Forex Crunch is honored to be the No. 1 forex blog to follow in 2014 in MahiFX’s Top 50. You can see the full interactive list here. As mentioned in the publication, no one has been paid to appear in the list. It is also an honor to appear along very respectable sites in the forex … “Forex Crunch is No. 1 in MahiFX’s Top 50 Forex”

Month: June 2014

Carney Suggests Interest Rates May Rise Soon, GBP Jumps

The Great Britain pound soared today, reaching the strongest rate since November 2012 versus the euro, with help of very hawkish comments from Bank of England Governor Mark Carney. The Governor revealed that he considers raising interest rates sooner than the market is anticipating. Carney was speaking yesterday at the Mansion House Bankers and Merchants Dinner. His speech was very optimistic as the Governor said: Growth has … “Carney Suggests Interest Rates May Rise Soon, GBP Jumps”

EUR/USD: Trading the Michigan Consumer Sentiment Index June 2014

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 13:55 GMT. Indicator … “EUR/USD: Trading the Michigan Consumer Sentiment Index June 2014”

BOE’s Bombshell. What’s The Next Shoe To Drop

Sometimes we notice trends and trade those trends however it only becomes apparent sometime afterwards what the reason was all about. I’ve been selling any strength in the FTSE100 for some time now based on the premise than it did not seem to be able to make new all-time highs and was lagging its European … “BOE’s Bombshell. What’s The Next Shoe To Drop”

Iraqi Oil Putting it to the Markets

On Wednesday the markets woke up to find that crude oil was trading noticeably higher. At first I thought the summer driving season was upon us and as usual crude generally goes up during this time of year. Then it was discovered that turmoil in Iraq was causing this situation. My thoughts in this regard … “Iraqi Oil Putting it to the Markets”

Loonie Experiences Mixed Trading Day

The Canadian dollar had a mixed trading session today as fundamentals were confusing and did not give a clear direction for the currency to go. Over the longer term, the loonie still maintains its bullish bias against the US dollar and the euro and remains flat versus the Japanese yen. Bank of Canada Governor Steven Poloz was speaking today at the press-conference regarding the Financial System Review, and he was rather optimistic. Poloz said: It … “Loonie Experiences Mixed Trading Day”

Dollar Falls vs. Major Peers as US Data Disappoints

The US dollar dropped today as most of economic reports that came out from the United States were rather poor, making market participants question if the US economy is ready for monetary tightening from the Federal Reserve or policy makers will wait before starting interest rate hikes. Unemployment claims increased from 313,000 to 317,000 last week from the week before even though experts promised them … “Dollar Falls vs. Major Peers as US Data Disappoints”

Won Drops on Concern About Korea’s Recovery

The South Korea fell today as the nation’s central bank left interest rates unchanged and voiced concern about the strength of the currency that may hurt economic growth. The Bank of Korea decided to keep its key interest rate at 2.5 percent during today’s policy meeting. The central bank said in the statement: In Korea, despite exports having sustained their buoyancy the Committee appraises the economic recovery to have shown signs of slowing, as domestic … “Won Drops on Concern About Korea’s Recovery”

Drop of Employment Doesn’t Prevent Aussie’s Rally

The Australian dollar dipped after data showed a drop of employment, but the currency bounced later and trades now above the opening level as the report turned out to be not as bad as it looked at the first glance. Australian employment dropped by 4,800 in May from April on a seasonally adjusted basis, while analysts expected it to rise at the previous month’s rate of 10,300. The unemployment rate remained at 5.8 percent. Yet the report was not … “Drop of Employment Doesn’t Prevent Aussie’s Rally”

