The Eurozone economy has started the week by taking centre stage with the release of disappointing inflation data showing a slowdown in the region’s economy. The flash CPI reading, a key indicator of the health of the economy, decreased from February’s reading of 0.7% to 0.5%, which now puts substantial pressure on European Central Bank … “Draghi under pressure to boost flagging Eurozone economy”

Month: March 2014

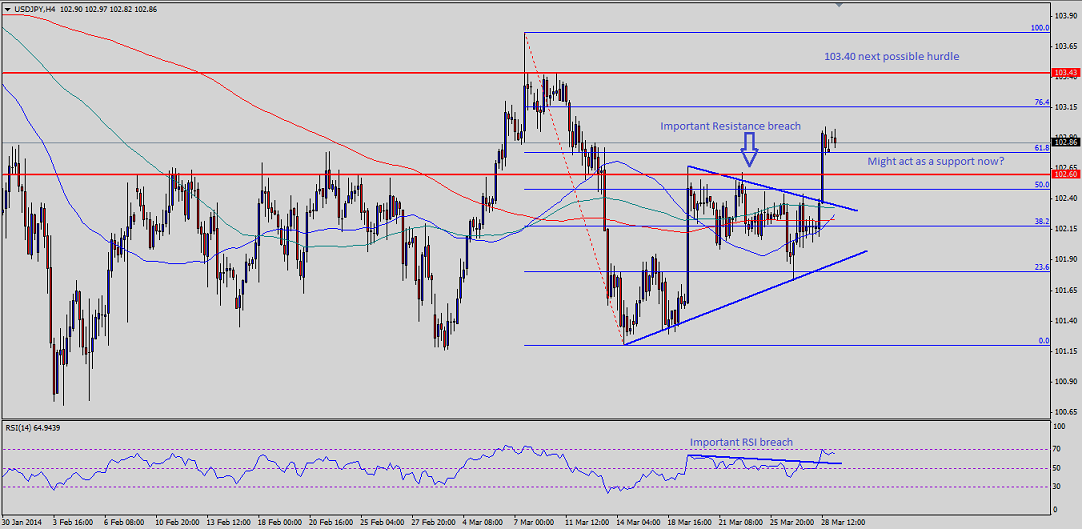

USDJPY broadly unchanged after Japanese Industrial Production data

USDJPY broke an important triangle last Friday, and spiked higher. The pair traded sideways for some time before buyers jumped in order to push the pair above 102.40 and 102.60 resistance levels. Earlier during the Asian session, Japanese industrial production data was published by the Ministry of Economy, Trade and Industry. The outcome was mixed, … “USDJPY broadly unchanged after Japanese Industrial Production data”

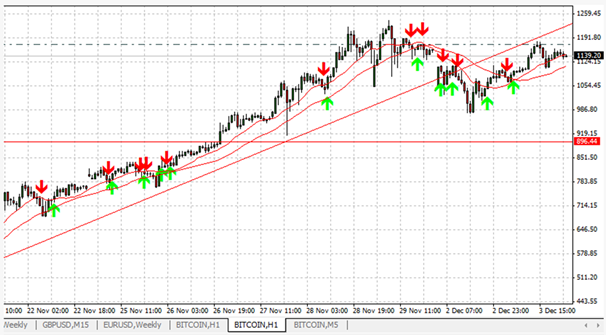

Bitcoin Trading: More Fundamental Than Technical

What’s Bitcoin? There has been much media hype and frenzy over Bitcoins, likened to the gold rush in the 19th and early 20th centuries. Bitcoin is a peer to peer network launched in 2009 after the Global Financial Crisis, that allows for the proof and transfer of ownership, without the need for a trusted third … “Bitcoin Trading: More Fundamental Than Technical”

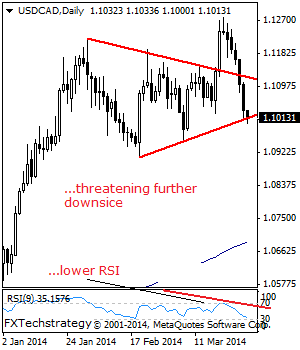

USD/CAD: Trading The Canadian GDP Mar 2014

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Monday at 12:30 GMT. … “USD/CAD: Trading The Canadian GDP Mar 2014”

Aussie Ends Amazing Week & Month

The Australian dollar demonstrated an amazing performance this week, rising against other most-traded currencies. The Aussie currency together with the New Zealand dollar were the best-performing currencies among majors this month. The Australian dollar started the week on a strong footing even though data from China was poor. The comments of Australia’s central bank chief helped the currency to maintain the upward momentum, supporting the outlook for a period of stable interest rates. … “Aussie Ends Amazing Week & Month”

Franc Drops on Zurbruegg’s Comments, Shows Some Resilience

The Swiss franc fell against the euro today, pushed down by yesterday’s comments of Fritz Zurbruegg, Governing Board member of the Swiss National Bank. The currency was flat versus the US dollar and even managed to gain on the Japanese yen. Zurbruegg said yesterday that the elevated exchanged rate makes it necessary for the central bank to keep the cap on the currency: The value of the Swiss franc is still high. With the three-month Libor close to zero, … “Franc Drops on Zurbruegg’s Comments, Shows Some Resilience”

Euro Recovers From Earlier Losses

Euro is recovering from earlier losses today, eking out gains even after the latest German inflation data. Some Forex traders are waiting to analyze comments by Mario Draghi, and others are waiting to see what impact US data will have on the Forex market. Even though the euro is heading higher, it’s not a day for big moves on the currency market. There’s a lot of uncertainty, with some … “Euro Recovers From Earlier Losses”

US Dollar Consolidates Ahead of Data Dump

US dollar is consolidating right now, and is a little lower against some of its counterparts, even as the dollar index remains slightly higher. Rangebound trading is in effect right now, thanks in large part to the fact that Forex traders are waiting for a rash of data from the United States. Today’s US trading session should bring with it a data dump, and many Forex traders are waiting to see … “US Dollar Consolidates Ahead of Data Dump”

USD/CAD: Further pressure on the cards

USDCAD: The pair weakened further on Thursday leaving further pressure on the cards. Support lies at the 1.1000 level. We expect this big psycho level to hold and turn it higher but if breaks, further declining could occur towards the 1.0950 level and then the 1.0900 level. Bulls may come here and turn the pair … “USD/CAD: Further pressure on the cards”

Yen Drops, Ignoring Positive Data

The Japanese yen ticked down today even after the release of economic reports that were rather good and supported the view that the economy expands at stable pace and no additional stimulus is necessary. Japan’s core Consumer Price Index demonstrated stable growth at 1.3 percent, while the Tokyo core CPI rose 1.0 percent in February, accelerating from January’s 0.9 percent. The unemployment rate unexpectedly fell by 0.1 percentage … “Yen Drops, Ignoring Positive Data”