The Swiss franc soared yesterday and remained strong today even as the nation’s central bank kept the cap on the currency in place and signaled that it wants the Swissie to weaken. The Swiss National Bank maintained interest rates near zero on today’s meeting. The bank complained about the strength of the franc and promised to keep the ceiling intact as long as necessary in the statement: The Swiss National Bank (SNB) is maintaining its minimum exchange rate of CHF 1.20 … “Swiss Franc Retains Strength After SNB Maintains Ceiling”

Month: September 2013

NO Taper Wrap Up – All the Information

For long weeks, expectations have been building up to the big FOMC decision, that supplied a big drama in financial markets when the Fed surprised and decided not to taper QE. A lot has been written around the event. Here is a wrap of everything related: the previews before the event, the breaking news, currency specific … “NO Taper Wrap Up – All the Information”

Fed’s tapering decision should support risk currencies for a

The US Federal Reserve bottled it on tapering its quantitative easing programme, which was positive news for risk currencies and risk assets and the relief will no doubt support rallies in these markets, but the Fed has merely kicked the can down the road. Fears over the strength of the US recovery and worries about … “Fed’s tapering decision should support risk currencies for a”

Euro Gains as ECB Rate Cut Not Considered Imminent

Euro is gaining ground today as concerns about an ECB rate cut are eased — at least for the time being. The decision of the Federal Reserve to keep the asset purchase program in place in the United States has helped money markets, and made things a little easier for policymakers in the eurozone. The surprising decision of the Federal Reserve to keep its asset purchase in place without tapering has impacted markets all over the world. Prior to the decision, money … “Euro Gains as ECB Rate Cut Not Considered Imminent”

Aussie Pulls Back After Earlier Gains

Aussie jumped higher after the announcement that the Federal Reserve would not start tapering its asset purchases this month. However, after its earlier performance, the Australian dollar has eased back, and is now heading lower against its major counterparts. Following the news that the Federal Reserve would not begin tapering its asset purchases, the Australian dollar jumped to a three-month high against the US dollar. … “Aussie Pulls Back After Earlier Gains”

Post FOMC Video Rundown

After the very surprising decision by the Fed to refrain from tapering QE, Financial Juice hosted a rundown of the event. In the video below, Lior Cohen of TradingNRG and I spoke about the event and its aftermath. In the video below, we discuss the reasons for and against tapering as well as the next moves. … “Post FOMC Video Rundown”

Norway Krone Stronger After Central Bank’s Policy Meeting

The Norway krone advanced today after the nation’s central bank left its key policy rate unchanged and signaled that it plans interest rate hikes, not cuts. The Norges Bank kept the main interest rate at 1.5 percent today. The bank said in the statement: The analyses imply a key policy rate at today’s level in the period to summer 2014, followed by a gradual increase to a more normal level. The signs that the central bank … “Norway Krone Stronger After Central Bank’s Policy Meeting”

NZD Rises as GDP Maintains Pace of Growth

The New Zealand dollar ticked up today after a report showed that the nation’s economy was able to maintain pace of its growth little changed last quarter as was expected by market participants. New Zealand gross domestic product grew 0.2 percent in the second quarter of this year, matching expectations. The first quarter’s expansion was revised slightly up to 0.4 percent. The data was considered good by traders, propelling … “NZD Rises as GDP Maintains Pace of Growth”

Join us for a post FOMC Shakedown at 12:00 GMT

The Federal Reserve refrained from tapering QE in a big surprise that sent shockwaves in all financial markets and asset classes. Why did this happen? And more importantly, what’s the next move of the Fed and where are markets headed? Join Lior Cohen of Trading NRG and Yohay Elam of Forex Crunch at 12:00 GMT … “Join us for a post FOMC Shakedown at 12:00 GMT”

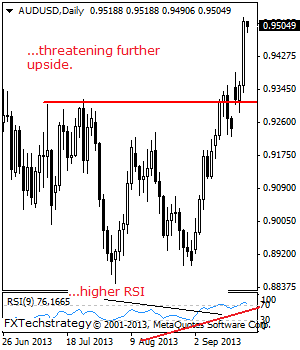

AUDUSD: Rallies, Eyes Further Upside

AUDUSD: With continued upside offensive seeing the pair rallying on Wednesday, the risk is for more strength to occur. Resistance resides at the 0.9550 level with a cut through here opening the door for a run at the 0.9600 level. Further out, resistance resides at the 0.9650 level and then the 0.9700 level. Its daily … “AUDUSD: Rallies, Eyes Further Upside”