The plethora of top-tier data from the US economy this week could be crucial in setting the tone for dollar trading in the long run, breaking that long period of currency consolidation seen for almost the entire month of April.

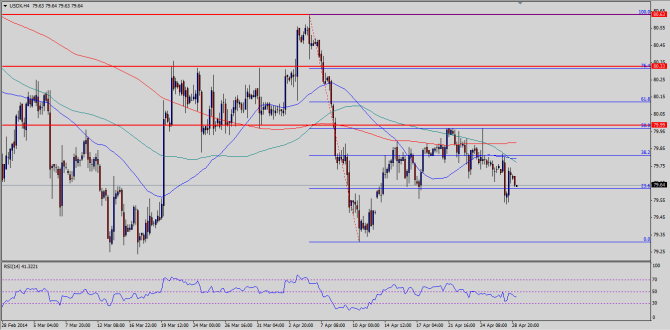

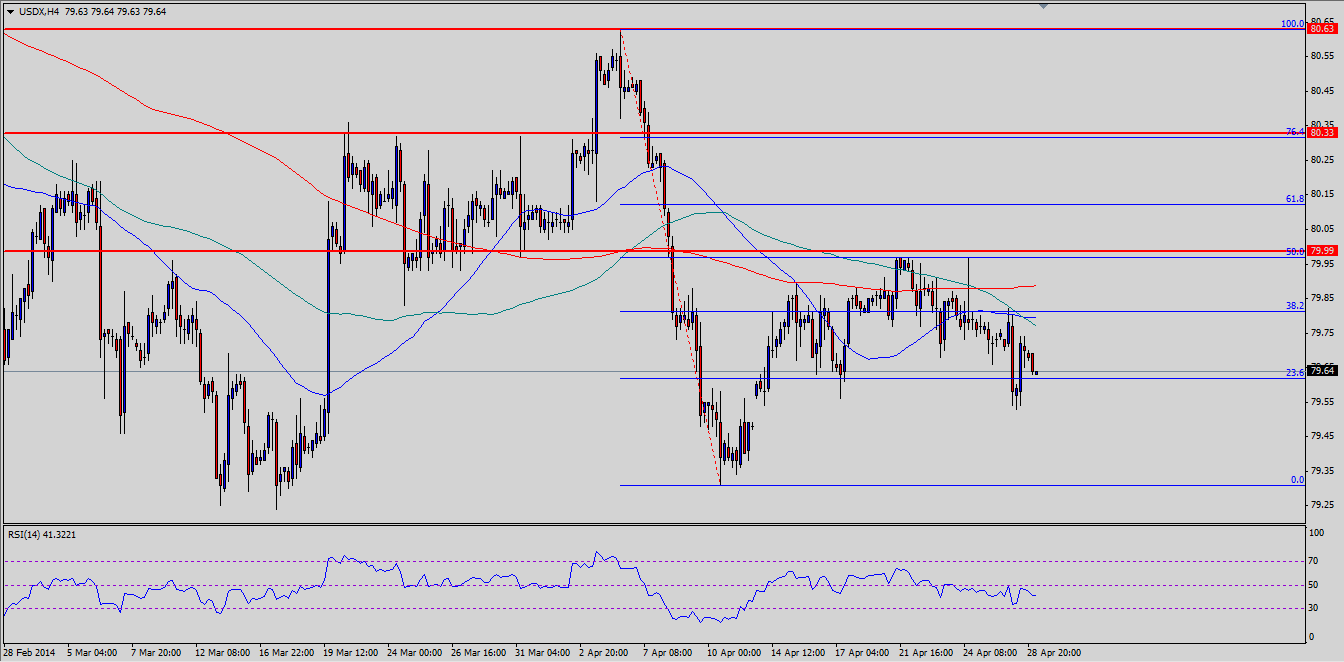

The USD Index 4-hour time frame shows that the currency has pulled up to an area of interest close to the 10500 level and former support area. This could mean that buying pressure is already exhausted and that the Greenback might be ready to resume its drop.

As you can see from the latest price action of the US dollar, the previous FOMC interest rate decision last March sparked a very strong rally. This was when the Fed pushed through with its taper despite the weakness in hiring throughout the winter months and when Fed Chairperson Yellen spoke of a potential rate hike taking place around six months after asset purchases end. However, the gains were soon erased when the US economy printed another bleak jobs figure and the FOMC minutes revealed that not all policymakers support Yellen’s upbeat interest rate hike time frame.

This downbeat sentiment sparked a turnaround for the dollar and pushed it to the 10400 index level. Another dovish FOMC statement might allow the currency to drop to these previous lows once more.

Also bear in mind that the upcoming advanced quarterly GDP release could have a strong impact on dollar behavior in the long run. After all, this would confirm whether the economy is slowing down or picking up pace. A weak reading could be very bearish for the dollar as it might force the Fed to rethink its taper pace while a strong result could be dollar bullish since it would reaffirm the Fed’s tapering plan.

Aside from that, the upcoming NFP release on Friday might also have a say in long-term dollar movement. Recall that the March figure came in weak but it was enough to push US employment back to pre-recession levels. Revisions to previous figures could also impact dollar price action in the near term.

Overall, the fundamental bias for the dollar is still to the downside, as it is coming off a very recent sharp selloff. The rally in April may have been a simple market correction, as bears reestablish selling momentum and add to their short dollar positions at better prices, pending the outcome of this week’s US reports.