The Malaysian ringgit fell today along with other Asian currencies as concerns about probability of tighter monetary policy in the United States were bothering investors, making them reluctant to invest in riskier assets of emerging markets. While some high-beta currencies were ignoring the impact of the Federal Reserve policy announcement, many still felt the downside pressure and were unable to resist it. Stimulus tapering was expected and probably did not … “Malaysian Ringgit Dips with Asian Currencies on Fed Concerns”

Month: March 2014

Canadian Economic Data Surprises Positively, Loonie Moves Higher

The Canadian dollar climbed today with help of macroeconomic data from Canada that was surprisingly good, easing the negative impact that comments of the central bank governor had on the currency earlier this week. The Consumer Price Index rose 0.3 percent in February from January on a seasonally adjusted basis, accelerating from the previous month’s growth of 0.2 percent. Annual inflation slowed, but was still above the expected level. … “Canadian Economic Data Surprises Positively, Loonie Moves Higher”

FOMC and Beyond – Impact Across the Board

Janet Yellen’s speech on Wednesday about rising interest rates caused U.S. equities to fall at first, however markets rebounded in the next trading session on the back of positive data. Yellen hinted that interest rates might increase by the middle of next year and borrowing costs could alter as soon as Q3. Post factory data coming out … “FOMC and Beyond – Impact Across the Board”

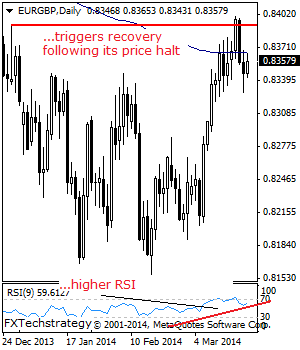

EURGBP – Halts Weakness, Eyes Further Strength

With EURGBP halting its weakness and triggering corrective recovery higher, the risk is for more strength to occur. Immediate upside target resides at the 0.8397 level where a breach will set the stage for a run at the 0.8450 level and subsequently the 0.8500 level, its psycho level. Its daily RSI is bullish and pointing … “EURGBP – Halts Weakness, Eyes Further Strength”

Euro Recovers Thanks to Account Surplus

Euro is recovering from its recent lows today, thanks in large part to a currency account surplus in the eurozone. For the first time in three days the 18-nation currency is gaining against the US dollar, and the euro is also up against other major counterparts. The latest eurozone data shows a record current account surplus for the month of January, with portfolio investments rising to 16.9 billion euros. The news is positive for the eurozone, … “Euro Recovers Thanks to Account Surplus”

Aussie Rallies with Asian Stocks

The Australian dollar climbed today even as a report showed that growth of leading indicators eased in January. The likely reason for the rally was the gains of Asian stocks. The Conference Board Leading Economic Index for Australia increased 0.2 percent in January after rising 0.8 percent in the previous month. The MSCI Asia Pacific Index, which tracks stocks of Asian countries excluding Japan, rallied 0.8 percent today. The rally was considered to be … “Aussie Rallies with Asian Stocks”

Fitch Keeps US Credit Rating at AAA, Does Not Benefit USD

Fitch Ratings kept the US sovereign credit rating at AAA with stable outlook. This should have given another boost for the dollar but, surprisingly enough, the US currency was not strong at all today, falling against the Japanese yen and dipping versus the euro. The greenback rose against the Great Britain pound, but the gains were small and are all but erased as of now. Fitch announced today: Fitch Ratings … “Fitch Keeps US Credit Rating at AAA, Does Not Benefit USD”

Mexican Peso Overcomes Negative Influence of Fed Announcement

The Mexican peso advanced today even as the prospects for an interest rate hike from the Federal Reserve next year were hurting most currencies of emerging markets as well as other risky assets. The Fed announced another stimulus cut yesterday and signaled that borrowing costs may reach 1 percent next year. The news hurt most high-beta currencies as it means less cheap money for the world financial system. Yet the peso … “Mexican Peso Overcomes Negative Influence of Fed Announcement”

Interest Rate Outlook Boosts Brazilian Real

The Brazilian real gained today on speculations that the central bank will keep raising interest rates, attracting investors from countries with near-zero interest rates to South American nation’s assets. Central Bank of Brazil President Alexandre Tombini reiterated this week that he is going to ensure that inflation will slow to the 4.5 percent target. One of the measures to rein inflation is interest rate hikes. It … “Interest Rate Outlook Boosts Brazilian Real”

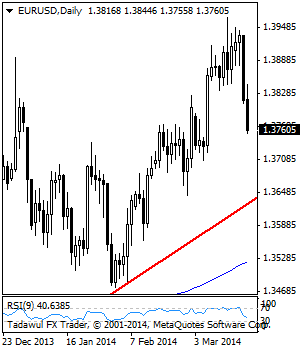

EURUSD: Declines, Follow Through Lower

EURUSD: With EUR extending its sell off during Thursday trading session today, further weakness is expected in the days ahead. On the downside, support lies at the 1.3700 level and then the 1.3631 level. Below here will aim at the 1.3561 level. Further down, support comes in at the 1.3500 level. Its daily RSI is … “EURUSD: Declines, Follow Through Lower”