US Unemployment Claims is released weekly, and measures the number of people filing for unemployment for the first time. It is considered an important measure of the health and direction of the US economy. A reading which is higher than the market forecast is bullish for the euro. Here are all the details, and 5 … “EUR/USD – Trading the US Unemployment Claims”

Month: July 2014

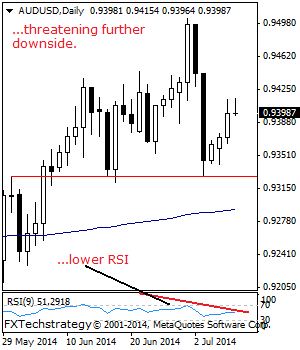

AUDUSD July 9 2014 Vulnerable, Risk Still Points Lower

AUDUSD: Although AUDUSD continues to recover higher, it remains vulnerable to the downside below the 0.9504 level. On the downside, support lies at the 0.9350 level where a violation will aim at the 0.9300 level followed by the 0.9250 level. A cut through here will turn attention to the 0.9200 level. Its daily RSI is … “AUDUSD July 9 2014 Vulnerable, Risk Still Points Lower”

For Second Session Dollar Fails to Rally

The US dollar yet again attempted to rally and yet again it failed. Even another better-than-expected employment report was not able to boost the currency, which erased its earlier gains versus the euro and the Great Britain pound and fell versus the Japanese yen today. The Bureau of Labor Statistics reported today that the number of job openings rose by 4.64 million in May. The figure was above the predicted reading of 4.53 million … “For Second Session Dollar Fails to Rally”

Unexpectedly Poor Data Makes GBP Soft, Currency Shows Resilience

The Great Britain pound turned down today as economic indicators came out much worse than was expected, prompting the British Chamber of Commerce to talk about necessity for the Monetary Policy Committee to delay interest rate increases. The currency recovered against some of its peers, including the US dollar and the euro, but remained soft versus the Japanese yen. It was expected that this week’s macroeconomic reports would be … “Unexpectedly Poor Data Makes GBP Soft, Currency Shows Resilience”

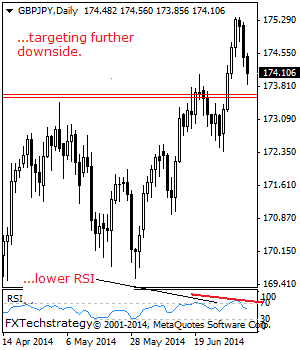

GBPJPY: Bearish, Targets Further Downside

GBPJPY – With further decline seen on Monday, the cross faces further downside pressure in the days ahead on correction. On the upside, resistance resides at 175.50 level where a break will set the stage for a run at the 176.00 level where a break will aim at the 176.50 level. Its daily RSI is … “GBPJPY: Bearish, Targets Further Downside”

Are We in the Era of the Cowboy Investor?

In conversations about widely successful investors and traders, the same names will always reoccur: Warren Buffett, Jesse Livermore, W.D.Gann and so on. However, when you ask for a great investor of the current era, most people would struggle to name one. Is this a sign of the widespread appeal that trading has generated? Perhaps due … “Are We in the Era of the Cowboy Investor?”

Aussie Gains with Business Sentiment

The Australian dollar gained today as the Australian business confidence improved last month, albeit not much. The currency was also supported by hopes for strong employment growth. The Business Confidence Index of National Australia Bank rose from 7 in May to 8 in June. NAB said: Business confidence showing no ill effects from the governmentâs âtough budgetâ, rather improving in line with better business conditions (reflecting sales and profits) … “Aussie Gains with Business Sentiment”

Euro Drops Below 1.3600 Level Against US Dollar

Euro has dropped below the 1.3600 level against the US dollar, and is down against other major currencies as well. There is a bit of risk aversion on the Forex market today, as well as speculation that the ECB will have to take further action on stimulus if the euro’s strength remains where it is. Even with all that has been done by ECB policymakers to weaken the euro and stimulate the eurozone economy, … “Euro Drops Below 1.3600 Level Against US Dollar”

NZ Dollar Gains as Fitch Raises New Zealand’s Credit Rating Outlook

The New Zealand dollar gained today as Fitch ratings raised the outlook for the nation’s credit rating from stable to positive, adding to signs that the New Zealand economy performs very well. Fitch kept the credit rating at AA, two notches below the top grade, but raised the outlook to positive. The credit agency cited several reasons for such decision, among them “fiscal consolidation” that “is strengthening the resilience of New Zealand’s … “NZ Dollar Gains as Fitch Raises New Zealand’s Credit Rating Outlook”

US Retail Forex Industry recovers in May, client assets

By Gerald Segal After hitting rock bottom in April with a multi-year low reported in client assets, US retail forex brokers recovered somewhat in May to post a 1% overall increase in assets … Source: Leap Rate