Euro is struggling today, and is mostly lower against many of its counterparts. This is largely due to the latest round of data released by European Union leaders. With the unemployment rate still high, the current worry is stagnation, even with better manufacturing data. The latest release of unemployment data for the eurozone shows that the jobless rate is still high, at 11.8 per cent for March. This is near … “Euro Struggles as Unemployment Remains High”

Month: May 2014

Taiwan Dollar Rallies as Growth Makes Currency Attractive

The Taiwan dollar rose today and headed to a weekly gain on hoped that economic growth and the rally of nation’s stocks will attract more investors to the emerging economy. The government report showed that Taiwan’s gross domestic product grew 3.04 percent in the first quarter of 2014 from a year ago, a bit more than was expected. Global funds expanded their holdings of nation’s equities by $3.1 billion this quarter. The positive developments … “Taiwan Dollar Rallies as Growth Makes Currency Attractive”

Dollar Jumps as Non-Farm Payrolls Beat Expectations

The US dollar jumped against most its major counterparts today after non-farm payrolls came out even better than optimistic forecasts and the unemployment rate declined more than was predicted by analysts. US non-farm payrolls added 288,000 in April after rising 203,000 in March (revised from 192,000). The consensus forecast promised smaller growth by 216,000. Moreover, the unemployment rate edged down from 6.7 percent to 6.3 … “Dollar Jumps as Non-Farm Payrolls Beat Expectations”

Loonie Rides Greenback’s Coattails Against European Currencies

Canadian dollar is higher against its European counterparts, riding the coattails of the greenback. Positive news out of the United States is helping the North American currencies, sending them higher against the euro and the pound. The nonfarm payrolls report is out for April in the United States, and the news is helping matters in North America. The United States added 288,000 jobs in April, and the unemployment rate fell to 6.3 per cent. This is … “Loonie Rides Greenback’s Coattails Against European Currencies”

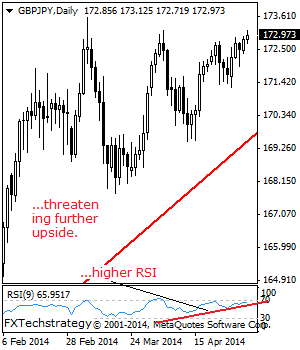

GBP/JPY: Sets Up For Further Recovery

GBPJPY – With the cross reversing its Wednesday losses on Thursday to close higher, further upside is now envisaged. In such a case, resistance comes in at the 173.13 level where a break will open the door for additional gains towards the 174.00 level. Further out, resistance stands at the 174.84 level and then the … “GBP/JPY: Sets Up For Further Recovery”

EUR/USD: Trading the US NFP May 2014

US Non-Farm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Update: Non-Farm Payrolls … “EUR/USD: Trading the US NFP May 2014”

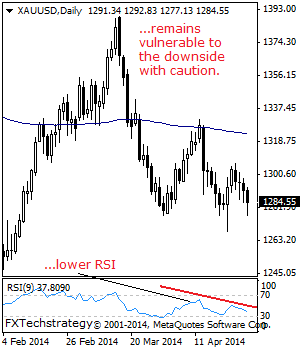

GOLD: Weakens, Susceptible.

Although GOLD still faces downside risk declining further on Thursday, recovery threats are now building up. On the upside, resistance is seen at the 1,318.30 level where a violation will aim at the 1,331 level. Above here if seen will trigger further gains towards the 1,359.00 level followed by the 1,380.00 level. Further out, resistance … “GOLD: Weakens, Susceptible.”

NZ Dollar Gains on Optimistic Outlook for US Economy

The New Zealand dollar advanced today together with some other currencies of emerging markets as optimistic forecasts for tomorrow’s non-farm payrolls led to speculations that the US economy will lead global growth. Forecasters predict that tomorrow’s report will show growth of US employment by 216,000 jobs. Today’s unemployment claims data spoiled the optimistic outlook somewhat but did not erase it altogether. Signs of economic growth … “NZ Dollar Gains on Optimistic Outlook for US Economy”

Dollar Pauses Decline Ahead of Non-Farm Payrolls

The US dollar halted its decline that has occurred after yesterday’s monetary policy announcement of the Federal Reserve. Positive macroeconomic indicators helped the currency to resist the downward pressure, though the employment data was unexpectedly poor and made traders reluctant to buy the greenback ahead of tomorrow’s non-farm payrolls. Today’s data from the United States showed that personal income and expenditures grew in March, while the manufacturing index rose, surprising … “Dollar Pauses Decline Ahead of Non-Farm Payrolls”

Euro Looks for Direction After Data

The euro is in a kind of currency market limbo right now, looking for direction after the latest economic data for the eurozone. Eurozone leaders and ECB policymakers have expressed an interest in a weaker euro recently. The hope is that a weaker euro would help stimulate economic growth. Inflation and other measures of economic growth in the eurozone are lackluster, and a recovery depends on moves to goose the economy into growth. However, even with the desire to weaken … “Euro Looks for Direction After Data”