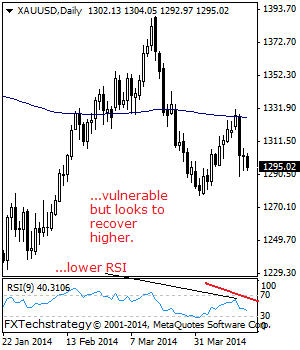

With GOLD continuing to maintain its downside bias, further decline continues to be envisaged. But corrective recovery risk may occur. Support lies at the 1,289.36 level where a break will pave the way for a run at the 1,277.58 level. A turn below here will shift focus to the 1,250.00 level followed by the 1,230.00 … “GOLD: Threatens Further Downside”

Month: April 2014

A simple but effective strategy for trading the news.

Trading the news can be very profitable if you can correctly guess which way price is going to move. Price can often move 30 or 40 pips very quickly on big news releases, but knowing which way its going to move is very much a gamble, so most traders do not trade the news, as … “A simple but effective strategy for trading the news.”

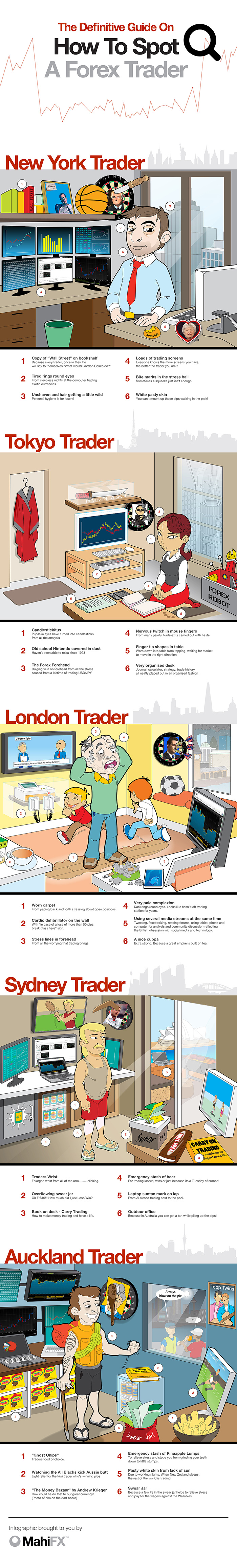

Infographic: Guide on how to spot a forex trader

Courtesy of MahiFX, here is an infographic titled “How to Spot a Forex Trader”. The amusing graph describes the various characteristics of forex traders. Look out for the small details on everyone’s desk. Click the image to enlarge:

