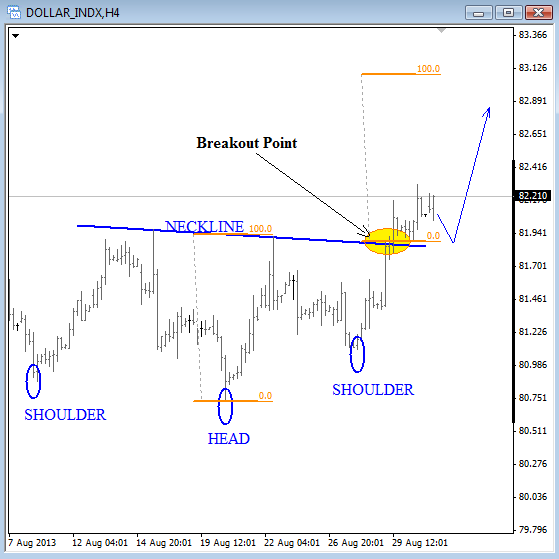

Inverse H&S On USD Index Suggests More Weakness On

Markets gapped on Sunday against the USD after the U.S. President Barack Obama delayed a military strike against Syria by requesting authorization from an incredulous Congress. From a technical perspective the wave patterns and direction did not change much. We are bullish on USD. This means we expect weakness on the majors, such as EUR, … “Inverse H&S On USD Index Suggests More Weakness On”

GBP/USD: Trading the British Construction PMI September 2013

British Construction PMI Index is based on a survey of purchasing managers in the UK construction industry. Respondents are surveyed for their view of a wide range of business conditions, including employment, new orders, prices and inventories. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 … “GBP/USD: Trading the British Construction PMI September 2013”

Could PMIs be missing something?

Purchasing managers’ indices are considered excellent forward looking indicators, as they reflect growth prospects. Usually, there is a nice correlation between PMIs and future growth, often with a two month lag. However, an example from a very developed country casts doubt on validity of PMIs, especially in turning points. Sweden reported a contraction of 0.1% … “Could PMIs be missing something?”

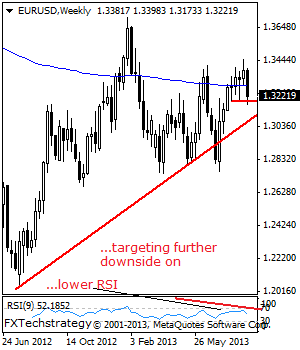

EURUSD: Turns Lower On Correction.

Unless EUR follows through lower on the losses of the previous week, there is risk of a return to the to the upside. If this occurs, the 1.3451 level will be targeted. A break through here will set the stage for more strength towards the 1.3500 level with a break resuming its broader upside and … “EURUSD: Turns Lower On Correction.”