The US dollar demonstrated a nice rally last week with help of the policy statement of the Federal Reserve. Is it possible for the greenback to extend its rally this week as well? Truth be told, it is unlikely that the dollar will be able to rally much more over the course of the next five trading days. The rally after the Fed announcement was too big and by the end of the previous week the currency has … “Dollar Outlook: Analysts Expect Week of Calm After Week of Strength”

Month: March 2014

Japanese Yen Lower as Risk Appetite Appears

There’s a bit of risk appetite in the markets, and the Japanese yen is lower as a result. even though some worries about China and Ukraine initially caused a bit of aversion, things have changed and the yen is moving lower — even against the euro. Forex traders and investors are mostly shrugging off the disappointing growth data out of China, as well as ignoring the continued crisis in Ukraine. While political leaders around the world decry Russia’s … “Japanese Yen Lower as Risk Appetite Appears”

Slow Growth Drags Euro Lower

Euro is dragging today, heading lower as slower growth in the eurozone hurts performance. The German data was disappointing, and as was a PMI reading for the entire eurozone. With the dollar firming, thanks to the latest out of the Federal Reserve, it’s no surprise that the euro is struggling. A release of preliminary PMI data for March indicates that the eurozone’s reading has slipped from a 32-month high. Even though the eurozone remains in expansion territory, … “Slow Growth Drags Euro Lower”

PBoC Raises Reference Rate, Yuan Advances

The Chinese yuan rose today as the nation’s central bank boosted the reference rate for the currency. The yuan was previously falling after the central bank had widened the trading range for the currency. The Peopleâs Bank of China raised the daily fixing by 0.04 percent to 6.1452 per dollar today. The yuan weakened 0.25 percent on the previous four days after the bank had increased the trading band to 2 percent on the either side of the reference rate, but … “PBoC Raises Reference Rate, Yuan Advances”

Aussie Resilient in Face of Poor Chinese Manufacturing PMI

The Australian dollar slipped at the start of the current trading session but rebounded and trades above the opening level as of now. The decline was caused by the worse than expected China’s manufacturing data released over the weekend. The HSBC Flash China Manufacturing Purchasing Managersâ Index dipped from 48.5 in February to 48.1 in March, while analysts have expected an increase to 48.7. Usually, poor economic reports from China push the Australian currency down, … “Aussie Resilient in Face of Poor Chinese Manufacturing PMI”

GBP/USD: Trading the British CPI Mar 2014

British CPI (Consumer Price Index), which is released each monthly, is an inflation index which measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday … “GBP/USD: Trading the British CPI Mar 2014”

Is the US Embracing a Finite Mentality?

This past week it was announced that the both the US Congress and President are toying with the idea of eliminating any “loopholes” to Social Security and eliminating the Mortgage Tax deduction. In terms of Social Security in the United States, millions rely on it as in fact most persons in the US don’t have … “Is the US Embracing a Finite Mentality?”

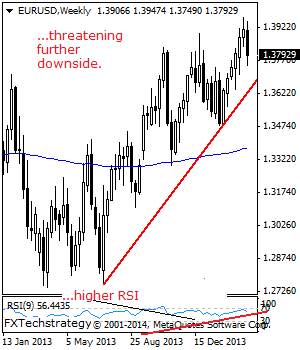

EURUSD: Closes Lower On Sell Off

EURUSD: With EUR triggering weakness the past week to close lower at the end of the week, further decline is likely. However, we are watching out for signs of corrective recovery in the new week. Support lies at the 1.3749 level. Further down, support comes in at the 1.3685 level where a violation will target … “EURUSD: Closes Lower On Sell Off”

Cable set to accelerate on the downside with a break

The Fed decision to taper has ignited volatility in the market, and one of the majors which was affected the most is the GBPUSD pair. The GBPUSD pair is under pressure for the last couple of weeks, and even better than expected labor data failed to attract the buyers. The pair is showing five swings … “Cable set to accelerate on the downside with a break”

Week of Fed Decision Turns Out Good for Dollar

The Federal Reserve monetary policy meeting was the most important event this week, overshadowing all other news. The Forex market was anticipating stimulus reduction, which has indeed happened, but the reaction to the policy announcement was still strong as US policy makers managed to surprise market participants and to drive the US dollar up. The dollar has started the week with softness despite risk aversion created by the tensions between … “Week of Fed Decision Turns Out Good for Dollar”