GOLD: The commodity remains vulnerable to the downside having declined the past week. The risk is for more downside to occur towards the 1,272.00 level. A violation of here will aim at the 1,250.00 level with a turn below here shifting attention to the 1,215.00 level and next the 1,180.00 level. Conversely, resistance lies at … “GOLD: Bearish, Vulnerable To The Downside – Technical Analysis”

Month: October 2013

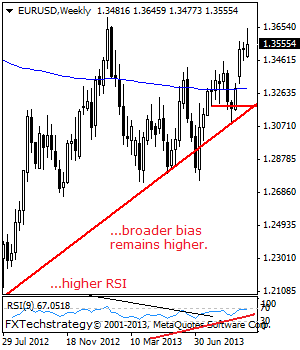

EURUSD: Bullish, Maintains Its Broader Upside Bias

EURUSD: The pair continues to hold on to its medium term uptrend suggesting further upside. Risk of a return to the 1.3645/1.3700 levels remains. Further out, resistance resides at the 1.3800 level followed by the 1.3850 level. Its weekly RSI is bullish and pointing higher supporting this view. Conversely, on a reversal of its current … “EURUSD: Bullish, Maintains Its Broader Upside Bias”

Week of US Government Shutdown, Not That Bad for Dollar

This week had a significant impact on the Forex market as the US government experienced a partial shutdown. The US dollar was falling because of this event, which overshadowed other news. Yet by the weekend the currency made a huge thrust to the upwards, trimming losses against some majors and even gaining against others. Many market participants were hoping that US politicians would come to a last-minute agreement before the deadline to avoid a shutdown. … “Week of US Government Shutdown, Not That Bad for Dollar”

US Dollar Ends Week Mixed

The US dollar ended the week mixed, rising against some currencies and falling against others, as Forex traders were trying to assess the damage the partial US government shutdown will cause to the economy. There were different opinions regarding the impact of the budget standoff on the economy. Some analysts were saying that the shutdown will be short-lived and damage will be minimal, while others expect rather server losses to the economy. As a result … “US Dollar Ends Week Mixed”

Pound Ends Week with Sharp Drop

The Great Britain pound slumped on Friday and slumped hard. There were not many fundamental reasons for such sharp drop and Forex market analysts were speculating that the currency has just overextended its rally. Some specialists were arguing that a violent correction should be expected after such long rally that the pound has demonstrated. Others pointed out that recent fundamental reports gave reasons … “Pound Ends Week with Sharp Drop”

China’s Growth Benefits Taiwan Dollar

The Taiwan dollar strengthened yesterday as signs of robust economic growth in China was helping Asian currencies, attracting investors to the region. The latest PMI reports, both manufacturing and non-manufacturing, were quite good, suggesting that China’s growth retains momentum. It made traders more interested in Asian assets. As a result, investors were buying Taiwan bonds, leading the TAIEX index to the highest level since May on a closing basis yesterday. USD/TWD … “China’s Growth Benefits Taiwan Dollar”

Yen Stronger as BoJ Sees Economy Recovering

The Japanese yen was almost flat versus the US dollar today, but rose against other major currencies, like the euro and the Great Britain pound, after the Bank of Japan left its monetary policy unchanged at today’s meeting. Japanese yen maintained interest rates near zero and kept the ¥60–70 trillion asset purchase program intact. The BoJ said in the statement that “Japan’s economy is recovering moderately”. All in all, … “Yen Stronger as BoJ Sees Economy Recovering”

Loonie Struggles a Bit on US Government Troubles

Canadian dollar is struggling a bit right now, although the loonie has managed to log some small gains against the greenback. The impact of the US government shutdown is being felt by the Canadian dollar, which is sensitive to economic concerns in the United States. The United States is Canada’s main trading partner, so it is no real surprise that the US government shutdown is having an impact on the Canadian dollar … “Loonie Struggles a Bit on US Government Troubles”

Euro Pulls Back After Hitting 1.36 Against Dollar

Euro is pulling back today after reaching the 1.36 level against the US dollar. The 17-nation currency got a boost earlier, but has since settled back as more traders consider the situation. Euro got a boost from the most recent ECB announcement yesterday, as well as help against the US dollar as the impasse over government funding continues. However, some feel that the greenback might have been oversold against … “Euro Pulls Back After Hitting 1.36 Against Dollar”

Q4 outlook – what awaits us at the end of

As we enter the last quarter of a dramatic year in forex trading, there are plenty of open questions – a recipe to volatility. In the webinar made on October 3rd for FXstreet, we reviewed the major events and the different directions of major and minor currencies in the wake of the new quarter. The Fed is … “Q4 outlook – what awaits us at the end of”