The Great Britain pound advanced versus the Japanese yen and trimmed its losses against the US dollar today after the Bank of England decided to leave its monetary policy unchanged. As was expected, the BoE made no changes to its policy. The central bank announced: The Bank of England’s Monetary Policy Committee at its meeting on 9 October voted to maintain the official Bank Rate paid on commercial bank reserves at 0.5%. The Committee also … “BoE Makes No Changes to Policy, Pound Stronger”

Month: October 2013

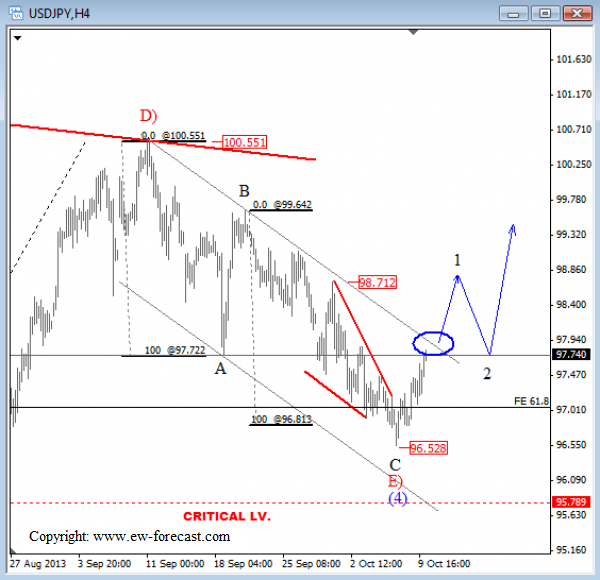

USDJPY Could Rally While 10-Year US Notes Are Moving

US Bonds were trading lower in the last two sessions after the minutes of the Federal Reserve showed that most policymakers still favored a tapering program this year. But, the sell-off in bonds came on news that QE could end in mid-2014. The USD was firstly down on the news, but then it recovered during … “USDJPY Could Rally While 10-Year US Notes Are Moving”

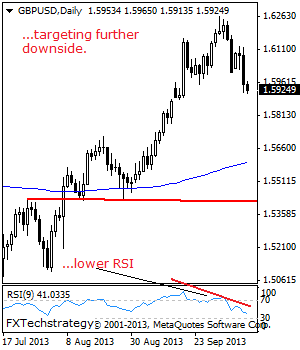

GBPUSD: Weak, Vulnerable

GBP extended its corrective weakness on Thursday leaving more downside pressure on the cards. Support comes in at the 1.5950 level where a violation will aim at the 1.5900 level. Further down, the 1.5850 level stands as the next downside objective with a breach targeting the 1.5800 level. Its daily RSI is bearish and pointing … “GBPUSD: Weak, Vulnerable”

Which way next for USD/JPY?

Unsurprisingly, the current US government shutdown is weighing on many currency pairs involving the USD. However, the dollar has particularly lost ground against the yen and this is due to a variety of factors. The US government is only partially functional with over 800,000 workers being told to stay at home without pay. This has … “Which way next for USD/JPY?”

Euro Soft vs. Dollar, Strong vs. Yen

Various news from the United States made the euro weaker than the dollar, resulting in the third consecutive session of losses for the shared European currency today. At the same time, positive data from Germany allowed the euro to gain on the Japanese yen. The dollar surged against the euro on the news that US President Barack Obama is going to nominate Janet Yellen as the next head of the Federal Reserve. The minutes of the last Fed policy meeting added … “Euro Soft vs. Dollar, Strong vs. Yen”

Australian Dollar Loses Gains as Employment Disappoints

The Australian dollar dipped today as nation’s employment grew last month less than was expected even though the unemployment rate went down. The currency trimmed gains versus the euro and the Japanese yen and fell against its US counterpart. Australian employment grew by 9,100 jobs, trailing the forecast of 15,200. At the same time, the unemployment rate managed to drop to 5.6 percent. Analysts have though that it would stay at 5.8 … “Australian Dollar Loses Gains as Employment Disappoints”

Central bank intervention can’t be far off as US debt

The increasing possibility that interest payments will be missed on US Treasuries poses serious risks to the global financial system and could trigger rounds of central bank intervention should USD go into free fall. The political stalemate in the US, should it become protracted, could result in a major sell-off of USD, particularly against safe … “Central bank intervention can’t be far off as US debt”

US Dollar Gains Ground as Uncertainty Continues Over Shutdown

US dollar is higher today, thanks in large part to uncertainty over the government shutdown. So far, there are no signs of an end to the impasse, and the added stress of a debt ceiling debate could be coming next. Risk aversion is making an appearance as a result, and there are concerns about what could be next. Greenback is a little higher against its major counterparts today. A little spark of risk … “US Dollar Gains Ground as Uncertainty Continues Over Shutdown”

OANDA’s fxTrade Mobile now supports German

Good news for German speaking OANDA users: the international forex broker now supports the German language in its mobile platform. OANDA recently purchased Currensee. For more on the German language support, here is the full press release: LONDON – October 9, 2013 – OANDA Europe Limited, a subsidiary of OANDA Corporation, a global provider of … “OANDA’s fxTrade Mobile now supports German”

Poor Economic Data Hurts Sterling

The Great Britain pound slid today as UK macroeconomic data disappointed traders and led to doubts about recovery that now seems more fragile that it looked previously. It was expected that manufacturing production will affect the pound significantly. It has indeed done so, but in a completely unexpected manner. Manufacturing production It was expected from July, while forecasts promised 0.3 percent growth. … “Poor Economic Data Hurts Sterling”