The Australian dollar today rose ahead of tomorrow’s employment data, which is expected to be good, even as the consumer sentiment retreated. Analysts predict that tomorrow’s report will show an increase of employment by 15,200 jobs. The Westpac Melbourne Institute Index of Consumer Sentiment fell by 2.1 percent in October after jumping 4.7 percent in the prior month. Still, the report called the reading “a solid result”, explaining that the decline was expected … “Aussie Logs Gains Ahead of Jobs Report”

Month: October 2013

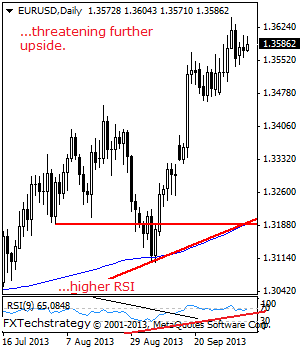

EURUSD: Price Extension Envisaged

EURUSD: With the pair maintaining its broader upside there is risk of an eventual return to the upside. As long as it can hold above the 1.3568 level, its medium term uptrend remains intact. Resistance resides at the 1.3645 level where a breach will aim at the 1.3710 level, its Feb 01’2013 high with a … “EURUSD: Price Extension Envisaged”

Franc Slides Despite Good Fundamentals, Stays Away from Ceiling

The Swiss franc slumped today even as yesterday’s macroeconomic data from Switzerland was rather good. As a result, the currency stays far away from the cap of 1.20 per euro that has been set in September 2011 by the central bank. The currency managed to gain on the Japanese yen. Swiss retail sales grew 2.4 percent in August from a year ago, exceeding the consensus forecast of 1.7 percent. The Consumer Price Index rose … “Franc Slides Despite Good Fundamentals, Stays Away from Ceiling”

Canadian Dollar Falls as Trade Deficit Widens

The Canadian dollar dropped yesterday as the unexpected increase of the nation’s trade deficit added to pessimism caused by the budget impasse in the United States. The currency attempts to rebound against the Japanese yen today, but keeps losses versus other major currencies. US politicians continue to bicker even as other nations urge them to get together and avoid hurting the world economy. There is not much time left before the USA runs out … “Canadian Dollar Falls as Trade Deficit Widens”

AUD/USD: Trading the Australian jobs Oct 2013

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Oct 2013”

Budget Impasse Continues to Weigh on Greenback

The current budge impasse continues to weigh on the greenback today, sending the currency lower against the euro and the pound. US dollar has managed to log gains against the Japanese yen, but the dollar index is lower today anyway. Disagreements over how to end the government shutdown are the focus for the US dollar right now, and that is weighing on the greenback’s performance. After shutting down the government over the Patient Protection and Affordable Care … “Budget Impasse Continues to Weigh on Greenback”

Euro Gets Boost from Jobs Data, German Improvements

Euro is getting a boost today, thanks in large part to the latest jobs data, and to improvements in Germany’s economic data. Germany is seeing an increase exports, and there is a decline in the eurozone’s jobless rate. Right now, the German economy is making strides. Exports rose in August, according to the Federal Statistics Office, and there was also a drop to 6.9 per cent unemployment for Germany. On top of that, the ZEW reports that investor … “Euro Gets Boost from Jobs Data, German Improvements”

Aussie Rallies as Business Confidence Improves

The Australian dollar rallied today despite concerns about the situation in the United States that made the currency drop yesterday. The Aussie profited from improving business confidence. The business confidence index of the National Australia Bank climbed from 4 in August to 12 in September. The report said: Confidence surges to its highest level in 3½ years. Business conditions, however, still subdued â with employment poor. AUD/USD rallied from 0.9426 … “Aussie Rallies as Business Confidence Improves”

Infinium Note bought by FXCM

FXCM continues its shopping spree. The US based broker recently bought Faros Trading and it now announces a new deal, with Infinium: a market maker in forex and commodities. FXCM bought a $12 million note issued by Infinium. The note matures in August 2015. The deal was also done through Lucid. FXCM owns 50.1% of Lucid. … “Infinium Note bought by FXCM”

Pound Recovers as Optimism Returns

The Great Britain pound erased its losses versus the US dollar and rose against the Japanese yen as positive macroeconomic data revived optimism for recovery in the United Kingdom. Analysts’ pessimistic expectations about the sterling were not correct so far. The currency rallied as the Residential Market Survey of Royal Institution of Chartered Surveyors was quite positive. The Quarterly Economic Survey of the British Chamber of Commerce was very good too. David Kern, … “Pound Recovers as Optimism Returns”