- This Yen cross should be watched by both bulls and bears for breakout or reversal;

- the pair has been hammering the 94.00 price, a significant level since the late ’80s and ’90s;

- strengthening Japanese GDP figures hint at Yen appreciation in the absence of more QE.

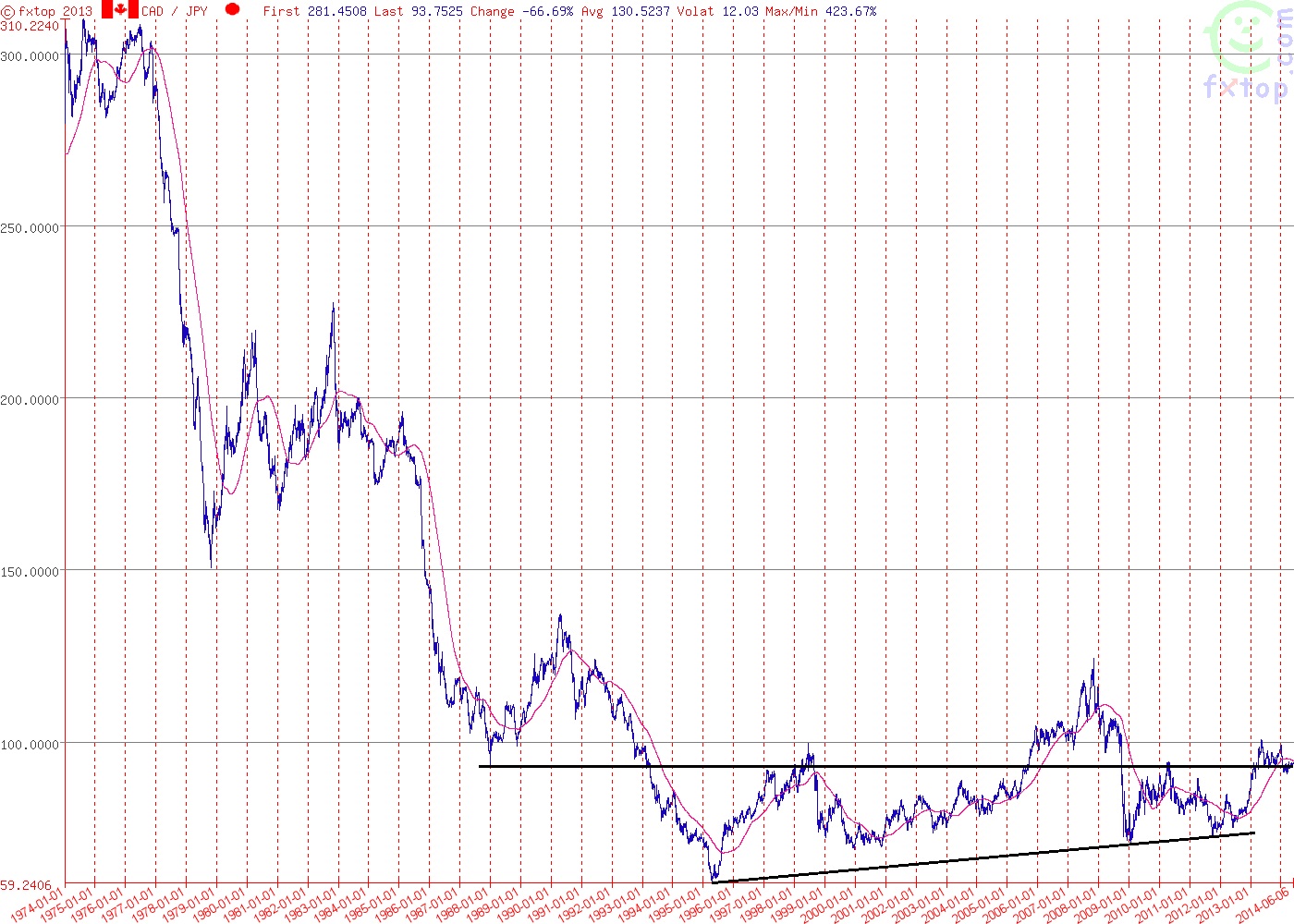

Traders watching this pair may like to open up an historic chart such as the one in Fig. 1 below, courtesy of fxtop.com: immediately, they would see how the current resistance, 94.00, can be retraced all the way back to 1988. While it was support then, it acted as resistance in 1997, driving the pair down to around 68.00: after being broken in 2005, it was again resistance in 2010 and after a spell as support in 2013 it became once again resistance from the beginning of this year.

When faced with such long-term price levels, traders have one of two choices: take notice or ignore them at their peril. Our next question is this: how should we approach the bearish and bullish scenarios for this pair? With its ‘chopping’ in the 92.50 – 94.00 range for the last two months, and with an ATR at historic lows, this pair is coiling up like a spring, and we must be prepared for both scenarios.

