Forex price action is actually the oldest form of technical analysis. The market movements that enable us to trade price action have always been present. Without them the market simply wouldn’t move. In this article I’m going to discuss what price action is as well as how it can be used as a trading strategy.

What is Price Action?

Price action is simply the way the Forex market moves through each hour, day, week, etc. It forms the “ebb and flow” that can make the Forex market so profitable. It gives us swing highs and swing lows. It also forms uptrend and downtrends.

Get enough individuals trading the same chart and certain levels and patterns begin to emerge. This is because the majority of human beings are followers. Most of us find some comfort in following the crowd. In the Forex market this is especially true, because following the crowd is often where the money is. Have you ever heard the saying, “follow the money”?

Using Price Action to Your Advantage

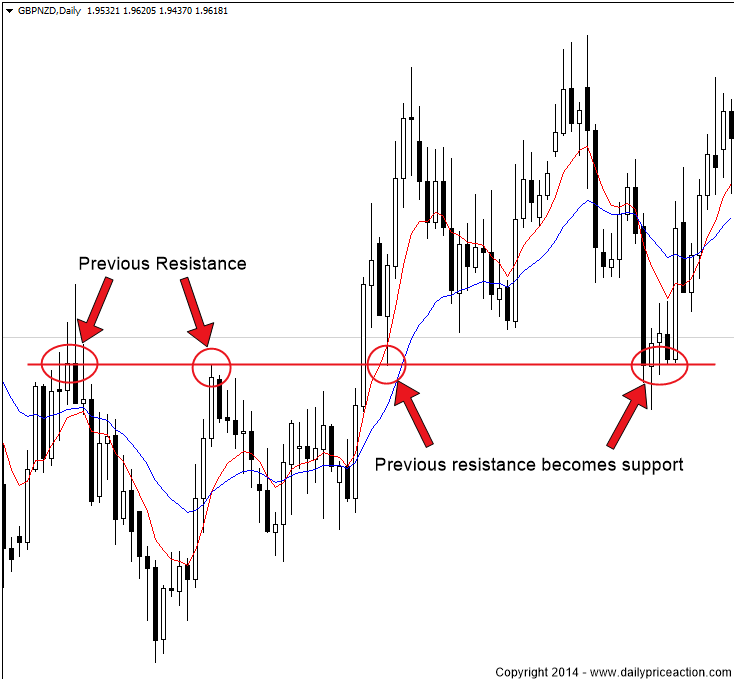

So how do we take these levels and patterns and turn them into something we can use? Simple. Mark these support and resistance levels on your chart and trade between them. Use them as guides to form a directional bias on where a market may be headed.

These levels can come in the form of horizontal support and resistance or trend lines. Regardless of the type of level, these areas represent potential turning points in the market. We can use these levels to watch for trading opportunities. However the fact that the market has reached a key level isn’t necessarily enough to make it a valid trade setup. We need a price action signal, or trading strategy, to confirm the level.

In addition to support and resistance levels, Forex price action also gives us reversal and continuation signals. For example a reversal pin bar at a key level can be a confirmation signal that the level may hold. Another example could be a continuation inside bar in between two key levels. If the inside bar occurs during a strong trend, it could be a signal for us to join the trend and ride the market to the next price action level.

Using price action to identify both key levels and buy or sell signals is a powerful and profitable combination. The best part about it is that it won’t ever change. While many indicators out there only working in a trending or range bound market, price action works in both. It’s also timeless. Without it the Forex market simply wouldn’t work.

While only some traders may use a MACD or Stochastics indicator, price action is present on every screen across the world. These key levels that form are the same for every trader looking at the same time frame. More traders seeing the same levels and patterns means greater consistency – which is what’s needed to become a profitable Forex trader.

The next time you open a Forex chart, take a little time to identify some key levels. Then take a look at each level and notice the price action signals that formed which could have provided you with an entry signal. You might be surprised at what you find.

By Justin Bennett of http://dailypriceaction.com