The Chilean peso managed to log gains today even after the nation’s central bank cut its monetary policy interest rate yesterday for the fourth time in six months. The Central Bank of Chile lowered its key interest rate by 25 basis points to 4 percent. The bank said about the state of the global economy: Internationally, incoming information confirms the outlook of gradual recovery of the developed economies, while projections for emerging markets, particularly … “Peso Gains Even as Chilean Central Bank Lowers Main Rate”

Month: March 2014

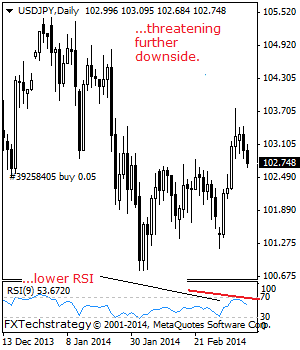

USDJPY: Bearish On Corrective Pullbacks

USDJPY: The pair has triggered a correction and looks to extend it further in the days ahead. On the downside, support comes in at the 102.26 level, its Feb 26’2014 high. Further down, support stands at 101.50 level and then the 101.00 level with a turn below here switching focus to the 100.75 level, its … “USDJPY: Bearish On Corrective Pullbacks”

Temporary Insanity and USDJPY

I am not a lawyer but I believe one of the more fascinating aspects of studying the law is the concept of “Intent” to commit a crime. You see it is not really enough to commit a crime, the prosecutor must prove that the accused had “intent” or intended to commit the crime. For most … “Temporary Insanity and USDJPY”

Euro Extends Drop on Draghi’s Comments

European Central Bank President Mario Draghi suggested yesterday that the euro is too strong, and the exchange rate should fall in the future. Such comments led to the decline of the shared 18-nation currency yesterday, and the drop was extended today. Draghi explained that the exchange rate is becoming “increasingly relevant in our assessment of price stability” as it threatens inflation. He also said that the forward guidance “creates a de facto … “Euro Extends Drop on Draghi’s Comments”

Yen Gains as Crimean Referendum Looms

The Japanese yen continued to rise today, gaining for the fourth consecutive trading session against the US dollar and for the fifth versus the Great Britain pound, as concerns about the situation in Ukraine made investors stick to safer assets. The Crimea region will hold a referendum over the weekend, deciding whether to separate from Ukraine and join Russia. Meanwhile, the United States say that the referendum would be illegal and Russia should back off from … “Yen Gains as Crimean Referendum Looms”

Indian Rupee Rises Despite Falling Inflation

The Indian rupee advanced today despite the inflation report that showed growth of consumer prices that was below analysts’ forecasts. The data led to speculations that the nation’s central bank will keep interest rates unchanged on the next month’s meeting. Annual inflation was at 8.1 percent in February, below the median estimate of 8.3 percent. It was the lowest level since January 2012. Industrial production, on the other hand, was … “Indian Rupee Rises Despite Falling Inflation”

Brazilian Real Gains, Ignoring Unfavorable Data

The Brazil real rose today even though economic data from the South American country continued to disappoint, suggesting that the central bank should reduce the pace of interest rate hikes. Brazil’s retail sales rose 3.5 percent in January from a year ago, missing the analysts’ estimate of 5.3 percent. The report followed yesterday’s unfavorable inflation data. The poor economic indicators led to speculations that the Central Bank of Brazil may … “Brazilian Real Gains, Ignoring Unfavorable Data”

OANDA adopts open approach to technology

I had the chance to speak with Paul Hayward, MD EMEA, Asaf Yigal, Co-Founder of Currensee (the social trading platform that OANDA recently acquired) and Stuart McPhee of OANDA. In the conversation we discussed various topics that are certainly of interest to traders. Currensee and OANDA The integration of Currensee is going very well. Execution is … “OANDA adopts open approach to technology”

Economic Data Helps Risk Appetite, Sends Dollar Lower

US dollar index is down today, dropping as risk appetite improves in the Forex market. US retail sales data is helping, and global stocks are improving. With traders looking for yield, the greenback isn’t needed as a safe haven, and that is sending it lower. Greenback is down almost across the board following the release of retail sales data that indicates an improvement from the previous month. This is … “Economic Data Helps Risk Appetite, Sends Dollar Lower”

EUR/USD: UoM Consumer Sentiment Index – March 2014

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 13:55 GMT. Indicator … “EUR/USD: UoM Consumer Sentiment Index – March 2014”