Eurozone CPI Flash Estimate, which is released at the end of each month, is an inflation index which measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the Eurozone CPI Apr 2014”

Month: April 2014

A pick up in Eurozone inflation, a good thing or not?

When the Eurozone flash CPI data for April is released on Wednesday this week, Mario Draghi and the ECB will potentially have the next stone laid on the road towards Quantitative Easing. However, there are several significant questions that the recent data poses. How long might the road be? Also, is Eurozone QE just Mario Draghi’s … “A pick up in Eurozone inflation, a good thing or not?”

Hungarian Central Bank Slashes Main Rate, Forint Retains Appeal

The Hungarian forint advanced today even after the nation’s central bank reduced its main interest rate. The bank was not particularly pessimistic despite the interest rate cut, helping the currency to retain its appeal. The Magyar Nemzeti Bank (Hungary’s central bank) cut the central bank base rate by 10 basis points to 2.50 percent. The bank was rather optimistic despite the cut, saying: In the Councilâs judgement, Hungarian economic … “Hungarian Central Bank Slashes Main Rate, Forint Retains Appeal”

What is the Future of High Frequency Trading?

There’s been a smouldering story concerning the future of high frequency trading that began four years ago with the ‘flash crash’ that momentarily caused the biggest drop in the Dow Jones Index ever seen. Since then, high frequency trading has been refined over and over again so that now it is said to give traders … “What is the Future of High Frequency Trading?”

Ukraine Difficulties Erode Eurozone Confidence

The situation in Ukraine continues to deteriorate, and that is impacting confidence across the eurozone. The pessimism starting to rise in the 18-nation currency region is impacting the euro, and sending it lower against some of its counterparts. The latest confidence reading of the Economic Sentiment Indicator, used by the European Commission, indicates a drop from 102.5 to 102 in March. This is the first time that confidence hasn’t risen since April 2013. The news has many … “Ukraine Difficulties Erode Eurozone Confidence”

Ruble Rebounds on Hopes for Mild Sanctions

The Russian ruble gained today on speculations that sanctions against the nation will not be too severe and the conflict with Ukraine will not result in a full-scale war. The ruble still remains among the worst-performing currencies. It is expected that sanctions from the United States and the European Union against Russia for its involvement in the conflict with Ukraine will be relatively mild. The Russian troops are moving away from … “Ruble Rebounds on Hopes for Mild Sanctions”

UK Pound Continues in an Upward Trend

UK pound is continuing its upward trend today, heading higher as expectations for monetary tighten improve. With data improving in the United Kingdom, and questions being raised in other major economies, the UK pound seems like the place to be right now. Better than expected data is helping the UK pound again. Last week’s positive data is providing a reason to buy sterling, and this week is only … “UK Pound Continues in an Upward Trend”

Won Rallies on Wider Current-Account Surplus

The won advanced today as South Korean current-account surplus widened last month, supporting the positive outlook for the nation’s economic growth. There are speculations that the rally was also caused by exporters who converted their earnings into the domestic currency. The Bank of Korea reported that the current-account surplus increased from $4.5 billion in February to $7.35 billion in March. Economists estimated ahead of the official data South Korean exports grew … “Won Rallies on Wider Current-Account Surplus”

Is FX volatility set for a recovery?

Volatility in the foreign exchange markets has been declining for the past few years. One of the major causes has been the consistent ultra-loose monetary policy engaged by the key central banks such as the Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England. Just looking at the average … “Is FX volatility set for a recovery?”

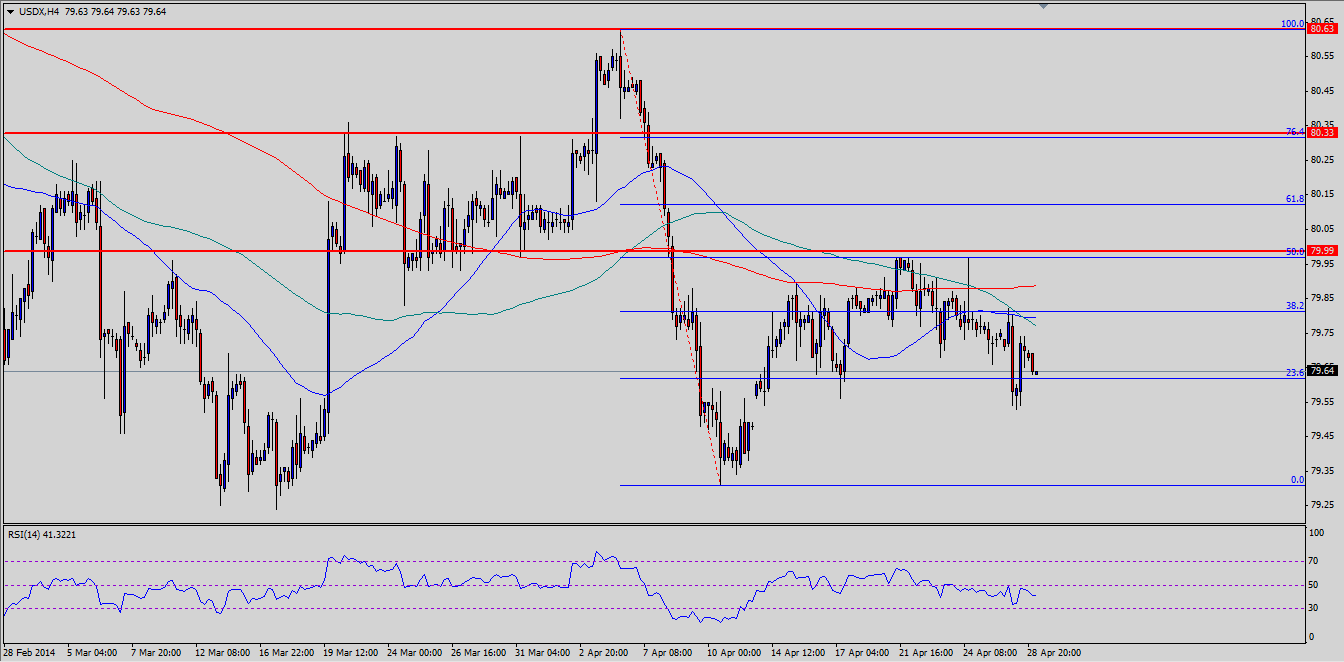

USDX Long-Term Price Direction

The plethora of top-tier data from the US economy this week could be crucial in setting the tone for dollar trading in the long run, breaking that long period of currency consolidation seen for almost the entire month of April. The USD Index 4-hour time frame shows that the currency has pulled up to an … “USDX Long-Term Price Direction”