The UK Claimant Count Change measures the change in the number of people claiming unemployment benefits. Along with the Unemployment Rate, which is released at the same time, it provides a snapshot of the UK employment sector. A reading which is higher than the estimate is bullish for the pound. Here are the details and 5 … “GBP/USD: Trading the British Nov 2013”

Month: November 2013

Canadian Dollar Mixed After Holidays

The Canadian dollar demonstrated a mixed performance today, falling against its US counterpart, rising versus the Japanese yen and staying flat against the euro. Signs of economic growth in the United States, the major Canada’s trading partner, were helping the loonie somewhat. Yet those same signs led to speculations that the Federal Reserve will scale back its stimulus and such talks are negative for the Canadian currency. The conflicting fundamentals resulted … “Canadian Dollar Mixed After Holidays”

Euro Strong, Endangered by Slowing Economic Growth

The euro was relatively strong at the start of the week, but speculators are concerned that this week’s fundamental reports may hurt the currency, showing slowing economic growth. The beginning of the week was good from the macroeconomic point of view as Italian industrial production grew 0.2 percent in September following the 0.2 percent decline in August. Still, other reports released this week are not expected to be as good. Most importantly, … “Euro Strong, Endangered by Slowing Economic Growth”

US Dollar Mixed Today on Data From Around the World

Greenback is turning in a mixed performance today as Forex traders process all the recent economic data from around the wold. There’s still a bit of strength for the US dollar from the recent payrolls report, but a bit of risk appetite is appearing on the better economic data out of China, and that is weakening the greenback a little bit. Over the weekend, improving economic data in the United States prompted a rally in the US dollar. The improved … “US Dollar Mixed Today on Data From Around the World”

NZ Dollar Rallies with Help from China, Retreats

The New Zealand dollar was rallying today on positive macroeconomic reports from China, but retreated later and is trading below the opening level as of now. The currency was most likely dragged down by fears of quantitative easing tampering from the US Federal Reserve. China’s inflation accelerated by 0.1 percentage point to 3.2 percent in October, according to the National Bureau of Statistics of China. Industrial production 10.3 percent last month, more … “NZ Dollar Rallies with Help from China, Retreats”

Protests in Thailand Hurt Baht

Protests in Thailand were weighing on the baht as foreign investors were pulling out capital, concerned by the political unrest. Concerns about potential monetary tightening from the US Federal Reserve made the currency even weaker against the US dollar. Thai politicians were discussing an amnesty to those convicts who were imprisoned for political offenses and this led to demonstrations against the planned amnesty bill. There are concerns that the protest will … “Protests in Thailand Hurt Baht”

Great Britain Pound: Ready to Break from Range?

The Great Britain pound was moving basically sideways since the middle of September. Can the sterling break from the range or sideways trading will persist in the future? Fundamentals were helping the UK currency, and this weekâs macroeconomic reports are also expected to be mostly supportive. Yet the pound was not able to rise above the recent highs even with the help of positive economic data, primarily because recovery was already … “Great Britain Pound: Ready to Break from Range?”

Weekly Overview (04 – 08.11.2013) Stock market debut for

Indices Last week saw a real frenzy on the stock markets caused by social network Twitter (TWTR), which had priced its IPO at $26 per share. On Thursday, the shares made their debut on the NYSE and within a few minutes after trading had started, the price rose by over 70%, briefly crossing the $50 … “Weekly Overview (04 – 08.11.2013) Stock market debut for”

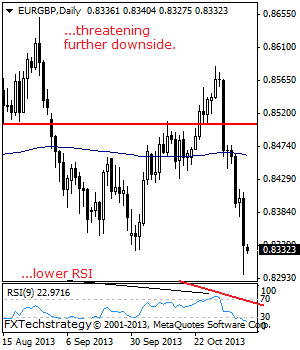

EUR/GBP: Sells Off, Eyes Further Decline

EUR/GBP: With a sell off seeing EUR/GBP extending its downside pressure, the risk is for a move lower towards the 0.8300 level. A turn below here if seen will aim at the 0.8250 level. Further down, support resides at the 0.8200 level where a breach will turn attention to the 0.8150 level. Conversely, EUR/GBP will have … “EUR/GBP: Sells Off, Eyes Further Decline”

Surprises from ECB & NFP Result in Another Week of Losses for Euro

The euro demonstrated the second consecutive weekly losses as surprises from the European Central Bank and US non-farm payrolls pounded the currency into the ground. Last week the euro was soft mostly because of dollar’s strength, but this week the shared 17-nation currency has its own reason to drop: the unexpected interest rate cut from the European Central Bank. Strictly speaking, the cut itself was anticipated, it is the timing … “Surprises from ECB & NFP Result in Another Week of Losses for Euro”