The rhetoric coming out of Japan suggests there is a drift in emphasis away from monetary policy and towards reforms to make the economy more dynamic. On paper that should be bullish for JPY. However, currency weakness is likely to remain a key policy for Japan. The Bank of Japan is starting to explore ways … “Taper talk reaches Japan, but may not be that bullish”

Month: May 2014

Loonie Gains Ahead of GDP Report as Current Account Deficit Narrows

The Canadian dollar rallied today ahead of tomorrow’s report about gross domestic product as the nation’s current account deficit shrank last quarter. The currency remains strong, though it was trading sideway’s lately. Canada’s current account deficit narrowed by $3.3 billion to $12.4 billion in the first quarter of this year on a seasonally adjusted basis, exactly as forecasters predicted. The report said: This increase was led by an improved trade in goods … “Loonie Gains Ahead of GDP Report as Current Account Deficit Narrows”

Dollar Resilient in Face of GDP Contraction

The US dollar was resilient today in face of data that showed a contraction of the US economy last quarter, the first decline since 2011. The currency fell initially after the report but managed to erase most of its losses by now. US gross domestic product fell 1.0 percent in the first quarter of 2014 after rising 2.6 percent in the previous three months. The drop was expected by market analysts but they have … “Dollar Resilient in Face of GDP Contraction”

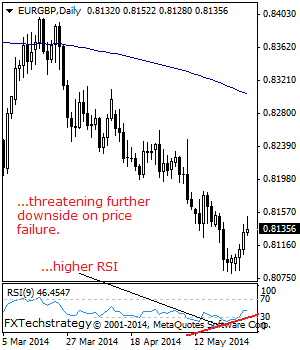

EURGBP- Loses Upside Momentum and Hesitates

EURGBP- With further recovery higher stalling and taking back most of its intraday gains, it now looks to begin a correction of its move from the 0.8080 to 0.8152. If this is eventually triggered, expect a retarget of the 0.8116 level where a violation if seen will activate further downside towards the 0.8080 level where … “EURGBP- Loses Upside Momentum and Hesitates”

Brazil’s Central Bank Ends Longest Cycle of Monetary Tightening

The Brazilian central bank halted the record stretch of interest rate increases, refraining from boosting borrowing costs at the latest policy meeting that has ended yesterday. The real retained its strength, rising against the dollar today in spite of the news. The Central Bank of Brazil left its target interest rate at 11 percent after nine consecutive rate hikes. The central bank struggles to tame rising inflation without endangering economic … “Brazil’s Central Bank Ends Longest Cycle of Monetary Tightening”

Aussie Gains Ground on Business Investment Data

The Australian dollar is moving higher today, gaining almost across the board on the latest business investment data. The idea that, perhaps, the Australian economy doesn’t need to rely so heavily on China is helping boost sentiment toward the Aussie right now. Aussie has been struggling lately, thanks to concerns that China’s economic growth might be slowing. Because Australia is so tight with China, this … “Aussie Gains Ground on Business Investment Data”

NZ Dollar Loses Shine Analysts Say

The New Zealand dollar dipped today, falling for the second day and igniting talks that the period of strength for the currency is over and a bearish trend has begun. Various technical analysts say that it looks like the kiwi is in danger of a downside breakout, while others argue that it has already occurred. The interest rate outlook, which was supportive for the currency previously, is not helpful right now as there … “NZ Dollar Loses Shine Analysts Say”

UK Pound Struggles a Bit

UK pound is struggling a bit right now. Some disappointing data is contributing to the situation, and, as a result, the pound’s strength is waning a bit. Sterling is struggling a little bit today, losing ground to the euro and the yen especially, even though it is currently higher against the US dollar. One of the issues with the UK pound was a sell order triggering stop loss trades yesterday, but there … “UK Pound Struggles a Bit”

USD/CAD: Trading the Canadian GDP May 2014

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and a reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Friday at 12:30 … “USD/CAD: Trading the Canadian GDP May 2014”

3 ways central banks can move markets

If there is one thing a forex trader must learn early on in their career, it is that central banks can have a huge effect on the movements of a currency pair. In today’s markets, that is even more the case, since the world’s central banks have taken a leading role in rescuing the global … “3 ways central banks can move markets”