The Taiwan dollar retreated today, but still traded near the highest level in four months after the US Federal Reserve shook the market by refraining from quantitative easing tampering. The Fed made no changes to its stimulus program last week, surprising Forex market participants who have expected some form of QE tampering. Most currencies, except safer ones, surged after the decision, though trimmed their gains … “Taiwan Dollar Retreats, Still Near Four-Month High”

Month: September 2013

Time for the US dollar to recover?

With the German elections over, attention now focuses on the US debt ceiling. Chancellor Merkel did exceptionally well in the German elections with an estimated 42 per cent of the vote. However, the results leave Merkel’s Christian Democrats just short of an overall majority and a protracted period of coalition building lies ahead. The reaction … “Time for the US dollar to recover?”

Aussie Rises as China’s Manufacturing Growth Beats Expectations

The Australian dollar rose today after a report of China’s manufacturing was released on the weekend, showing that the sector expanded this month with faster pace than was predicted by analysts. The HSBC Flash China Manufacturing Purchasing Managers’ Index rose from 50.1 in August to 51.2 in September. It was the highest reading in six months. Analysts have anticipated a smaller increase to 50.9. The report said: The firmer footing was supported … “Aussie Rises as China’s Manufacturing Growth Beats Expectations”

Fed stuns the markets; What to expect this week? Weekly

Forex: Last week’s biggest and most surprising headliner proved to be the Fed’s unexpected decision to keep its current monetary policy unchanged, which was followed by emotional reactions on the financial markets. Maintaining the influx of $85 billion in the country’s economy in the form of purchases of government bonds and mortgage-backed assets had a serious … “Fed stuns the markets; What to expect this week? Weekly”

Graeme Whittington is OANDA’s new CTO

Graeme Whittington, who was a BlackBerry executive, will head OANDA Corporation’s new technology efforts. OANDA is one of the more innovative forex brokers. The company recently introduced new features in its fxTrade mobile application. For all the details about the appointment, here is the official press release: LONDON – September 23, 2013 – OANDA Europe Limited, … “Graeme Whittington is OANDA’s new CTO”

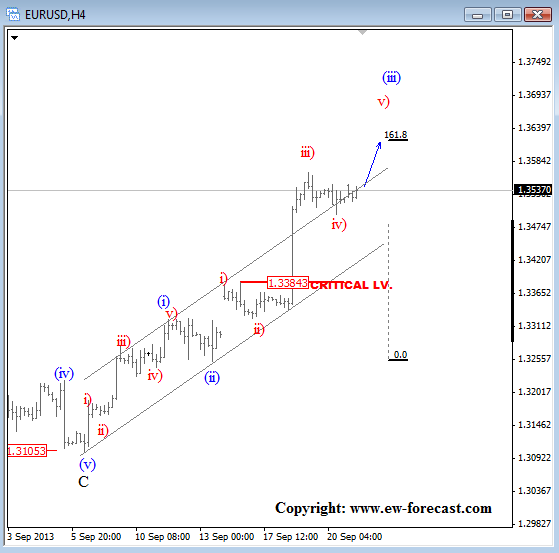

EURUSD Could Move Above 1.3600 – Elliott Wave Forecast

EURUSD closed above the 1.3500 figure last week. This suggests more upside this week. The reason for the bullish outlook in the short-term is a sharp rally from the 1.3320 low which appears to be a third leg within a third based on the personality of the move. Recently a third leg has stopped at … “EURUSD Could Move Above 1.3600 – Elliott Wave Forecast”

GOLD: Weak, Targeting Further Downside

GOLD: With the commodity still vulnerable to the downside, the threat of a return to the 1,291.12 level remains. A violation of here will aim at the 1,250.00 level. A turn below here will turn attention to the 1,215.00 level and next the 1,180.00 level. Its weekly RSI is bearish and pointing lower supporting this … “GOLD: Weak, Targeting Further Downside”

EUR/USD: Trading the IFO September 2013

The German Ifo Business Climate is a monthly composite index of about 7,000 businesses, which are surveyed about current business conditions and their expectations concerning economic performance over the next six months. A reading which his higher than the forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD.. … “EUR/USD: Trading the IFO September 2013”

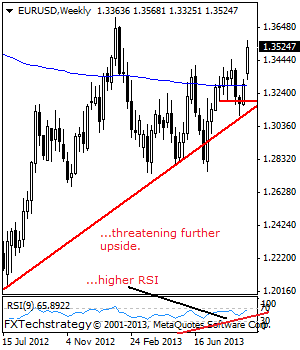

EURUSD: Bullish after conquering the 1.3451 Level

EURUSD: Having taken out the 1.3451 level, there is risk of a return to the 1.3600 level. Further out, resistance resides at the 1.3700 level followed by the 1.3800 level. Its weekly RSI is bullish and pointing higher supporting this view. Conversely, on a reversal of its current upside it could recapture the 1.3451 level. … “EURUSD: Bullish after conquering the 1.3451 Level”

Is the Kiwi’s Move Overdone?

NZDUSD has recovered 78.6% of its losses from the April-June 2013 High-Low range. The pair has benefited from the recent institutional inflow against its major counterparts such as EUR, GBP high-betas. The post-FOMC surge higher seems to be overdone but likely to sustain within weekly price range. As the Buy Climax starts to fade, current … “Is the Kiwi’s Move Overdone?”