The ebb and flow of overseas investments around the world is often a major factor in the fluctuations in the forex markets, and so any insight into possible patterns of business investment is often of great help to the potential forex trader. For this reason, a recent report by BT is of great interest.

BT has conducted a report surveying 1150 business decision makers in 13 global regions to explore the reasons for international expansion, as well as which specific markets are desirable to expand into and why. The report is a revealing look at the state of the worldwide business landscape in our increasingly globalised world.

A huge majority of 80% of business decision makers felt that international expansion is highly essential for the success of their business. When you include those that felt it was essential to some greater or lesser degree, that figure jumps to a mammoth 96%. Three quarters of the respondents said that growth opportunities were an important reason for international expansion. Clearly in a post-recession economy, many firms are looking to international growth as a proxy for possibly restricted domestic business opportunity.

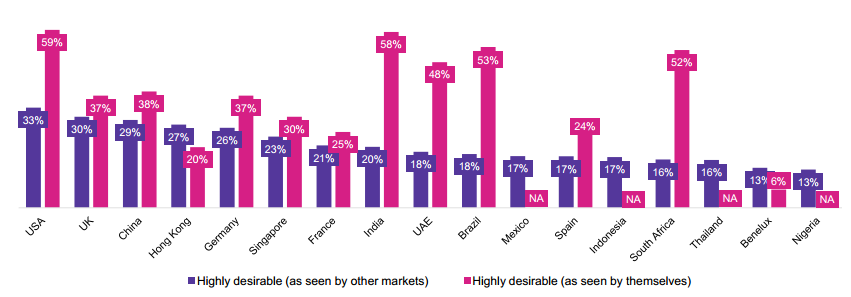

The desirability of specific markets is also of great interest. The business decision makers were asked which countries were most desirable to expand into, as well as their opinion on the desirability of their own market. In this part of the survey, the US, UK and China were seen as the three most desirable markets across all respondents, with 33%, 30% and 29% respectively saying that they saw these markets as highly desirable expansion locations. Equally interesting was the often massive gap between a market’s perception of its own desirability and its actual desirability in other markets. The most notable of these gaps came from South Africa (52% perceived desirability vs only 16% actual desirability), Brazil (53% vs 18%), India (58% vs 20%) and UAE (48% vs 18%). Interestingly, 59% of the USA’s respondents saw themselves as a desirable market, but only 33% of respondents in other markets felt the same way.

Notably, China, Hong Kong and Singapore all performed extremely well in the survey, indicating that these major Far East markets are still extremely attractive to overseas business investors. In China, some of the most appealing elements of expansion into the country were the massive potential customer base, the average affluence of these citizens, and interestingly the IT skills of the workforce. These reasons were reasonably similar across the three markets, but in Hong Kong the respondents cited the tax and governance regime as an extremely desirable element for expansion into Hong Kong.

While this report is of interest in its own right in the sense that it provides an interesting look into what sort of decisions businesses are making when it comes to their international expansions, and also some of the reasons that they make the decisions that they do, it is also of interest to those wishing to trade on the forex markets as well. After all, a high level of investment in any given country creates demand for that country’s currency. So we can infer that if these businesses are representative of the global position, and if they actually follow through on their intentions, we are likely to see an increase in demand for the currencies of the most desirable of these nations, and hence a strengthening of those currencies. Whether or not this proves to be the case, the data is an interesting affirmation of the importance of the Far East as a market, but it also suggests that globally the US and UK are still far from spent forces as drivers of global economic growth and business investment.

See the full report here

Prepared by Shaun Myandee for IG Australia

This information has been prepared by IG Markets Limited. ABN 84 099 019 851, AFSL 220440. We provide an execution-only service. The material on this page does not contain (and should not be construed as containing) personal financial or investment advice or other recommendations, or an offer of, or solicitation for, a transaction in any financial instrument, or a record of our trading prices. No representation or warranty is given as to the accuracy or completeness of the information. Consequently any person acting on it does so entirely at his or her own risk. The information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who view it. IG accepts no responsibility for any use that may be made of the comments and for any consequences that result.