New Zealand gross domestic product expanded last quarter more than was predicted by analysts. Surprisingly enough, the New Zealand dollar demonstrated weakness after the news not only against the very strong US dollar, but also versus its Australian counterpart. New Zealand GDP rose 1.4 percent in the third quarter of 2013, exceeding expectations of a 1.1 percent increase and 0.3 percent growth in the second quarter. It … “Accelerating Economic Growth Does Not Help Kiwi”

Month: December 2013

Euro Strengthens on Banking Union Outline

Euro is seeing a bit of strength today, thanks to the latest news about the banking union. It’s not enough for the 17-nation currency to overcome its earlier losses to the dollar and the yen, but the euro is paring its earlier losses and looking toward the future. Yesterday, eurozone leaders finally released an outline for its plan to tighten the banking system throughout the eurozone. For the last year and a half, leaders have been trying to figure out … “Euro Strengthens on Banking Union Outline”

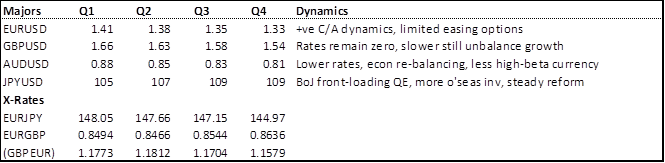

FX Outlook 2014 – Conditional Dollar Strength

Editor’s note: We hereby bring the 2014 foreign exchange outlook written by FxPro Head of Research Simon Smith. Executive Summary The post-crisis FX environment will continue to be characterised by greater volatility and shorter trends. We see conditional dollar strength, which means that we are not heading for a secular dollar bull market as the … “FX Outlook 2014 – Conditional Dollar Strength”

Gold price could bottom out next year

Gold prices could bottom out next year with so much of the potential bad news for the yellow metal, such as rising economic confidence and the US Federal Reserve’s intentions to taper its bond purchasing programme already well known. The outlook for gold for next year remains very uncertain. There are plenty traders betting that … “Gold price could bottom out next year”

Pound Stays Resilient After Fed, Helped by Employment Data

The Great Britain pound was little changed today following yesterday’s massive gains. The rally was caused by very good employment data from the United Kingdom, but was spoiled to a degree by the policy announcement of the US Federal Reserve. The number of Britons seeking unemployment benefits fell by 36,700 from October to November, exceeding analysts’ expectations of 35,200. The unemployment rate unexpectedly fell from 7.6 percent to 7.4 percent. The Bank of England … “Pound Stays Resilient After Fed, Helped by Employment Data”

Dollar Post-Tapering: Strongest in Five Years vs. Yen

The US dollar jumped today, reaching the highest level in five years against the Japanese yen, after the Federal Reserve announced tapering of its asset-purchase program. The currency maintained losses versus the Great Britain pound. The Fed announced that it is going to reduce the size of monthly purchases: In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions, the Committee decided to modestly reduce the pace of its asset … “Dollar Post-Tapering: Strongest in Five Years vs. Yen”

Aussie Supported by Stevens’ Comments

The Australian dollar was little changed against its US peer and rose versus the Japanese yen today after Reserve Bank of Australia Governor Glenn Stevens signaled that interest rates does not deter economic growth, meaning that there is less incentive for the central bank to cut rates further. Stevens said today in his testimony to the House of Representatives Standing Committee on Economics in Canberra: The Board has maintained … “Aussie Supported by Stevens’ Comments”

Indonesian Rupiah Falls on Ore Export Ban Concerns

The Indonesian rupiah fell today on concerns that the nation’s current-account deficit will widen after the government will implement the planned ore export ban. The Indonesian government wants to process ore domestically and plans to forbid selling it overseas. It may be beneficial to the economy in the long run, but in the short term it will likely lead to an increase of the current account shortage. The rupiah fell on such outlook as well as due to traders’ … “Indonesian Rupiah Falls on Ore Export Ban Concerns”

On tapering, JPY and AUD are vulnerable; on No-tapering,

Markets are highly anticipating the FOMC statement. To taper or not to taper? The dollar is set to rise on a tapering decision or fall on a no-taper decision. Which currencies are more vulnerable to a taper decision? And which are well positioned to take advantage of a no-taper decision? We’ll try providing quick answers. … “On tapering, JPY and AUD are vulnerable; on No-tapering,”

FOMC Preview: Dectaper coming? 5 Scenarios

Ben Bernanke and his colleagues in the FOMC are meeting to decide on monetary policy and QE tapering is on the agenda. Will the Fed reduce the number of bond buys? If so, how much? Will it be accompanied by some kind of sweetener? And if tapering isn’t announced, will the Fed make it clear … “FOMC Preview: Dectaper coming? 5 Scenarios”