Fundamental Bias: Neutral

Key Takeaways

• ECB’s attempt to push the Euro down was successful, as EURUSD traded below 1.3800.

• EURUSD reacted strongly from the triangle resistance zone before collapsing.

• The pair is now heading towards a critical support zone at around 1.3730-1.3680 levels.

The Euro is approaching a critical support zone where buyers are expected to return, so investors looking to sell the Euro need to be careful moving ahead.

Technical Analysis

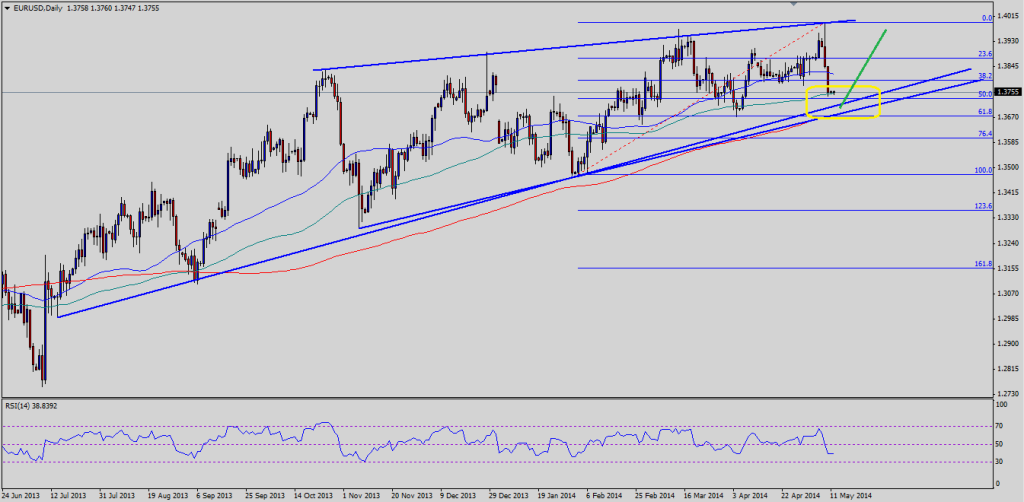

There is a monster contracting triangle on the daily timeframe for the EURUSD pair. The recent run towards the all-important 1.40 level failed right around the triangle resistance zone following the ECB’s press conference after the interest rate decision. The pair formed a nice bearish daily candle and moved lower. However, the pair is now approaching a critical support. There are several support levels starting with the 100-day simple moving average and followed by a confluence support area of triangle trend line, trend line connecting lows and 200-day SMA. It is important to note that the 50% fib level of the last move higher from the 1.3478 low to 1.3996 high at 1.3734 is also likely to act as a strong support. So, there are many reasons for the pair to gain traction around the mentioned support zones.

Alternatively, if the buyers fail to defend the support zone, then a break lower might take the pair towards the previous low at 1.3500 in the medium term. A break and close below 1.3660 could be crucial for the pair, as it would be mean that the pair has placed an important top right around 1.40 level.

There is a major risk event scheduled during this week – Euro zone inflation report, which is likely to act as a strong mover for the EURUSD pair. The market and investors are always forward looking, so any surge higher in the inflation rate would suggest that the ECB might stay away from easing in the near future.

Further reading: Could EURUSD Be The Trade Of The Year?