NZDUSD is trading lower Intraday as the market awaits US jobs data, which will be released during Friday’s NY session.

The pair has formed three back-to-back bearish candles on Daily timeframe, which can be considered as a sign of weakness. Even better than expected Chinese HSBC Services PMI was unable to help the pair.

Chinese HSBC Services PMI and Non-Manufacturing PMI

During the Asian session, Chinese Non-Manufacturing Purchasing Managers Index (PMI) and HSBC Services PMI figures were published by China Federation of Logistics and Purchasing (CFLP) and HSBC respectively. HSBC Services PMI jumped to 51.9 from 51.0 and Non-Manufacturing PMI fell from 55.0 to 54.5.

A point to note is that overall business activity was driven by the manufacturing sector, which posted its sharpest contraction of output since November 2011, according to the report. This might be one of the reasons for the decline in NZDUSD. The highlight of the report was that “employment rose for the first time in five months at the composite level”.

Technical Analysis

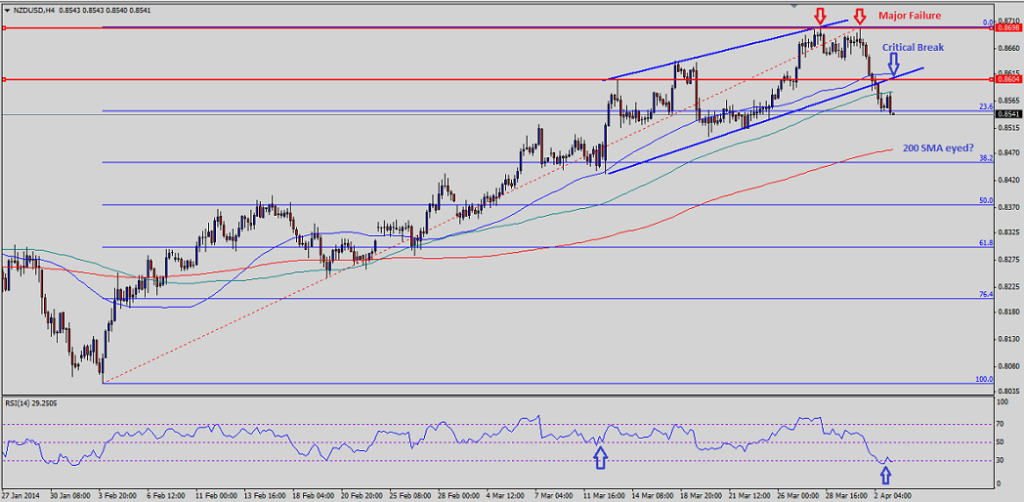

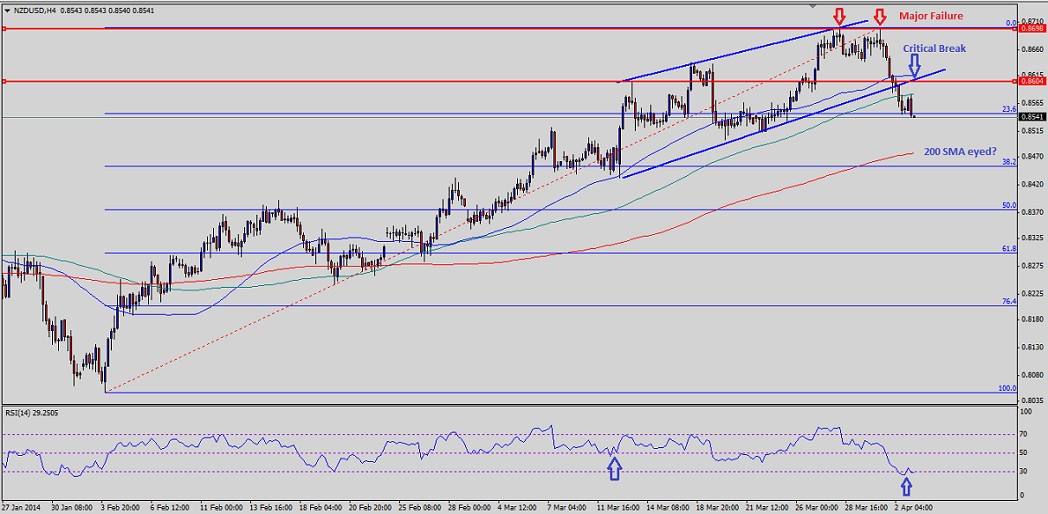

NZDUSD has breached an important ascending channel, which acted as support a number of times. The pair also broke 50 and 100 simple moving average on the 4 hour timeframe. As of writing, NZDUSD sellers are trying to push the price below 23.6% retracement level of the last major swing from 0.8049 low to recent 0.8698 high. One important thing to note here is that pair failed to breach 0.8700 barrier two times, which ignited bearish pressure in short term. A break and close below 23.6% Fib level might open the doors for further downside acceleration towards 200 SMA.

RSI is bouncing back from the extreme levels, and a major divergence is noted as well, which can be considered as an early-warning. On the upside, the broken channel support region might now act as resistance before 50 SMA steps in. The pair can also find sellers around 100 SMA, which could act as a barrier in the short term.