There’s an inconvenient truth, which is that many western countries are so heavily indebted that they cannot afford rising interest rates, yet that is exactly what is starting to happen in the US and long before the US Federal Reserve tighten official rates. Steadily rising interest rates should be supportive for USD as the Fed … “Borrowing costs could threaten US recovery and USD rally”

Month: March 2014

Sterling Mixed as Fed Impact Battles Positive UK Data

The Great Britain pound fell against the US dollar today as the greenback retained strength after yesterday’s monetary policy decision of the Federal Reserve. The sterling struggled versus the yen but managed to gain on the euro as economic data confirmed recovery in the United Kingdom yet again. Confederation of British Industry released its Industrial Order Expectations index today that showed an increase from 3 in February to 6 in March. It was a somewhat … “Sterling Mixed as Fed Impact Battles Positive UK Data”

SNB Brings No Good News for Franc

The Swiss franc dropped against the US dollar and the Japanese yen today after Switzerland’s central bank maintained its extremely accommodative policy and the cap on the currency. The Swissie was virtually flat against the euro. The Swiss National Bank maintained interest rates near zero and the ceiling on the franc at 1.20 per euro. The central bank reiterated the pledge to limit franc’s gains versus the euro as long as it is necessary. The SNB mentioned that … “SNB Brings No Good News for Franc”

Euro Weaker on Expectations

Euro is weaker today, continuing its difficulties as concerns about the eurozone, and as expectations for a stronger US dollar, weigh on the 18-nation currency. The latest Fed expectations, along with changes to the ECB’s forward guidance, are keeping the euro down today. After yesterday’s Federal Reserve announcement, which some Forex traders took to mean that US rates would begin rising as early as April 2015, the euro fell to fresh two-week … “Euro Weaker on Expectations”

Loonie Continues to Struggle After Fed Announcement

The loonie is still struggling against the greenback today, finding it difficult to regain lost ground following yesterday’s announcement from the US Federal Reserve. While the Canadian dollar is gaining against its European counterparts, helped by US dollar strength, it continues to drop against the greenback. Yesterday, Federal Reserve Chair Janet Yellen made an announcement about the taper and about interest rates. She introduced a definite timetable … “Loonie Continues to Struggle After Fed Announcement”

Spotware wins legal battle against unlawful use of the

Financial technology provider Spotware, the company behind cTrader among other products, has won a legal battle against domain names who tried to benefit unlawfully from the cTrader brand. Spotware recently offered a netted accounts and hedged accounts under a single environment. For more about the case, here is the official press release: Spotware Systems Ltd, developers … “Spotware wins legal battle against unlawful use of the”

Japan Sales Tax and USD/JPY

April 1 this year will see the anticipated rate of sales tax in Japan rise from 5% to 8% and Prime Minister Shinzo Abe says he will make a decision later this year on whether to increase it further to 10% in 2015. This event has been the talk of the Japanese Yen traders during … “Japan Sales Tax and USD/JPY”

NZD Drops on Fed, New Zealand’s GDP Adds to Woes

The New Zealand dollar sank versus its US counterpart yesterday and continued to fall today after the Federal Reserve reduced its stimulus program and signaled about possible interest rate hike next year. The kiwi was also soft against other most-traded currencies after the official report showed that New Zealand economic growth slowed last quarter more than was expected. New Zealand gross domestic … “NZD Drops on Fed, New Zealand’s GDP Adds to Woes”

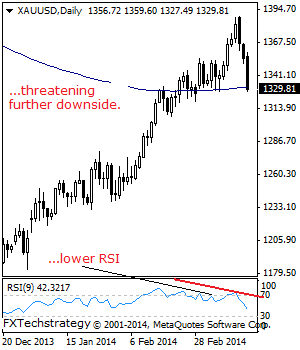

GOLD: Bearish, Extends Weakness

GOLD: With a second day of weakness occurring on Tuesday and GOLD following through lower during Wednesday trading session, further bearishness remains. Support comes in at the 1,319.20 level. This if taken out it will pave the way for a run at the 1,300.00 level. Below here will aim at the 1,280.00 level where bulls … “GOLD: Bearish, Extends Weakness”

Fed Trims QE, Dollar Moves Upside

The US dollar surged yesterday and retained its gains today after the Federal Reserve trimmed the quantitative easing program at the planned pace and signaled that an interest rate hike may happen as soon as the next year. As was widely expected, the Fed continued to reduce its monthly purchases at the same pace of $10 billion as at the previous meeting. The central bank’s statement was more hawkish than most analysts had expected and announced: The Committee … “Fed Trims QE, Dollar Moves Upside”