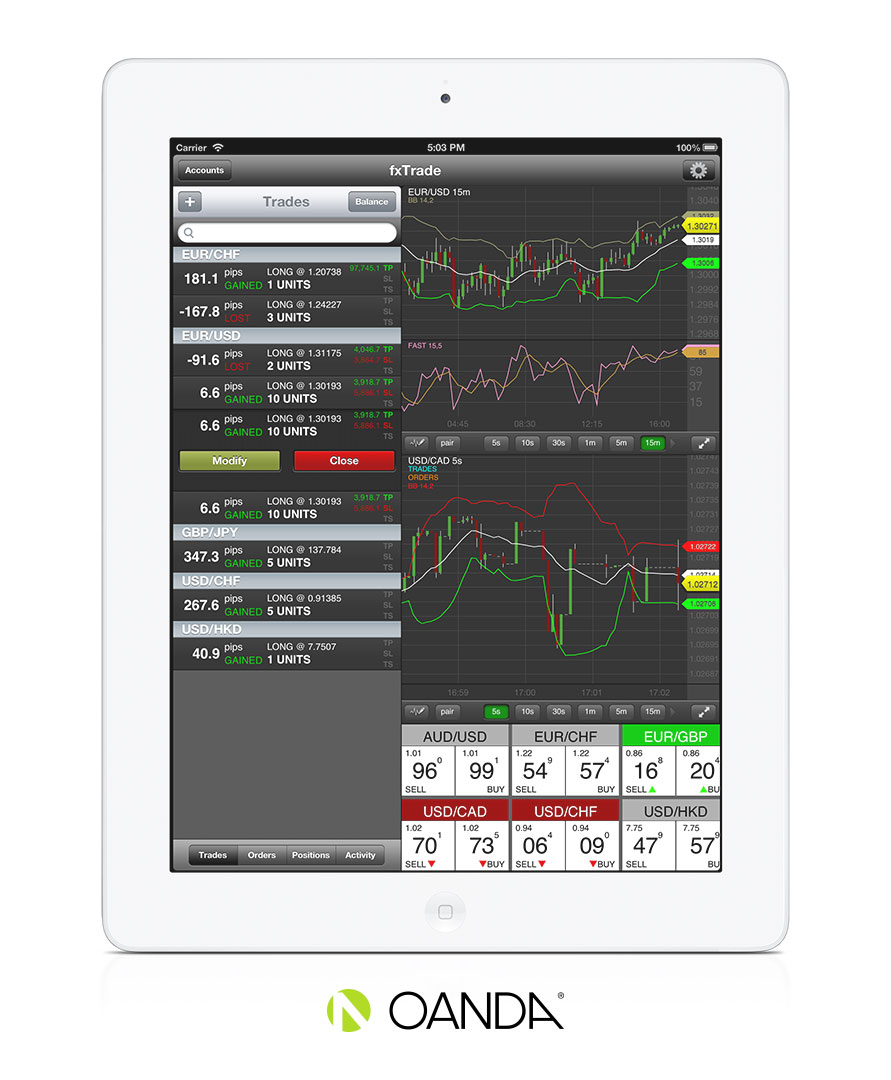

OANDA launches an Online Marketplace for forex traders

OANDA announces the launch of an online marketplace which consists of trading strategies, tools and other products for the online retail forex trader. OANDA recently adopted an open approach to technology. For more on the marketplace, here is the official press release: LONDON – April 17, 2014 – OANDA, a global provider of innovative foreign … “OANDA launches an Online Marketplace for forex traders”

GBP/USD: Trading The Philadelphia Fed Manufacturing Index

The Philadelphia Fed Manufacturing Index is an important leading indicator, and is based on a survey of manufacturers in the Philadelphia area. It examines manufacturers’ opinions of business activity, and helps provides a snapshot of the health of the manufacturing sector. A reading which exceeds the forecast is bullish for the British pound. Here are … “GBP/USD: Trading The Philadelphia Fed Manufacturing Index”

Cable Retreats on Positive Employment Figures

UK employment figures favoured Sterling as it found its way back above the long term bullish trendline. Cable gained 100 pips today after the Jobless Rate dropped below the 7% threshold to 6.9%, which is the highest in three months. This coupled with better then expected inflation figures bags the question, if the Bank of England … “Cable Retreats on Positive Employment Figures”

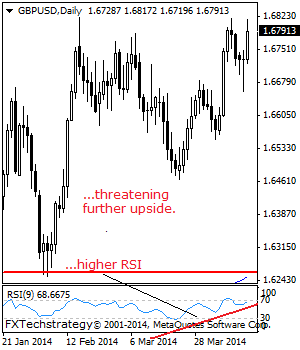

GBPUSD On The Offensive, Closes In On The 1.6819/22

With cable recovering higher and threatening the 1.3819/22 levels, further strength is envisaged. The pair needs to decisively break and hold above here to trigger further bullish offensive towards the 1.6877 level. Further out, resistance resides at the 1.6900 level where a break will aim at the 16950 level and then its big psycho level … “GBPUSD On The Offensive, Closes In On The 1.6819/22”

New GWAZY IB Portal launched by Windsor Brokers

Cyprus based forex broker Windsor launches a new version of its GWAZY IB portal. The broker launched the original version back in October. For more details about the new version, here is the official press release: Limassol, Cyprus, April 15th, 2014: Windsor Brokers Ltd. recently announced the launch of the brand new, all-in-one GWAZY IB Portal … “New GWAZY IB Portal launched by Windsor Brokers”

US inflation remains in Goldilocks territory – taper train

Annual core inflation in the US stands at 1.7% in March. This level, just below 2%, is good news for the US dollar: ongoing stability and no danger of deflation nor high inflation. The lack of deflation danger which looms over the euro-zone and which Japan is fighting enables the Federal Reserve to continue focusing … “US inflation remains in Goldilocks territory – taper train”

Correction deepens; what to expect this week?

Indices: US markets closed last week with serious sell-offs making investors reconsider their long positions. Indications for a rising inflation caused analysts to forecast an increase of the Fed’s interest rates in move to maintain the pace of growth. An anticipated change of policy by Fed Chair Janet Yellen led to declines in the leading indices: … “Correction deepens; what to expect this week?”