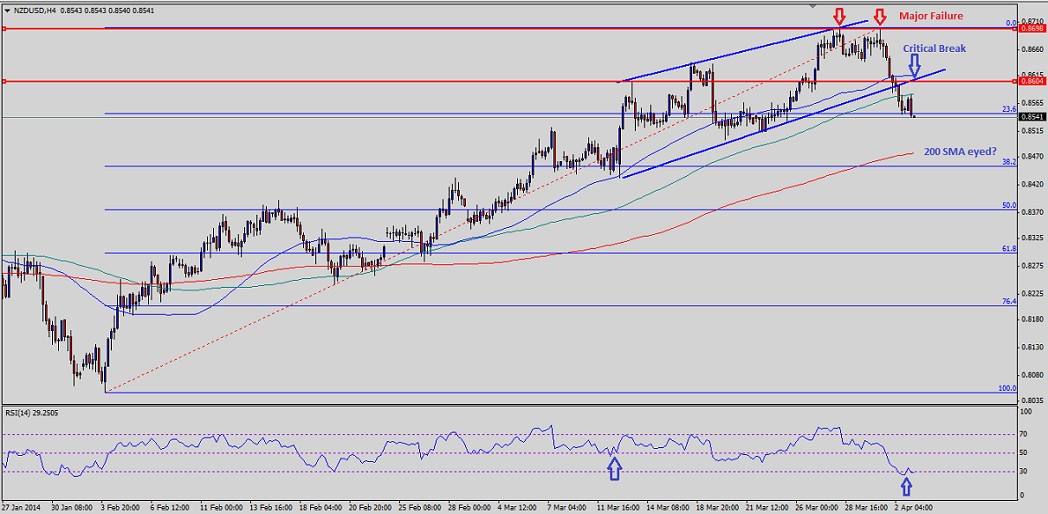

NZDUSD is trading lower Intraday as the market awaits US jobs data, which will be released during Friday’s NY session. The pair has formed three back-to-back bearish candles on Daily timeframe, which can be considered as a sign of weakness. Even better than expected Chinese HSBC Services PMI was unable to help the pair. Chinese … “NZDUSD smashed ahead of US jobs data”

Month: April 2014

Will the ECB ever really do QE?

There is an outside chance that the European Central Bank could upstage the normally all important US Non-Farm Payroll figures due this Friday with an announcement over new stimulus measures to combat potential deflationary pressures. Last week Bundesbank President Jens Weidmann and ECB executive board member left open the possibility that the central bank could engage in … “Will the ECB ever really do QE?”

GBP/USD: Trading the UK Services PMI April 2014

British Services PMI is based on a survey of Purchasing Managers in the services industry. The survey asks respondents for their view of a wide range of business conditions, including employment, new orders, prices and inventories. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 … “GBP/USD: Trading the UK Services PMI April 2014”

Webinar today: A look into Q2: Currencies taking separate

Join me for a free webinar today, April 1st, at 15:00 GMT, courtesy of FXStreet. The topic is: A look into Q2: Currencies taking separate paths. The first quarter of the year saw central banks beginning to move in separate directions. This divergence already moved currencies and we could see even stronger movements in Q2. In the … “Webinar today: A look into Q2: Currencies taking separate”

Forex Crunch Key Metrics March 2014

March saw better traffic than February, but just under the the traffic seen in March 2013. It seems that stronger volatility is needed to break to higher ground in terms of page views. Hopefully the second quarter will see bigger moves as monetary policy divergence takes its effect on markets. Here are the numbers: Website; … “Forex Crunch Key Metrics March 2014”

USD/JPY: Trading The ADP Non-Farm Employment Change

The ADP Non-Farm Employment Change measures the change in the number of employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for USD/JPY. Published on Wednesday at 12:15 GMT. Indicator Background … “USD/JPY: Trading The ADP Non-Farm Employment Change”

5 Most Predictable Currency Pairs – Q2 2014

A good currency pair will lose speed when approaching a clear line of resistance and support and then bounce back into range. If it has a strong momentum, this currency pair will pierce through the clear line and only leave dust behind them. We all like these pairs – the more predictable ones. Unfortunately, not … “5 Most Predictable Currency Pairs – Q2 2014”