Lior Cohen and Yohay Elam talk discuss the various options of investing in gold. Apparently there are very different ways and very different exposures you can take to the price of the precious metal. They then continue to talk about the good and the bad in the US economy and finish up with discussing the … “Test Episode #6: Investing in gold, state of the Fed”

Month: July 2014

3 dollar bullish events that the USD ignores (so far)

The US economy is improving and the Fed is finally moving, just. Yellen and her colleagues seem to try to avoid last year’s “taper tantrum” and take baby steps towards preparing the markets for monetary normalization. Here are 3 recent signs of moves towards the hawkish side, and how the dollar ignores it so far. … “3 dollar bullish events that the USD ignores (so far)”

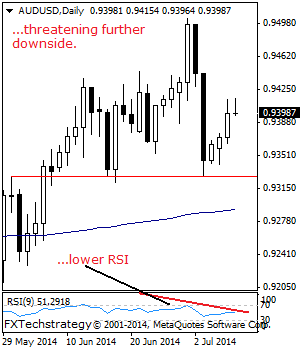

AUDUSD July 10 2014 weak, Still Points Lower

AUDUSD: Although AUDUSD continues to recover higher, it remains vulnerable to the downside below the 0.9504 level. On the downside, support lies at the 0.9350 level where a violation will aim at the 0.9300 level followed by the 0.9250 level. A cut through here will turn attention to the 0.9200 level. Its daily RSI is … “AUDUSD July 10 2014 weak, Still Points Lower”

How to Trade Tops and Bottoms

Double tops and double bottoms are the most frequently encountered chart patterns in forex trading. These patterns occur when the price hits a support or resistance level twice in a row and fails to break through. For instance, a double top occurs when the price rises to a resistance level, falls back, rises to the … “How to Trade Tops and Bottoms”

Pound Stays Strong, Endangering UK Economy

The Great Britain pound fell at the first half of today’s trading session as another set of poor economic indicators was released. Yet the currency managed to bounce in the second half, trimming its losses against the euro and gaining on the US dollar and the Japanese yen. It looks like the sterling intends to keep its strength, making economists concerned. Strong currency is not necessarily what the recovering economy of the United Kingdom needs right … “Pound Stays Strong, Endangering UK Economy”

Dollar Slips as Fed Downplays Optimism

The US dollar slipped against some of its major peers today, including the euro and the Great Britain pound, and trimmed its gains versus the Japanese yen. The greenback was weakened by the Federal Reserve meeting minutes, which suggested that investors should not take economic recovery for granted. The Fed released minutes of its June meeting today. The minutes revealed that US policy makers are concerned that financial market … “Dollar Slips as Fed Downplays Optimism”

Euro Turns it Around After Earlier Difficulties

A little bit of risk appetite is helping the euro turn things around today after earlier difficulties. However, many analysts still foresee problems for the euro, as Germany leads the eurozone into a further period of little to no growth. Earlier today, the euro was struggling against its major counterparts. Now, though, things have turned around a little bit and the euro is mostly higher against these currencies. A bit … “Euro Turns it Around After Earlier Difficulties”

Could Copper Hold the Key to Loonie Performance?

Canadian dollar is higher today, and so are copper prices. While we often think of the loonie as a petrocurrency, the truth might be that it is really more closely related to copper — and that might be giving the Canadian dollar a boost today. Canadian dollar is heading higher today, thanks in part to the gains in some commodities. Even though oil is lower today, loonie is higher, following … “Could Copper Hold the Key to Loonie Performance?”

Mixed Fundamentals Subdue Movement of Australian Dollar

The Australian dollar ticked up versus the Japanese yen today, trading sideways against its US counterpart at the same time. Signs of improving consumer confidence helped the Aussie, yet the currency was subdued by the news from China. The Westpac Melbourne Institute Index of Consumer Sentiment rose by 1.9 percent in July after rising 0.2 percent in June. Yet the report was not particularly optimistic, saying that “this is another … “Mixed Fundamentals Subdue Movement of Australian Dollar”

Yuan Holds Ground in Face of Poor Data

The Chinese yuan gained on the US dollar today even though macroeconomic reports from the Asian nation were not particularly good, feeding concerns about slowdown of the world’s second-biggest economy. China’s annual inflation slowed from 2.5 percent in May to 2.3 percent in June, being below the forecast value of 2.4 percent. The Producer Price Index fell 1.1 percent last month from a year ago. The data was less … “Yuan Holds Ground in Face of Poor Data”