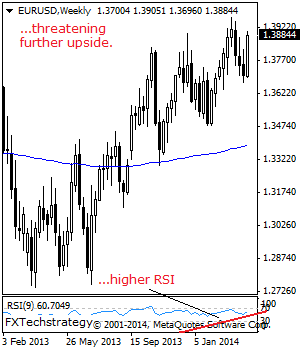

EURUSD: Although EUR continues to retain its upside bias, it faces the risk of a corrective pullback in the new week. Support lies at the 1.3820 level where a break will aim at the 1.3770 level. Further down, support resides at the 1.3676 level with a loss of there threatening further downside towards the 1.3600 … “EURUSD: Bullish On Rally”

Month: April 2014

EUR/USD: Trading The German ZEW Apr 2014

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 9:00 GMT. Indicator Background … “EUR/USD: Trading The German ZEW Apr 2014”

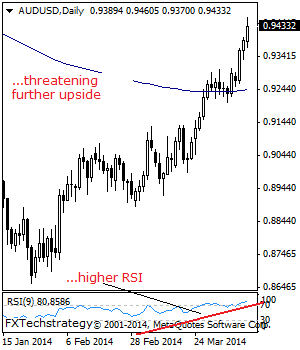

AUDUSD: Strengthens, Targets Further Upside

AUDUSD: With marginal price extension seen on Wednesday and a follow-through higher occurring today, further bullishness is likely towards the 0.9500 level. A break and hold above here will aim at the 0.9550 level and subsequently the 0.9600 level, its psycho levels. Its daily RSI is bullish and pointing higher suggesting further strength. On the … “AUDUSD: Strengthens, Targets Further Upside”

USD/JPY: Trading the UoM Consumer Sentiment April 2014

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. A reading that is stronger than expected is bullish for the US dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Friday at 13:55 GMT. Indicator Background The University of Michigan Consumer Sentiment Index, which … “USD/JPY: Trading the UoM Consumer Sentiment April 2014”

JPY Rally Likely to be Short Lived

The Bank of Japan disappointed JPY bears with its assessment that it is on track in achieving its 2% inflation target. However more stimulus is very likely probably from late Summer suggesting that the bear market for the Japanese currency will resume soon. The monetary expansion programme from the BoJ is already substantial running at … “JPY Rally Likely to be Short Lived”

FxPro launches the Prepaid Infinite Mastercard

Cyprus based Forex Broker FxPro launches the Prepaid Infinite Mastercard. The card enables FxPro clients to pay around the world using funds they have with the broker. FxPro recently won the “Best FX Services Provider” award. For more about the new card, here is the press release from FxPro. Afterwards, please find information about Intercash, the … “FxPro launches the Prepaid Infinite Mastercard”

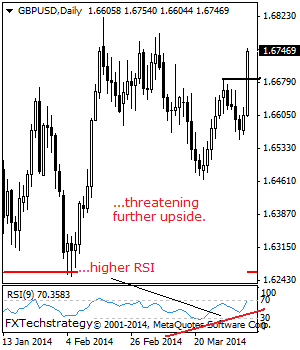

GBPUSD: Rallies, Remains On The Offensive

With GBP rallying strongly and taking out the 1.6683 level, further bullish offensive is expected. A hold above here will pave the way for a run at the 1.6785 level and then the 1.6822 level and next the 1.6900 level. Its daily RSI is bullish and pointing higher supporting this view. Conversely, support comes at … “GBPUSD: Rallies, Remains On The Offensive”

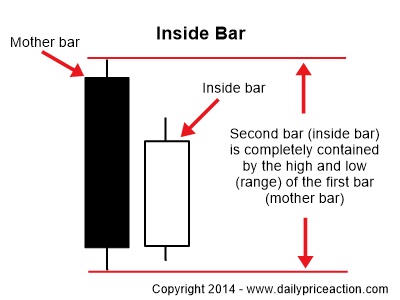

Price Action or Indicators: Why Not Both?

When I first began my Forex journey 6 years ago, I was completely in awe of the number of different strategies and indicators that were out there. It can be seriously overwhelming for a new trader. In the first 3 years I tried just about every indicator and strategy known to man. Nothing was working, … “Price Action or Indicators: Why Not Both?”

AUD/USD: Trading the Australian jobs April 2014

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian employment market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs April 2014”

Traders should demand true transparency from their broker and

Following the shutdown of ILQ in the US, which mostly had IBs as clients, I had quick written interview with Vatsa Narasimha, Executive Vice President and Chief Strategy Officer at OANDA Corporation. Narasimha notes that there are more stringent demands on players in the industry and that we can expect more consolidation. Traders should ask tough questions and demand true transparency … “Traders should demand true transparency from their broker and”