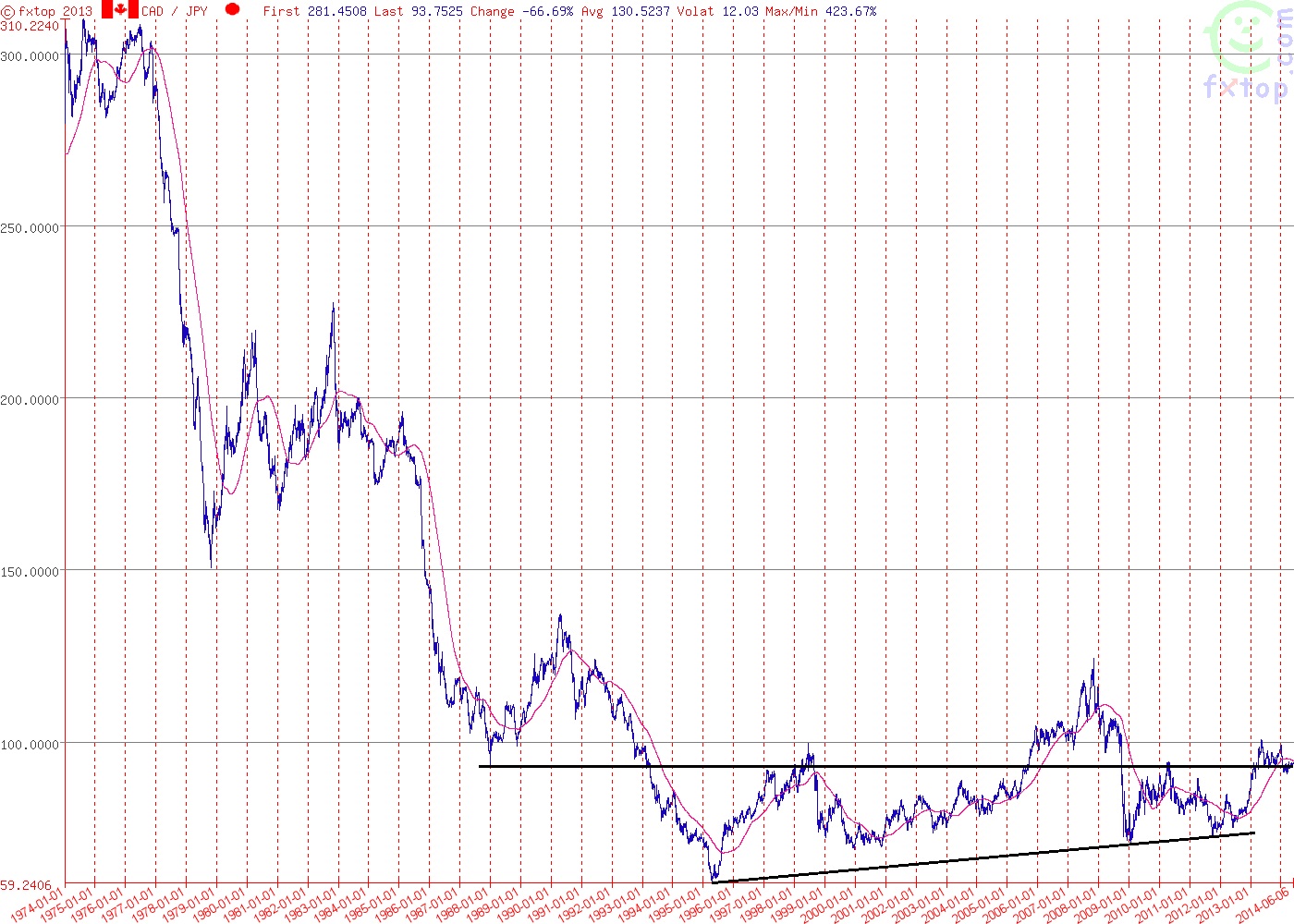

CAD/JPY: a Yen cross that is ripe for the picking

This Yen cross should be watched by both bulls and bears for breakout or reversal; the pair has been hammering the 94.00 price, a significant level since the late ’80s and ’90s; strengthening Japanese GDP figures hint at Yen appreciation in the absence of more QE. Traders watching this pair may like to open up … “CAD/JPY: a Yen cross that is ripe for the picking”