German GDP is a key release and is published each quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the euro. Here are all the details, and 5 possible … “EUR/USD: Trading the German GDP November 13 2013”

Month: November 2013

Bank Indonesia Raises Interest Rates, Rupiah Does Not React

The Indonesian central bank surprised Forex traders as it raised its interest rates yet again. But the rupiah did not react to the news and was flat versus the US dollar and fell against the euro. The Bank Indonesia raised its main interest rate by 25 basis points to 7.50 percent, while the Lending Facility rate and Deposit Facility rate were increased to 7.50 percent and 5.75 percent respectively. The central bank … “Bank Indonesia Raises Interest Rates, Rupiah Does Not React”

NZ Dollar Trims Losses vs. US Dollar & Japanese Yen

The New Zealand fell against its US counterpart yesterday, but is trying to rise today. The currency also erased earlier losses versus the Japanese yen. The Reserve Bank of New Zealand released its Financial Stability Report. The report was fairly optimistic, saying: New Zealandâs financial system remains sound. The banks are well capitalised and have strengthened their funding base, while non-performing loans continue to fall. … “NZ Dollar Trims Losses vs. US Dollar & Japanese Yen”

NZD/USD: Trading the New Zealand Retail November 2013

New Zealand Retail Sales is considered one of the most important indicator of consumer spending. The indicator’s release in the first week of each month provides analysts and traders with an early look at consumer spending. A reading that is higher than the market forecast is bearish for the US dollar. Here are all the details, and 5 possible … “NZD/USD: Trading the New Zealand Retail November 2013”

Euro Hangs on to Gains, but Questions Remain

Euro has managed to hang on to recent gains, heading higher as better news adds a degree of optimism. However, the fact remains that the eurozone is emerging from its second recession in the last five years, and there are still plenty of questions about the fate of the euro going forward. Recent gains for the euro have been providing some hope for the eurozone and the sustainability of the recent recovery. Indeed, the euro is higher across the board … “Euro Hangs on to Gains, but Questions Remain”

QE tapering in December still unlikely; EUR could do

With a predicted downgrade in Q3 GDP, low expectations for Q4 after the government shutdown and ongoing budget uncertainty among others, QE tapering in December isn’t that close, says Simon Smith of FxPro. In the interview below, Smith also sees plenty to play for towards year end, with a potential of a stronger euro. In … “QE tapering in December still unlikely; EUR could do”

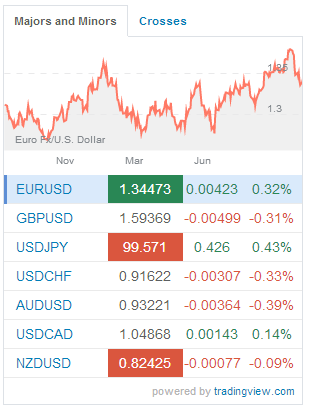

Live forex quotes added on the sidebar

A new feature is available on Forex Crunch: live forex quotes. The new widget on the sidebar shows by default the 7 major and minor pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, NZD/USD and USD/CAD. Clicking on the Crosses tab reveals the following crosses: EUR/GBP, EUR/JPY, GBP/JPY, AUD/NZD and EUR/AUD. The quotes are updated in real … “Live forex quotes added on the sidebar”

Yen Maintains Weakness

Japanese yen is maintaining its weakness right now, underperforming by many standards. The yen is down against its major counterparts, and this state of affairs is unlikely to change, with Japanese officials preferring a weak yen to a strong one. For 2013, the Japanese yen is on track to be one of the weakest currencies. Many consider that the yen is underperforming, but there is no real reason, as yet, to favor … “Yen Maintains Weakness”

Pound Drops as Fundamental Data Disappoints

The Great Britain pound tumbled today as today’s macroeconomic releases were disappointing, especially to those who were bullish on the currency. Most importantly, inflation slowed more than was expected. The Consumer Price Index was at 2.2 percent in October, falling from 2.7 percent in September and trailing the forecast of 2.5 percent. The House Price Balance of Royal Institution of Chartered Surveyors jumped to 57 percent in October, but was still below … “Pound Drops as Fundamental Data Disappoints”

Aussie Falls vs. Greenback as Business Confidence Deteriorates

The Australian dollar fell against its US peer today, dropping for the fourth straight trading session, as business confidence deteriorated last month. The currency rose versus the Japanese yen. The NAB Business Confidence fell from 12 in September to 5 in October. The report said: Businesses may have reassessed their expectations about future activity in the changed political environment given the continued weakness in actual business conditions. Nonetheless, overall confidence … “Aussie Falls vs. Greenback as Business Confidence Deteriorates”