The main focus this week was the monetary policy meeting of the Federal Reserve. It indeed had a noticeable impact on the Forex market but not necessarily in a way that most market participants have expected. It was expected that the Fed would reduce its monthly asset purchases by another $10 billion and this would bring the dollar higher. The US central bank indeed cut stimulus as was expected but … “Dollar Left Soft After Week of Fed Meeting”

Month: June 2014

CAD Shoots to Upside on Back of Positive Data

The Canadian dollar surged today with a help of positive macroeconomic data, including the Consumer Price Index that was higher than forecasts and above the central bank’s target. The currency jumped to the highest level since January. Canada’s CPI rose 0.5 percent in May from the previous month (not seasonally adjusted), while analysts predicted 0.2 percent growth. Year-on-year, the index was up 2.3 percent, exceeding the Bank of Canada … “CAD Shoots to Upside on Back of Positive Data”

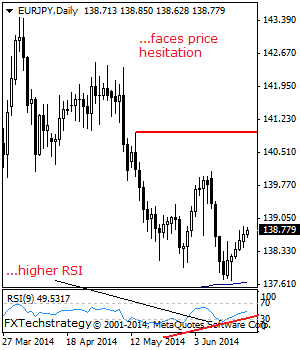

EURJPY: Price Hesitation Sets In

EURJPY- The cross remains biased to the upside though hesitating. In such case, further upside will aim at the 139.00 level followed by the 139.50 level where a breach will aim at the 139.95/8 level. Further out, resistance resides at the 140.94. We may see a breather here but if that fails, further gains could … “EURJPY: Price Hesitation Sets In”

3 reasons for upside pressure on NZD/USD

The Reserve Bank of New Zealand would certainly prefer a weaker value of the New Zealand dollar, but all market forces are pushing NZD/USD higher. With the pair just dipping from the highs, do we have a buy opportunity? Here are the 3 forces supporting a stronger NZD/USD: New Zealand GDP: The economy grew by 3.8% y/y … “3 reasons for upside pressure on NZD/USD”

US Dollar Recovers Ground Lost After Federal Reserve Announcement

US dollar is mostly higher today, gaining ground in the wake of losses following Wednesday’s Federal Reserve announcement. The greenback has recovered some of its losses, particularly against the euro, which it has sent back below the 1.3600 mark. US dollar is up pretty much across the board, thanks to some reflection by Forex traders, and a closer look at economic fundamentals. The greenback took a bit of a beating after Fed … “US Dollar Recovers Ground Lost After Federal Reserve Announcement”

Investors Flee South Korean Stocks, Won Drops

The South Korean won dropped today on signs that overseas investors were pulling their money from the nation’s economy. The drop should be welcomed by South Korean policy makers, who were not particularly happy with the strength of the currency, though talks about a potential intervention still persist. The exchange data showed that global funds sold $443 million more South Korea’s shares than they bought. … “Investors Flee South Korean Stocks, Won Drops”

Rupee & Rupiah Continue to Fall on Conflict in Iraq

Asian currencies declined today as the conflict in Iraq kept driving prices for crude oil higher, endangering economies of emerging markets. The Indian rupee and the Indonesian rupiah led the decline. Clashes between the government military and Islamist militants threaten to disrupt oil supply, and this pushed prices for crude higher. High energy prices will likely have an adverse impact on emerging economies, especially on those with a negative trade balances. Both India … “Rupee & Rupiah Continue to Fall on Conflict in Iraq”

BoE Interest Rate Outlook Overshadows UK Economic Data

The Great Britain pound advanced today, rising to the highest level since October 2008 against the US dollar, bolstered by speculations that the Bank of England will raise interest rates sooner than was expected. The interest rate outlook offset the negative impact of today’s economic data on the currency. BoE Governor Mark Carney hinted last week that monetary tightening may happen sooner that markets have been anticipating. … “BoE Interest Rate Outlook Overshadows UK Economic Data”

Norges Bank Says Interest Rate Cut Possible, Krone Drops

The Norwegian krone sank today after the nation’s central bank left its monetary policy unchanged at today’s meeting but said that an interest rate cut is possible in case the economy worsens significantly. The Norges Bank left its main interest rate at 1.5 percent today. As for the interest rate outlook, the central bank said: There are prospects that the key policy rate will remain at about today’s level … “Norges Bank Says Interest Rate Cut Possible, Krone Drops”

Euro Gains Ground on Dovish Fed Sentiment

Euro is gaining ground today, due in large part to the dovish sentiment coming out of the US Federal Reserve. Concerns that the Fed would announce interest rate increases sooner rather than later, along with worries about the eurozone economy, had been weighing on the 18-nation currency. Today, the euro is gaining ground against its major counterparts, and is back above the 1.3600 level against the US dollar. … “Euro Gains Ground on Dovish Fed Sentiment”