The Canadian dollar hit a three-year low against the US dollar today, thanks in large part to signs of economic recovery in the United States and the continued divergence of monetary policies between the United States and Canada. Canada’s economy appears to be stalling right now. Even as economic data shows that things are picking up in the United States and even the United Kingdom, Canada is being left behind — along with the eurozone. As a result … “Loonie Slides to Three-Year Low”

Month: January 2014

Euro Struggles Following ECB Decision

Euro is struggling a bit on the currency market today, following an expected interest rate decision from the European Central Bank. Concerns about growth in the eurozone continue to weigh on the 18-nation currency, and there isn’t a whole lot that can be done to boost the euro until the economy starts to pick up. As expected, the European Central Bank kept interest rates steady in the monthly meeting. Following the meeting ECB President Mario Draghi … “Euro Struggles Following ECB Decision”

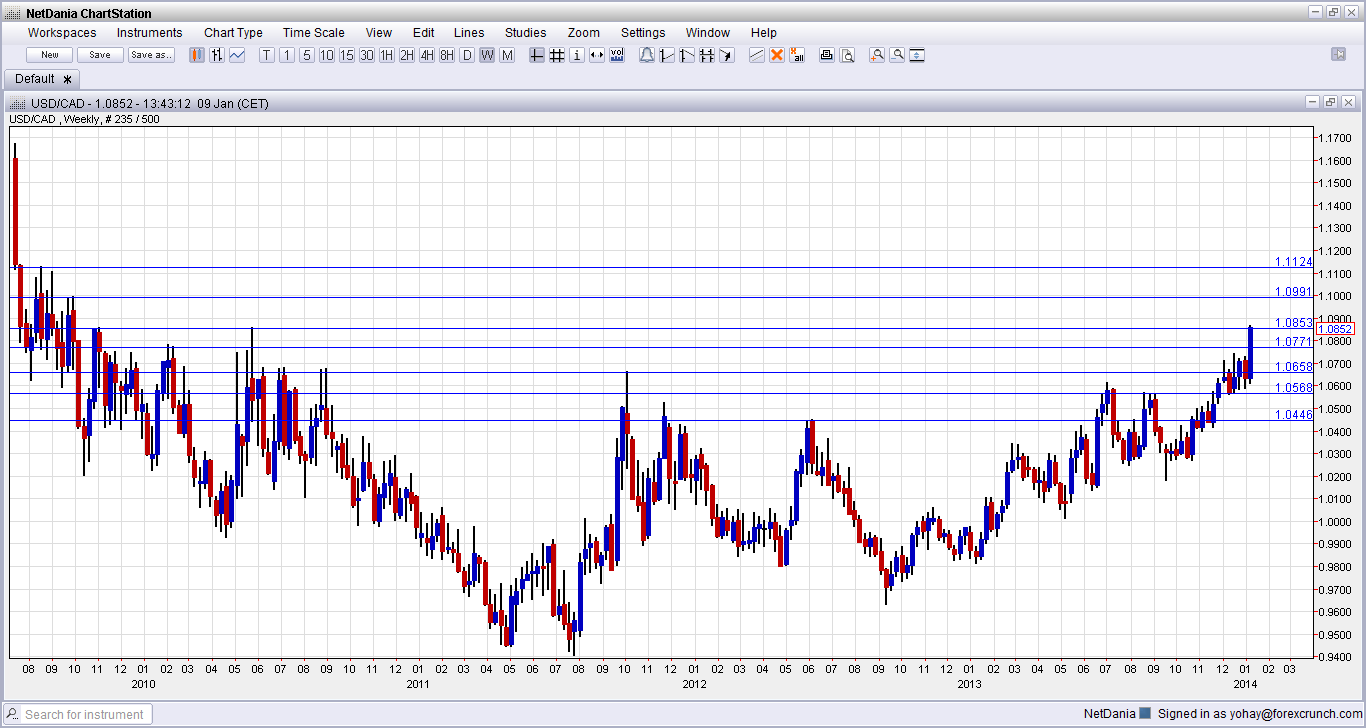

USD/CAD breaks to a 4 year high as C$ sell off continues

The Canadian dollar doesn’t have a minute to rest in its 2014 downfall. After USD/CAD broke above the 1.0750-1.0780 region, it made a continuous progress. And now, it broke above another critical level: 1.0850. This was the peak in May 2010 and worked as resistance also beforehand. After breaking this line, the Canadian dollar is … “USD/CAD breaks to a 4 year high as C$ sell off continues”

This week’s Non-Farm Payrolls should be bullish for USD

At last the US economy seems to have rediscovered sustainable growth and that should be reflected in Friday’s Non Farm Payroll numbers. A strong reading would support the US Federal Reserve’s tapering narrative and boost USD. Q4 2013 saw a slew of very positive economic data out of the US with last month’s NFP number … “This week’s Non-Farm Payrolls should be bullish for USD”

Stronger dollar in 2014, but gains could be limited; ECB

There are quite a few good reasons for the US dollar to rise in 2014, but with the recently adjusted forward guidance, the gains could be limited, says Simon Smith of FxPro. Apart from forecasting a 4% rise in the US dollar index, Smith also discusses the uncertainties regarding the next move of the European … “Stronger dollar in 2014, but gains could be limited; ECB”

Growth Outlook Boosts UK Pound

The latest growth outlook for the UK economy is pushing the pound higher today. Pound reached a five-week high against the euro, thanks to the fact that the United Kingdom is expected to see greater growth in the coming year than the eurozone. Sterling is pushing higher today, following a report from the Bank of England indicating that mortgage availability increased during the fourth quarter of 2013. Separately, lender Halifax reported that home … “Growth Outlook Boosts UK Pound”

Forecast: Dollar in 2014

The US dollar was demonstrating a lackluster performance until recently as the Federal Reserve kept its extremely accommodative monetary policy, while debt and budget issues made the safe haven role of the US currency highly questionable. Yet the Fed surprised the Forex market at the end of 2013, trimming its monetary stimulus. Does this mean that the greenback is ready to a surge upward in 2014? It is a possibility, but not a guarantee. … “Forecast: Dollar in 2014”

Yen Drops on Continued BOJ Easing

Yen is lower against most of its major counterparts today, dropping as continued easing from the Bank of Japan is expected. Even with some of the recent improvements to the Japanese economy, “Abenomics” is expected to continue, and that means long-term yen weakness. While other countries, particularly the United States and the United Kingdom, start to look at ways to move away from easing measures, Japan is still committed to its stimulus … “Yen Drops on Continued BOJ Easing”

US Dollar Gains Ground Following Economic Data

Is the US dollar getting ready for a revival? With a recovering economy, the United States looks poised to surge ahead of other economies, and the greenback is reclaiming its strength as a premier world currency. The latest economic data to confirm a resurgence in the US economy is the trade deficit data. According to the US Commerce Department, the trade deficit in the United States dropped to $34.3 billion for October. This is the lowest level in four years. Exports … “US Dollar Gains Ground Following Economic Data”

Loonie Lower as Canada Enters the Depreciation Fray

Over the past few years, a number of currencies have done what they can to weaken a bit in order to stimulate economies and gain an edge in global trading. Now it appears that Canada is ready to play that game, and the loonie is lower as a result. Canadian dollar is lower today, following yesterday’s comments from Finance Minister Jim Flaherty about the possibility of depreciation for the loonie. Acknowledging that it might … “Loonie Lower as Canada Enters the Depreciation Fray”