The Swiss franc gained today even though the nation’s central bank did not change its stance at today’s policy meeting, reiterating the pledge to do everything that is necessary to keep the cap on the currency. The Swiss National Bank kept its monetary policy unchanged today and issued rather dovish statement. Regarding the global economy, the SNB said that “global economic recovery remains hesitant” and “downside risks remain substantial”. … “Swiss Franc Rises Despite SNB’s Attempts to Contain Rally”

Month: June 2014

NZD Dips as New Zealand Economic Growth Misses Expectations

The New Zealand dollar dipped today after nation’s economic growth missed analysts’ estimate. The currency halted its decline by now and actually managed to erase all losses versus the US dollar. New Zealand gross domestic product expanded 1.0 percent in the first quarter of 2014, at the same rate as in the previous three months. Experts have predicted an increase by 1.2 percent. The kiwi is still supported by the prospects for additional interest rate … “NZD Dips as New Zealand Economic Growth Misses Expectations”

Dollar Drops on Fed Outlook for Growth & Interest Rates

The US dollar fell today after the Federal Reserve trimmed its monetary stimulus but lowered the growth forecasts and predicted that interest rates will remain extremely low for a long period of time. The Fed cut its monthly asset purchases by $10 billion to $35 billion dollar, a move that was widely expected by traders. The central bank reduced its projections for economic growth in 2014 to 2.1–2.3 percent from its … “Dollar Drops on Fed Outlook for Growth & Interest Rates”

Politics and forex: fears for Europe?

So far this year, a notable number of elections in Europe – in particular the local and European elections throughout the EU – have seen resulted in remarkable swings towards the nationalist right. Inside the eurozone, France and Greece have moved towards separatism, with similar results outside of it from England and Denmark. In the … “Politics and forex: fears for Europe?”

Ringgit Drops on Fed Stimulus Reduction Bets

The Malaysian ringgit fell today on concerns that probable stimulus reduction by the US Federal Reserve will spur investors to pull their money from emerging markets. The two-day monetary policy meeting of the Fed ends today and it is expected that the US central bank will trim the monthly asset purchases by another $10 billion. Market analysts say that traders are already pricing in an interest rate hike. As a result, … “Ringgit Drops on Fed Stimulus Reduction Bets”

Loonie Remains Mostly Lower

Speculators are keeping the loonie mostly lower again today. Some analysts think that these speculators are being stubborn, and that the Canadian dollar has more upside potential than is being shown. For now, though, the loonie continues to struggle. Canadian dollar is down against most of its major counterparts, with the main exception of the pound. While loonie weakness is to be expected at some point, in general, … “Loonie Remains Mostly Lower”

Indonesian Rupiah Suffers from High Oil Prices & Dollar Hoarding

The Indonesian rupiah dropped today on concerns that rising oil prices will hurt the trade balance and on speculations that importers were hoarding dollar. Indonesia has the same problem as India — rising prices for crude oil will likely cause the trade balance deficit to widen. The trade gap already reached $1.96 billion in April — the highest level in nine months. Additionally, there were signs that companies were buying dollars … “Indonesian Rupiah Suffers from High Oil Prices & Dollar Hoarding”

Daniel Skowronski wants OANDA to reinvent itself without losing

I had the chance to chat with Daniel Skowronski, the new MD Europe of OANDA. We talked about his plans for the company, current conditions in the industry, technology, and more. Daniel Skowronski made his way from an interbank trader at big international banks since 1991 via various positions in management and marketing in the … “Daniel Skowronski wants OANDA to reinvent itself without losing”

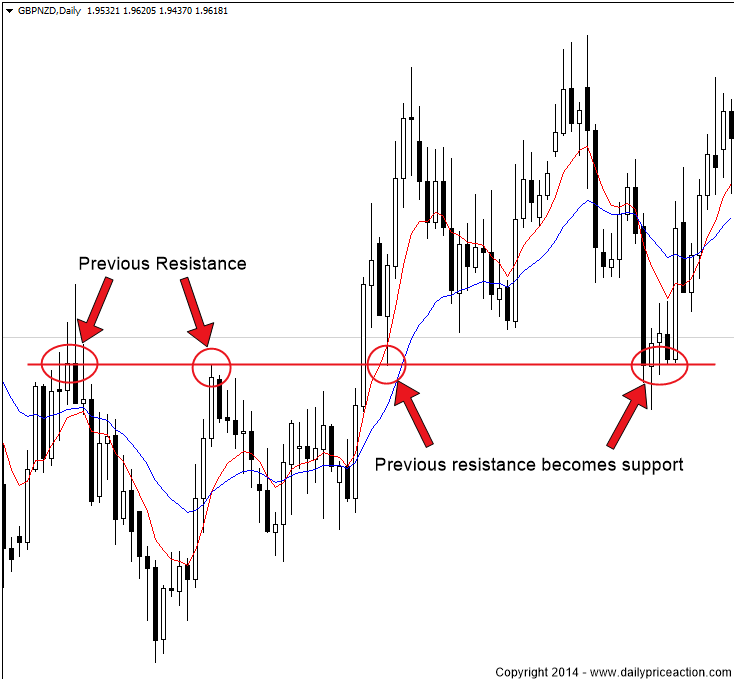

Using Price Action to Trade Forex

Forex price action is actually the oldest form of technical analysis. The market movements that enable us to trade price action have always been present. Without them the market simply wouldn’t move. In this article I’m going to discuss what price action is as well as how it can be used as a trading strategy. … “Using Price Action to Trade Forex”

NZD/USD: Trading the New Zealand GDP June 2014

New Zealand Gross Domestic Product (GDP) is a key release, released each quarter, which measures production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the New Zealand dollar. Here are all the details, and 5 … “NZD/USD: Trading the New Zealand GDP June 2014”