The Great Britain pound jumped today after the Bank of England refrained from changing its monetary policy, leaving the main interest rate and the asset purchase program the same. The BoE did not act at today’s policy meeting, and its statement, as usually, was very brief:â The Bank of Englandâs Monetary Policy Committee at its meeting today voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets … “BoE Stays Idle, Sterling Jumps”

Month: June 2014

Euro Sinks as ECB Expands Stimulus

The euro sank today after the European Central Bank fulfilled its promise and slashed interest rates, taking some of them into the negative territory. The shared 18-nation currency is attempting to regain its footing now, slowly crawling back to the opening level. The ECB announced that it cut its key interest rate on the main refinancing operations from 0.25 percent to 0.15 percent, while the interest rate on the deposit facility … “Euro Sinks as ECB Expands Stimulus”

Did Draghi make a critical mistake with forward guidance?

The ECB made history with a negative despot rate, introduced a wide array of steps and even talked about potential buys of assets. One of the measures is the TLTROs – targeted loans to aid the real economy. But one mistake could keep the euro strong and thus weigh heavily on the real economy. Update: EUR/USD rallies as forward … “Did Draghi make a critical mistake with forward guidance?”

Aussie Holds Ground Even as Trade Surplus Turns into Deficit

The Australian dollar rose against its US peer today even though the trade balance surplus unexpectedly turned into deficit in April. The currency sank against the Japanese yen earlier but bounced later and trades near the opening level currently. The Australian trade balance showed a deficit of A$122 million in April after demonstrating a surplus of A$1,024 million in March. Analysts anticipated an excess of A$400 million. Risky currencies were strong … “Aussie Holds Ground Even as Trade Surplus Turns into Deficit”

Malaysian Ringgit Rallies Ahead of ECB Decision

The Malaysian ringgit advanced today, snapping its three-day decline, as Forex market participants expect that the European Central Bank will cut its interest rates at today’s meeting, and this may increase capital inflows into emerging markets. The ECB will announce its decision at 11:45 GMT today, and it is expected that the central bank will lower borrowing costs, putting some of them into the negative territory. … “Malaysian Ringgit Rallies Ahead of ECB Decision”

ECB Preview: Going negative and beyond – 6 options for

Each ECB decision is important for the euro, but this one has even elevated expectations, triggered by the ECB itself in the previous meeting: Draghi’s hint of action in June already sent EUR/USD a few hundreds of pips lower and now tension is mounting towards the moment of truth. What will the ECB actually do? … “ECB Preview: Going negative and beyond – 6 options for”

A negative deposit rate is not necessarily euro-negative

The amount of money parked with the ECB has fallen dramatically over the past year, and the banks’ reaction to negative deposit rate is still to be seen. So, the impact of setting a negative deposit rate is not necessarily going to be euro negative, says Simon Smith of FxPro. In the interview below, Smith also … “A negative deposit rate is not necessarily euro-negative”

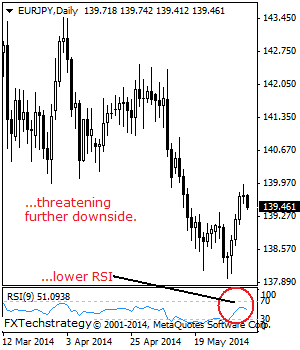

EURJPY: Pulls Back On Loss Of Momentum

EURJPY- With the cross closing flat on Wednesday and seen weakening during early trading today, more downside pressure is expected. Except it returns above the 139.95 level, it faces the risk of further decline. Resistance resides at the 140.94. We may see a breather here but if that fails, further gains could follow towards the … “EURJPY: Pulls Back On Loss Of Momentum”

EUR/USD: Trading the US Non-Farm Employment Change Jun 2014

US Non-Farm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Indicator Background … “EUR/USD: Trading the US Non-Farm Employment Change Jun 2014”

Dollar Rallies on Services PMI, Shrugs Off Negative Employment Data

The US dollar rallied today with help of a positive report about the services sector. The currency managed to log gains even though the private employment report was not as good as economists expected. Automatic Data Processing reported that employment grew by 179,000 jobs in May. The actual growth rate was far slower than predicted 217,000. This data made traders worry that the official report released on Friday will … “Dollar Rallies on Services PMI, Shrugs Off Negative Employment Data”