It’s a slow day for the markets, thanks to the Memorial Day holiday in the United States. However, the FX market is open, and the Canadian dollar is making some progress against its US counterpart as traders look ahead to economic data to be released later in the week. Loonie is getting a bit of a bump today as Forex traders and analysts look ahead to economic data due at the end of the week. Statistics Canada is expected to release … “Loonie Gains Against Greenback on Slow Memorial Day”

Month: May 2014

EUR/USD: Trading the US CB Confidence May 2014

CB Consumer Confidence is based on a monthly survey of about 5,000 U.S. households regarding their opinion of the economy. Traders should pay close attention to its release, which always has a strong impact on market prices. A higher reading than the market forecast is bullish for the dollar. Here are all the details, and 5 … “EUR/USD: Trading the US CB Confidence May 2014”

The Aussie Dollar is Vulnerable now.

The Australian Dollar fell by the most in four months last week after dovish comments from the RBA caused traders to re-evaluate their expectations for interest rate hikes. If you recall earlier in 2014 the talk was about how the US economy would strengthen further and the dollar would follow suit as expectations for interest … “The Aussie Dollar is Vulnerable now.”

Will We See a Reprise of Last Summer?

Last summer was a season fraught with challenge. In June of last year the Fed announced the end of Quantitative Easing as we knew it and everyone thought the sky was falling. It seemed as though each time a Fed member spoke it made the news and moved the markets. The markets were rising on … “Will We See a Reprise of Last Summer?”

Pound Edges Higher During Week of BoE Minutes

This week was relatively quiet despite releases of policy minutes of several major central banks. The Great Britain pound attempted to rally and was able to hold gains against such currencies the euro and the Japanese yen, while retreating close to the opening against the US dollar by the end of the week. The week was perhaps not as fateful for the pound as some experts have predicted but it was certainly not bad for the currency. The major … “Pound Edges Higher During Week of BoE Minutes”

OANDA opens shop in Sydney, Australia

OANDA, one of the largest forex brokers, announced the opening of an office in Sydney, Australia. The office is managed by Louis Cooper and focuses on clients Australia and New Zealand. The company says it is “bucking the overall industry trend” by growing steadily across Asia. For more details, here is the official press release: LONDON … “OANDA opens shop in Sydney, Australia”

EURJPY: Triggers Recovery, Aims At 139.86

EURJPY- With EURJPY halting its broader weakness and building slightly higher on the back its recovery off the 138.13 level, it faces further bull risk. In such a case, resistance comes in at the 139.88 level where a break will aim at the 140.94. We may see a breather here but if that fails, further … “EURJPY: Triggers Recovery, Aims At 139.86”

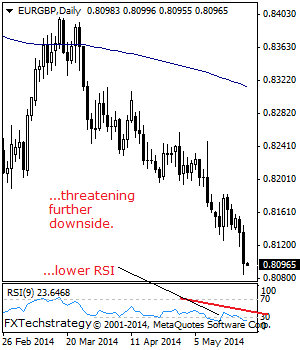

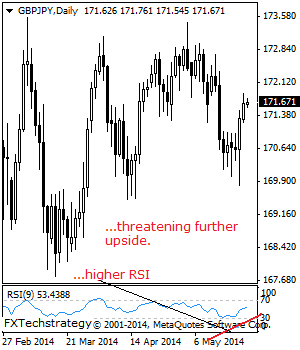

GBPJPY: Hesitates But Still Maintains Recovery Tone

GBPJPY – With the cross remaining bullish, further upside is expected. Resistance resides at the 171.82 level followed by the 172.78 level where a break will aim at the 173.13 level. A violation will aim at the 174.00 level and subsequently the 175.00 level. Its daily RSI is bullish and pointing higher supporting this view. … “GBPJPY: Hesitates But Still Maintains Recovery Tone”

Euro Continues to Fall, Reaching Three-Month Low Against Dollar

With each new piece of economic news that comes in, the euro struggles a little bit more. The 18-nation currency reached a three-month low against the US dollar, and continues to have difficulty against many of its other major counterparts. The latest news out of Germany is weighing on the euro, sending it lower against many of its major counterparts, including resulting in a three-month low against the US dollar. The Ifo index hit … “Euro Continues to Fall, Reaching Three-Month Low Against Dollar”

US Dollar Gains Ground as Sentiment Continues to Improve

Even though US stocks have been struggling, sentiment continues to improve for the US dollar. The latest data has been reasonably positive. At least, it has been more positive than European data. There are expectations that the Federal Reserve will have to move forward with tapering efforts soon, and that is lending strength to the greenback. Yesterday’s initial jobless claims report from the US Department of Labor … “US Dollar Gains Ground as Sentiment Continues to Improve”