The Indonesian rupiah fell today on speculations that the nation’s current-account deficit widened in the past quarter. Political uncertainty in Indonesia was also eroding the appeal of the currency. Analysts estimated ahead of the official report, which will be released on May 9, that Indonesia’s current-account shortfall increased from 2.2 percent to 2.4 percent of gross domestic product in the first quarter of 2014. It would be a biggest gap since December. Indonesia … “Rupiah Falls on Current Account Outlook & Political Uncertainty”

Month: April 2014

Dollar Weaker After Fed Trims Stimulus

The US dollar dipped today even after the Federal Reserve trimmed its stimulus program yet again. The possible reason for the drop was the mention of low interest rate for a prolonged period of time and also the unexpected halt of economic growth in the United States. The Fed ended its two-day monetary policy meeting today. The central bank was mildly positive about developments in the economy, saying: The Committee currently judges that there is … “Dollar Weaker After Fed Trims Stimulus”

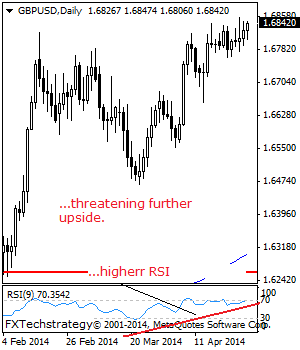

GBPUSD: Can GBP Break Above The 1.6857/77 Levels?

GBPUSD: Although closing marginally higher on Tuesday and struggling to strengthen further, downside threat remains while holding below the 1.6857/77 levels. The big question is can GBP break and hold above that zone. It is tough to break with poor price action on the upside but if it does break that area expect a run … “GBPUSD: Can GBP Break Above The 1.6857/77 Levels?”

UK Pound Struggles a Bit, Even With Recent Positive Data

The UK pound is struggling a bit today, thanks in large part to the fact that all the drivers for sterling are external. There is no major data on the docket for the pound, so sterling is at the mercy of data and announcements from everywhere else. Even so, the UK pound is managing to limit its losses, and even eke out some gains here and there. One of the difficulties weighing on the UK pound today is … “UK Pound Struggles a Bit, Even With Recent Positive Data”

US Dollar Pulls Back on Economic Expectations

US dollar is pulling back a bit against some of its counterparts as Forex traders consider economic expectations around the world. The movements in currency pairs are mostly small, however, due to a bit of waiting on the FOMC decision later today. Concerns about the US economy are weighing on the greenback right now. The Federal Open Market Committee is on day two of its two-day meeting, and a policy announcement is expected from … “US Dollar Pulls Back on Economic Expectations”

USD/JPY: Trading The ISM Manufacturing PMI Apr 2014

ISM Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible … “USD/JPY: Trading The ISM Manufacturing PMI Apr 2014”

USD/JPY: Trading The ISM Manufacturing PMI Apr 2014

ISM Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible … “USD/JPY: Trading The ISM Manufacturing PMI Apr 2014”

NZD Gains on USD, Rally Limited

The New Zealand dollar rose today against its US counterpart as the number of New Zealand building permits rose last month. Gains were limited as business confidence dropped. The currency was flat versus the Japanese yen. The seasonally adjusted number of new dwellings grew 8.3 percent in March after falling 1.6 percent in February. The ANZ Business Confidence was down from 67.3 in March to 64.8 in April. The report was … “NZD Gains on USD, Rally Limited”

BoJ Refrains from Stimulus, Yen Unable to Keep Gains

The Japanese yen rallied today after the Bank of Japan refrained from adding monetary stimulus during its monetary policy meeting. The currency reversed its move later, giving away most of its gains versus the US dollar and the Great Britain pound and erasing the rally against the euro completely. The BoJ left the monetary policy the same, saying in the statement: The Bank of Japan will conduct money market operations so that the monetary … “BoJ Refrains from Stimulus, Yen Unable to Keep Gains”

Euro-zone inflation numbers worsens Draghi’s dilemma

Euro-zone inflation ticked up 0.2% in CPI and +0.3% Core CPI according to preliminary data for April. EUR/USD is somewhat higher. The shift in the dates of Easter did have a positive effect on inflation in April, as the ECB expected. But is this good enough? Not at all. These numbers just worsen the situation for the … “Euro-zone inflation numbers worsens Draghi’s dilemma”