We all live in a Yellen submarine. Since the dovish central banker became the putative front-runner in the race to lead the Federal Reserve, fears about the debt ceiling debacle have been submerged under the expectation that cheap liquidity would continue to flow into the financial markets. Today, this dynamic is receiving additional momentum from … “We all live in a Yellen submarine”

Month: October 2013

Sterling still looking over-valued against the US dollar

Sterling has had a tremendous run since the first week of July against the US dollar as the currency has appreciated from 1.48 USD to over 1.62 USD last week. Sterling has come off a little in the last week with the rate now just below 1.60 USD as economic data has recently come in … “Sterling still looking over-valued against the US dollar”

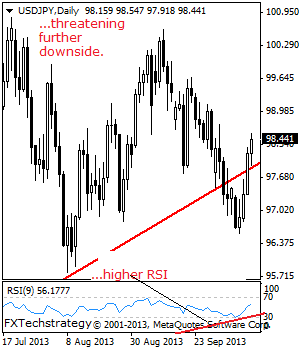

USD/JPY Sees Further Upside

The pair continues to extend its recovery leaving it targeting more upside in the days ahead. As long as it holds above the 96.18 level, the risk still remains higher. This leaves the threat of a return to the 99.00 level and the 100.60 level on the cards. A violation of here will aim at … “USD/JPY Sees Further Upside”

Australian Dollar Trades in Tight Range, Awaiting for US Politicians

The Australian dollar was moving largely sideways today as Forex traders hold breath, waiting for US politicians to demonstrate whether they are willing to find a compromise and avoid a default. Expectations of a positive trade report from China supported the currency. House Speaker John Boehner proposed to extend the deadline for lifting the debt ceiling from October 17 to November 22 without any conditions attached to the decision. House Republicans will discuss … “Australian Dollar Trades in Tight Range, Awaiting for US Politicians”

Mexican Peso Gains as S&P Confirms Positive Outlook

The Mexican peso advanced today as Standard & Poor’s affirmed the nation’s credit rating and the positive outlook. The currency also rallied on hopes that US politicians will avoid potentially catastrophic default. S&P confirmed Mexico’s BBB/A-2 foreign currency and A-/A-2 local currency sovereign credit ratings. The rating agency explained its decision: The ratings on Mexico reflect its track record of cautious fiscal and monetary policies, which have contributed … “Mexican Peso Gains as S&P Confirms Positive Outlook”

US Dollar Loses Ground as Risk Appetite Surges

US dollar is losing ground as risk appetite takes over. After logging gains earlier, the greenback is pulling back as high beta currencies see demand. US stocks have sky rocketed higher, and sentiment is improving, thanks to improve hopes for a budget deal and a debt ceiling deal in the United States. It looks as though Congressional leaders are ready to move forward with a deal to raise the debt ceiling … “US Dollar Loses Ground as Risk Appetite Surges”

EUR/USD: Trading the UoM Consumer Index – October 2013

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 13:55 GMT. Indicator … “EUR/USD: Trading the UoM Consumer Index – October 2013”

Currency Insights October 2013

As the ongoing Washington shutdown continues to give way to diverging domestic and global economic conditions, the next major hurdle for the world’s currencies, risk, and the US market will be the continuation of the budget discussion in the week ahead and the ultimate debt ceiling debate going into mid-October. We don’t expect a “grand … “Currency Insights October 2013”

Canadian Dollar Continues to Fluctuate

Canadian dollar is fluctuating today, performing erratically as rumors of a compromise on the debt ceiling issue come from the United States. Loonie is still struggling, though, as oil prices continue to drop, and as home prices data doesn’t quite meet expectations. Canadian dollar is gaining a little ground against European currencies today, but continues to struggle against the US dollar. The latest news out of the United States is that … “Canadian Dollar Continues to Fluctuate”

Ceiling for Swiss Franc No Longer Needed?

The recent weakness of the Swiss franc led to speculations that cap on the currency that the Swiss National Bank has introduced in 2011 is no longer necessary. The Swissie declined today, but rebounded later, erasing losses versus the US dollar and reducing the drop against the euro. As of now though, the currency resumed its drop. The franc was not trading near the ceiling of 1.20 per euro this year. This led to speculations … “Ceiling for Swiss Franc No Longer Needed?”