Yesterday at GMT 12:30 PM, US durable goods orders data was published by the US Census Bureau. The report suggested that durable goods orders increased $5.0 billion or 2.2 percent to $229.4 billion in February, exceeding the expectations of 1.0% rise. The outcome was encouraging as this upturn is after two consecutive declines. The setback was that the previous readings were revised further lower, pointing a mixed outcome. USDCAD traded lower after the data release, and challenged 1.1080 support level.

US Services PMI

The headline Flash U.S. Services PMI published by Markit Economics came better than expectations at 55.5 vs 54.2 estimate. Service sector recovered in March picking up sharply from February’s four-month low of 53.3. Other side of the story was that expansion in new business was the slowest for almost a year-and-a-half.

Technical Analysis

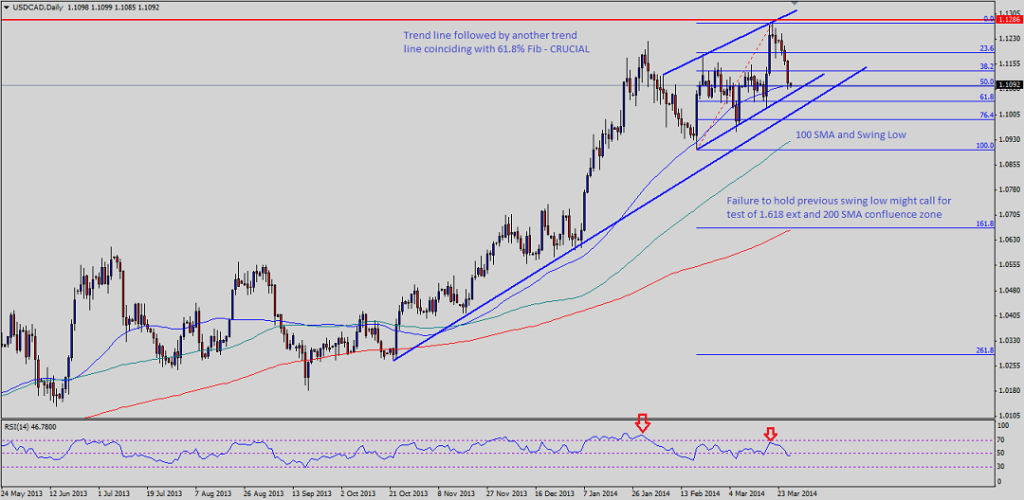

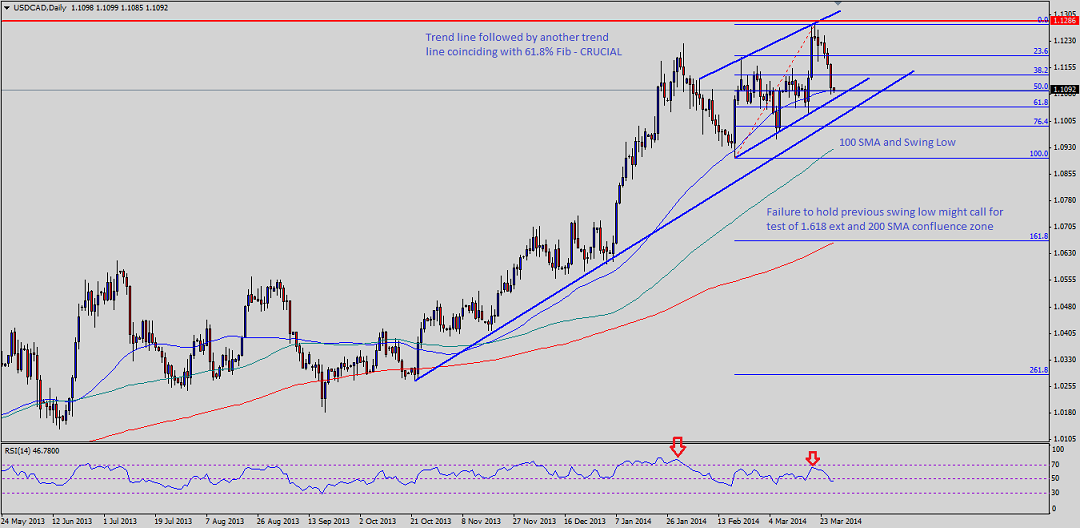

USDCAD after finding sellers around 1.1280 resistance zone fell sharply to register consecutive daily declines. The pair moved lower towards 1.1080 after the economic releases in the US. There is a rising channel forming on the daily timeframe for USDCAD. The pair is heading towards the channel support trend line, which might play a key role for further downside in the sessions ahead, as it also coincides with 50.0% Fibonacci retracement level of the last swing high. If channel breaks, then it might put a lot of pressure on USDCAD buyers. As of writing, USDCAD sellers are trying to push the pair below the 50-day simple moving average.

Any further downside acceleration would call for a test of next bullish trend line coinciding with the 61.8% Fib level. There is a divergence noted on the RSI between the last two highs, which suggests that recent high might be a false break. The most critical support level is seen around the confluence zone of 1.618 extension of last swing and 200 SMA. If USDCAD bounces from the channel or trend line support, then the pair can again challenge 1.1280 high.

US GDP (QoQ)

Today at GMT 12:30 PM, US Gross Domestic Product Annualized reading for fourth quarter will be released by the US Bureau of Economic Analysis. The growth rate is expected to improve from 2.4% to 2.7%. If the outcome beats the consensus, then US dollar could rebound against Canadian dollar in the NY session. On the other hand, any downside revision could encourage a downside shift for the US dollar in near term.