Figure 1

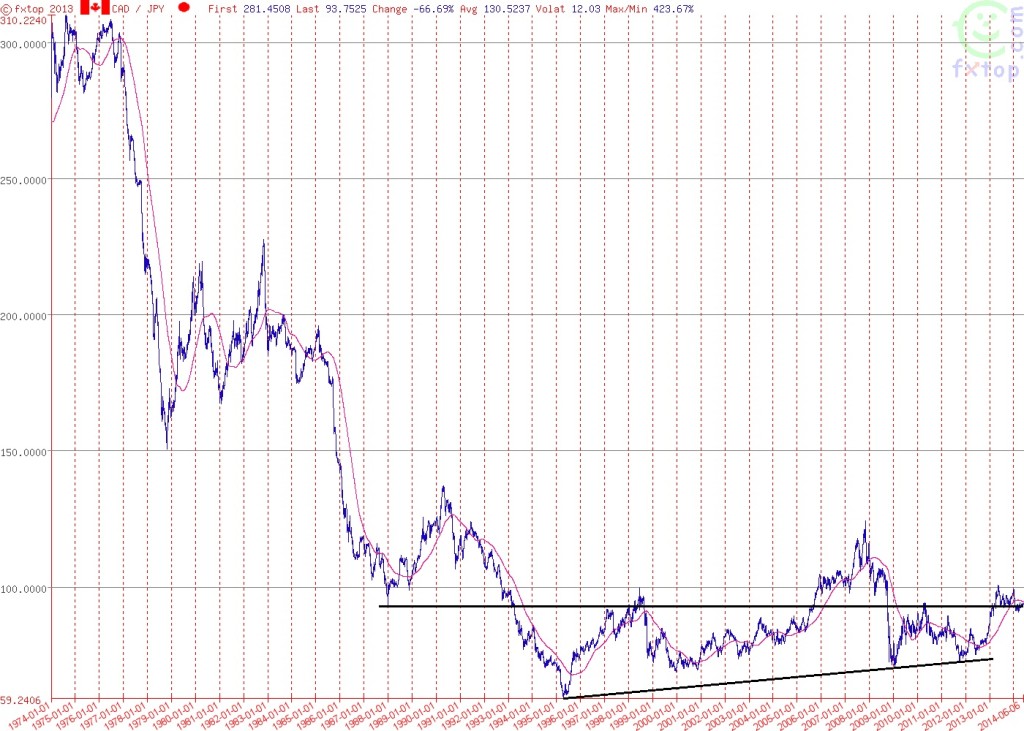

Figure 2

- The bullish scenario

Looking at the Figure 2 chart above, we can see that CAD/JPY price has moved up from the 68(.36) level of Jan. 2009 to test the Fibonacci 0.38 retracement of the 2007-high to 2009-low bear move, which sits at 90(.29): after failing to break through it in early 2010, it finally did so in early 2013, aiming confidently higher to challenge the 0.50 retracement at 97(.06), using the 0.38 level as new support. With the sellers exhausted in the Jan. 2014 down-move of over 800 pips, the buyers have set up shop at the cheaper price and are slowly building up a challenge to the 94.00 level (and, eventually, to the 0.50 Fib).

Furthermore, looking back at the chart of Figure 1, we can trace an up-trend line starting from the historic floor at 59(.24) in 1995, and providing support for the higher lows in 2009 and late 2011: this suggests that the 94 level will eventually break, leading to a challenge of the 100 level, which was resistance in 1998 and 2013 and neckline support for the ‘head and shoulders’ pattern in 2006-2008 – a historically and psychologically important level to surpass. Add to that a significantly bullish Nikkei 225, and the inverse relationship to the Japanese Yen, and you can see how the Canadian Loonie may push higher against its Yen half.

- The bearish scenario

Keeping the overnight lending rate at 1% this month, the Bank of Canada has maintained a four-year run of ‘no change’ policy: with the country enjoying a rather sluggish growth, a stronger currency is indeed a concern for Governer Poloz, with so much export dependency; Japan, on the other hand, in spite of its spiralling debt-to-GDP percentage (more than double that of Canada), has almost half the unemployment rate than Canada, enjoys better GDP prospects, and its consumer prices following the sales tax hike rose higher this April by 3.2% compared to a year ago, which is in line with the BoJ’s plan of raising inflation to 2% (from the beginning of 2014, Japan’s CPI has overtaken Canada’s, with last April registering at 3.4% against Canada’s 2%). This positive data means that anyone banking on Governor Kuroda announcing an upgrade of the BoJ’s already massive stimulus programme will have to wait, which means, conversely, that Yen crosses may well be on a bearish path.

From a price action perspective, buying volume around the 94 level suggests that the pick up in tick volume has not yielded the necessary upward momentum, creating weak moves that inevitably disappointed the bulls, the last ones being on the 8th and 26th of May, and 1st and 9th of June: this lack of momentum is reflected also in the long term, with the ATR indicator showing the pair’s current daily range at approximately 40 pips, which is the lowest of the entire ATR values since the beginning of the chart in 2001, and which is one fourth that of this time last year.

With such lack of volatility and volume, and no significant BoC interest rate hikes on the horizon, what would possibly stop the pair taking the path of least resistance? In short: what or who could stop the pair abandoning attempts to break this historical resistance level (94.00) and careering down three hundred pips (to 91.00, a significant level from early 2013 and 2014)?

Keep an eye out on this pair and be ready to act when the signals present themselves, either to the upside or to the downside.

Guest post by Francesco Sani, independent trader © June 2014